IRS Form 8868 Instructions

The Internal Revenue Code authorizes the IRS to grant automatic extensions for taxpayers who request one in writing. Tax-exempt organizations who file certain tax returns can request their extension by filing IRS Form 8868, Application for Automatic Extension of Time To File an

Exempt Organization Return.

In this article, we’ll walk through key aspects you need to know about this form, including:

- How to complete IRS Form 8868

- What the extension applies to

- Frequently asked questions

Let’s start by breaking down this tax form, one step at a time.

Table of contents

How do I complete IRS Form 8868?

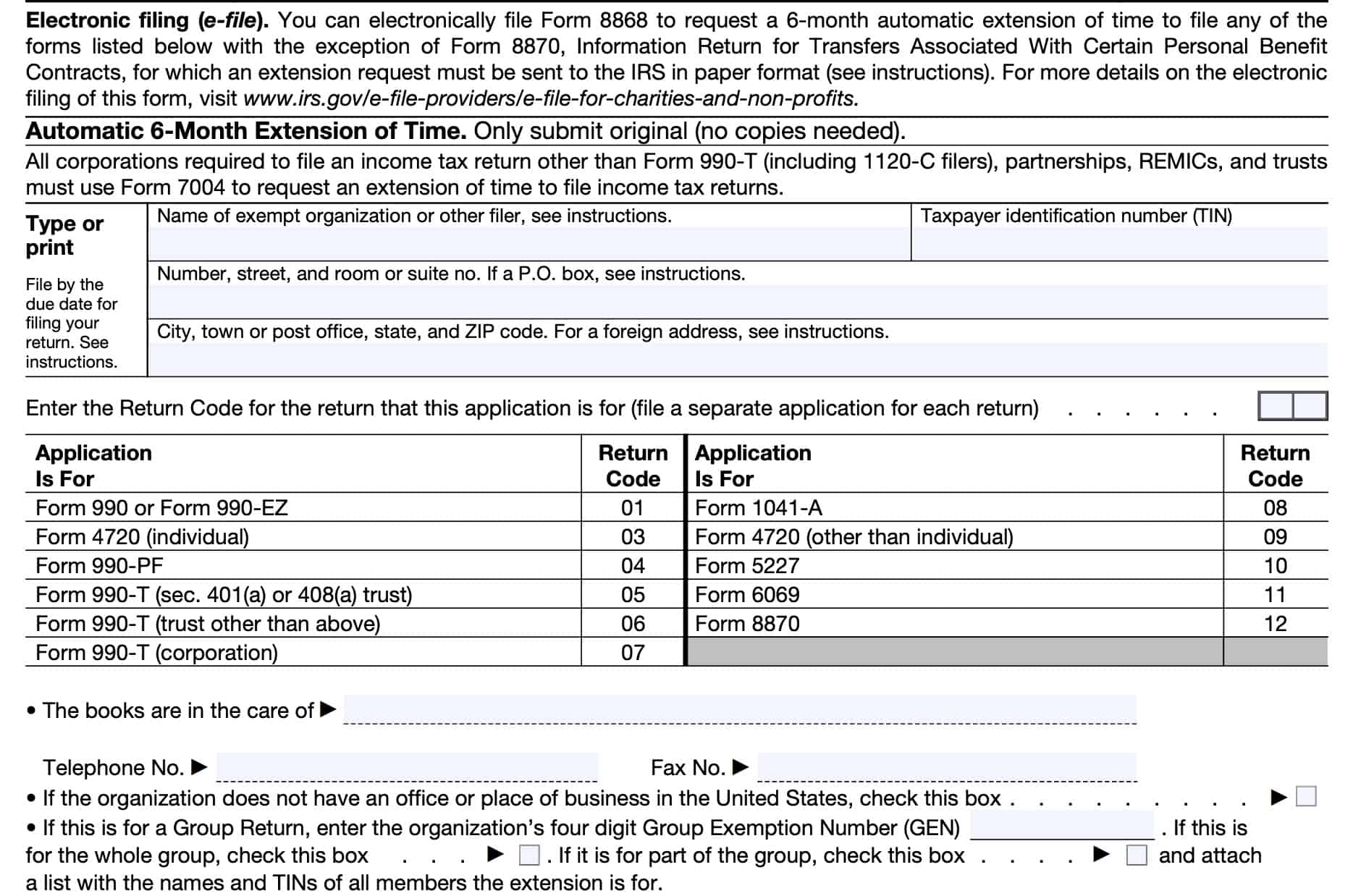

Before getting into the step-by-step instructions, there are a few things to know about IRS Form 8868.

First, you can electronically file for an automatic 6-month extension of time for every type of return listed below, with the exception of IRS Form 8870, Information Return for Transfers Associated With Certain Personal Benefit Contracts. The IRS requires extension requests for Form 8870 to be submitted in paper format.

Second, taxpayers must submit the original completed form, not a copy.

Finally, corporations (except those filing IRS Form 990-T), partnerships, trusts, real estate mortgage investment conduits (REMICs), must use IRS Form 7004 to request an additional extension, not Form 8868.

Top of form

At the top of the form, enter the following taxpayer information:

- Taxpayer name

- Taxpayer address

- Include street number, name, city, state, and zip code

- Taxpayer identification number (TIN)

The filer may be an exempt organization, a nonexempt organization, such as a disqualified person or a foundation manager trustee, or an individual.

If the tax-exempt organization’s mailing address has changed since it filed its last income tax return, you must use IRS Form 8822, Change of Address, to notify the IRS of the address change.

Return code

Just below the taxpayer information field, you’ll need to enter the return code for the organization’s tax return. Below is a list of the applicable return codes for each of the following forms:

| Tax return type | Return code |

| IRS Form 990 or Form 990-EZ returns | 01 |

| IRS Form 4720 (individual) | 03 |

| IRS Form 990-PF | 04 |

| IRS Form 990-T (Section 401(a) or 408(a) trust) | 05 |

| IRS Form 990-T (trust not listed above) | 06 |

| IRS Form 990-T | 07 |

| IRS Form 1041-A | 08 |

| IRS Form 4720 | 09 |

| IRS Form 5227 | 10 |

| IRS Form 6069 | 11 |

| IRS Form 8870 | 12 |

You may enter only one return code per extension request. If you must file an extension for different types of tax returns, then you must file a separate Form 8868 for each specific form.

Below the return code field, enter the following information regarding the location of records:

- Person responsible for maintaining records

- Telephone number

- Fax number

- Four-digit group exemption number (GEN)

- For a group return only

Also, check any of the appropriate boxes:

- If the tax-exempt organization does not have a presence within the United States

- If the extension request is for the entire group of non-profit organizations

- Must attach a list containing names and TINs for all group members

Finally, we’re ready to start with Line 1.

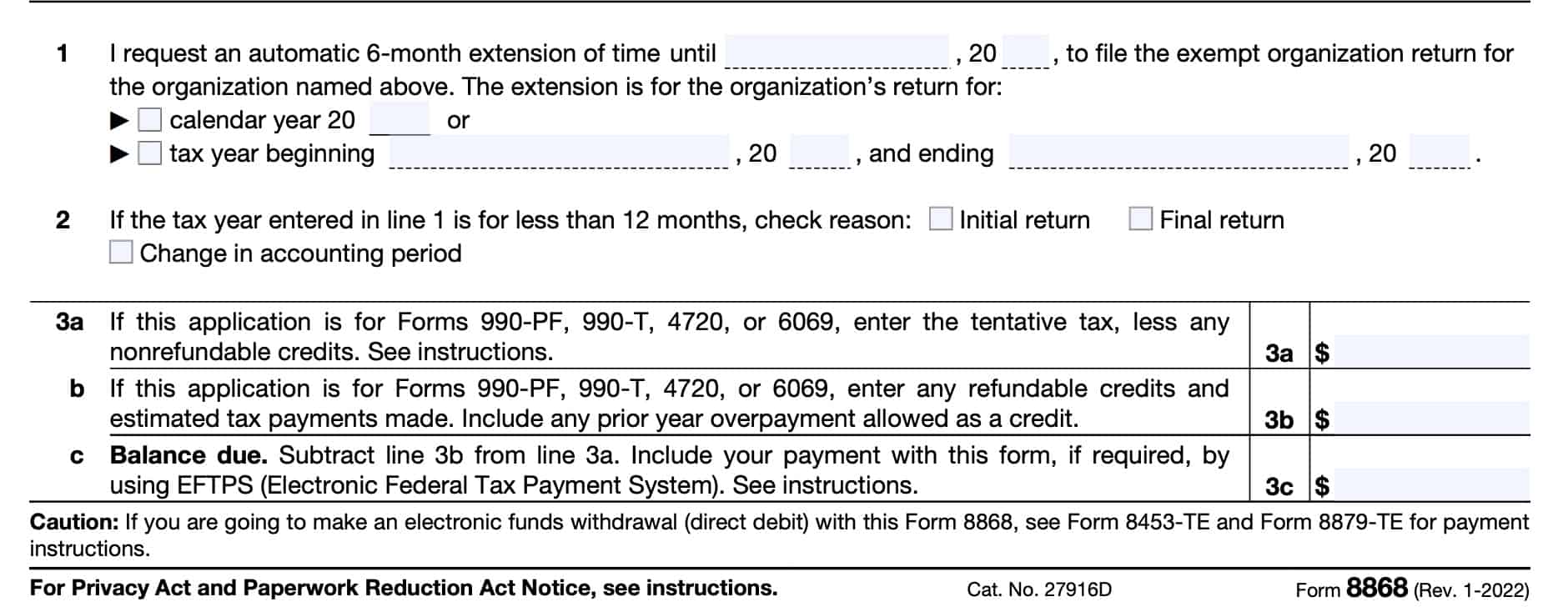

Line 1

In Line 1, you’re requesting an automatic extension of time for up to 6 months after the original filing deadline. Enter the extended due date of the return, but not more than 6 months after the original filling date.

Next, check the appropriate box, depending on whether you’re a calendar year tax filer or a fiscal tax year filer.

If you’re a calendar year taxpayer, indicate the tax year you’re requesting the extension for.

If you are a fiscal year filer, indicate the beginning and the ending months of your fiscal year tax return.

Line 2

If the tax year that you entered in Line 1 is less than 12 months, check the appropriate box to indicate the reason:

- Initial return

- Final return

- Change in accounting period

If you checked the box for change in accounting period, you must have applied for approval to change the organization’s tax year unless certain conditions have been met. IRS Publication 538, Accounting Periods and Methods, contains additional details.

Line 3

In Line 3, taxpayers will calculate tentative tax due. All taxpayers must complete Line 3, even if they do not expect to have a balance due on any tax liability.

Line 3a

In Line 3a, enter any tentative tax, minus any nonrefundable tax credits, for the following forms:

- Form 990-PF

- Form 990-T

- Form 4720

- Form 6069

See the organization’s IRS form and the form instructions to estimate the amount of tentative tax reduced by any nonrefundable credits. If you expect this amount to be zero, enter -0-.

Line 3b

In Line 3b, enter any refundable credits and estimated tax payments made for the following forms:

- Form 990-PF

- Form 990-T

- Form 4720

- Form 6069

Include any overpayment from last year or prior tax years allowed as a tax credit.

Line 3c

Subtract Line 3b from Line 3a. The result is your balance due.

As a general rule, all tax-exempt organizations must make all federal tax deposits (including excise and income taxes) electronically.

If required, submit your payment through the Electronic Federal Tax Payment System (EFTPS). The EFTPS tax payment service is provided free by the U.S. Department of the Treasury, and allows any taxpayer to submit payment to the Internal Revenue Service without additional fees.

Filing Form 8868 does not extend the time to pay tax. To avoid interest and late filing penalties, send the full balance due by the original due date of the exempt return.

Video walkthrough

Watch this instructional video to learn more about requesting an automatic extension of time for an exempt organization with IRS Form 8868.

Frequently asked questions

According to the IRS, blanket requests are not allowed. The exempt organization tax exemption form only applies to the specific tax return for which you are requesting an extension.

Generally, the due date for a exempt organization return is on the 15th day of the 5th month after the end of the organization’s fiscal tax year, or May 15th for most nonprofit groups. Filing IRS Form 8868 allows an automatic 6-month extension of that due date.

Generally, an exempt organization will file Form 8868 to request an automatic 6-month extension of time to file its return. Also, the trustee of a trust required to file Form 1041-A or Form 5227 must use Form 8868 to request an extension of time to file those returns.

How do I find IRS Form 8868?

You can find this tax form on the IRS website. For your convenience, we’ve included the most recent revision below.