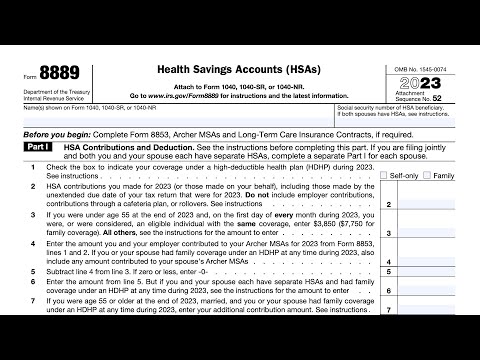

IRS Form 8889 Instructions

Many employers offer health savings accounts (HSAs) to their employees as a tax-advantaged way to pay eligible medical expenses. However, it’s the employee’s responsibility to properly report their HSA contributions and deductions by completing IRS Form 8889 as part of their income tax return.

This article will walk you through this tax form so that you understand:

- How to complete and file IRS Form 8889

- How health savings accounts work

- Some frequently asked questions from taxpayers

Let’s start with a step by step walkthrough on how IRS Form 8889 works.

Table of contents

How do I complete IRS Form 8889?

The HSA form contains 3 parts:

- Part I: HSA Contributions and Deduction

- Part II: HSA Distributions

- Part III: Income and Additional Tax for Failure To Maintain HDHP Coverage

Let’s take a look at a couple of things before we start Part I.

Taxpayer information

Your tax preparation software should automatically enter your name and Social Security number from your Form 1040.

Joint filers

If you are filing a joint tax return and your spouse also has an HSA, then you’ll need to complete a Form 8889 for each spouse.

Before you begin

If necessary, you may also have to file IRS Form 8853, Archer MSAs and Long-Term Care Insurance Contracts. This IRS form pertains to taxpayers who have one or more of the following:

- Archer MSA (Medical savings account)

- Medicare Advantage MSA (MA MSA)

- Long term care Insurance contracts

- Taxable accelerated life insurance benefits

Let’s begin with Part I, where you report contributions and calculate any HSA deduction.

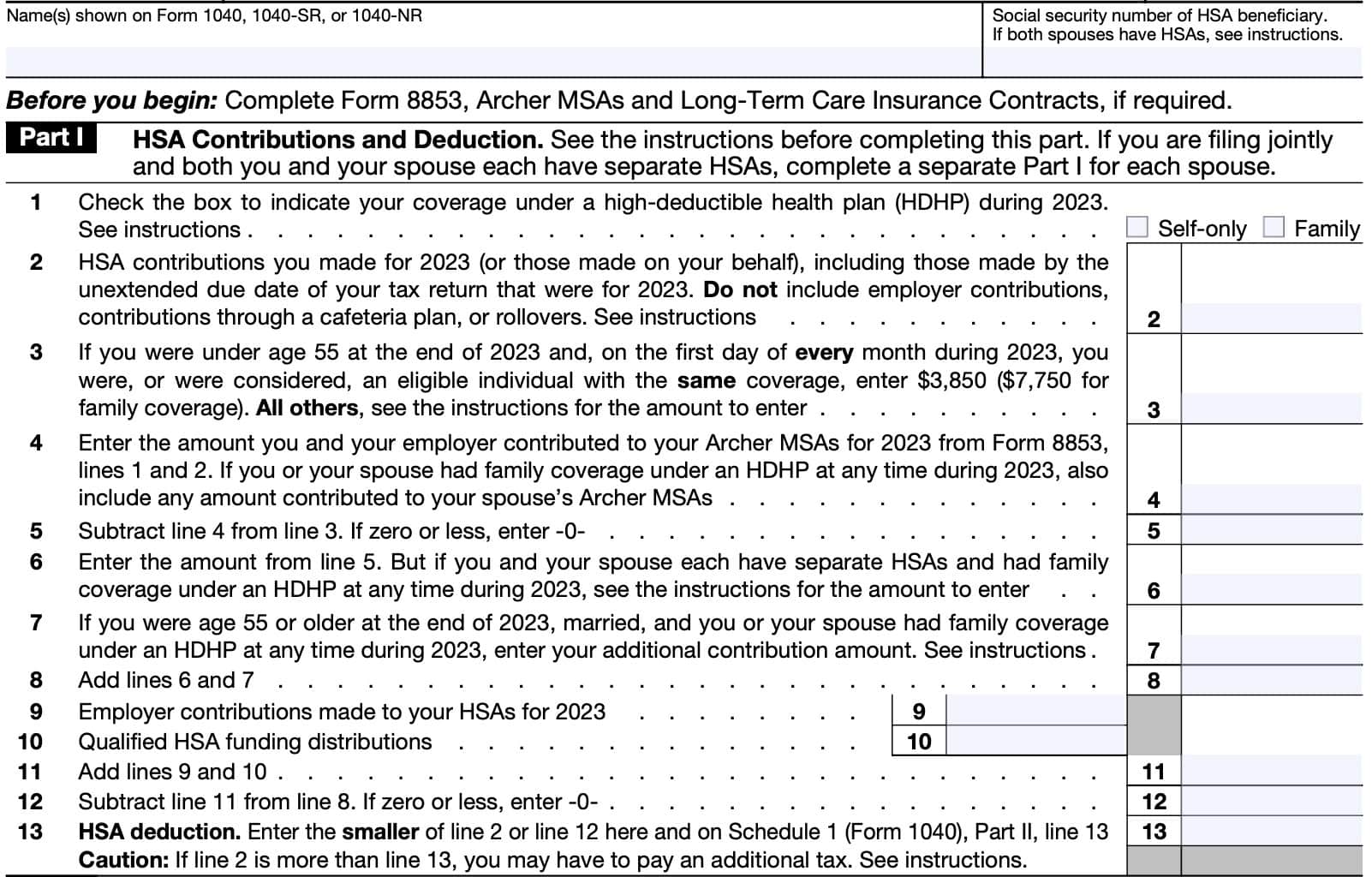

Part I: HSA contributions and deduction

In Part I, you’ll determine the following:

- Your HSA deduction

- Any excess contributions you made (or those made on your behalf), and

- Any excess contributions made by an employer

Let’s start at Line 1.

Line 1

Check the box to indicate whether your high-deductible health plan (HDHP) covers medical care for yourself only, or your family.

High deductible health plan

An HDHP is a health plan that meets the following requirements:

Self-only coverage

Minimum annual deductible: $1,500

Maximum annual out-of-pocket expenses: $7,500

Family coverage

Minimum deductible: $3,000

Maximum annual out-of-pocket expenses: $15,000

The out of pocket limit does not apply to deductibles and expenses for out-of-network services if the plan uses a network of providers. Instead, when determining the limit, you should only count the following for services within the network:

- Deductibles

- Out-of-pocket expenses

- Includes copayments

- Does not include premiums

Line 2: HSA contributions you made

Enter the amount that either you contributed to your HSA or that someone contributed on your behalf during the previous year.

Do not include any of the following:

- Employer contributions

- Contributions through a cafeteria plan

- Rollovers from another HSA

What is an HSA rollover?

A rollover is a tax-free distribution (withdrawal) of assets from one HSA or Archer MSA that is reinvested in another HSA of the same account beneficiary. Generally, you must complete the rollover contribution within 60 days after you received the distribution.

Tax tip: Your tax advisor or financial advisor can usually help you with the rollover of HSA funds from one plan to another before you start. This may help avoid additional taxes or an unexpected increase in your gross income.

Line 3

If you were under age 55 at the end of the calendar year, and you maintained your high deductible health plan coverage the entire year, you can enter:

- Self-only plan: $3,850

- Family plan: $7,500

If this does not apply to your situation, you may need to refer to the Line 3 Limitation Chart and Worksheet in the Form 8889 instructions to determine the amount you should enter in this field.

Line 4: Archer MSA contributions during the tax year

If you have an Archer MSA and you contributed to it during the tax year, carry the amount over from IRS Form 8853, Lines 1 and 2.

If you did not contribute to an Archer MSA, then leave this blank and proceed to Line 5.

Line 5

Subtract Line 4 from Line 3. If you do not have an Archer MSA or did not contribute to it during the year, then this amount will be the same as Line 3.

If the result equals zero or less, enter ‘0.’

Line 6

Carry over the number from Line 5.

If you and your spouse have separate HSAs and had family coverage under a high deductible health plan during the tax year

Then split this amount equally between you and your spouse, or decide on a different allocation that you and your spouse can agree to. Enter your allocation in Line 6.

If you and your spouse have separate HSAs but were not considered to have family coverage during the tax year

You will have to refigure the annual contribution limit that would have been entered on Line 5 if you had entered on Line 3 the total of the worksheet amounts only for the months you were treated as having family coverage.

- When refiguring Line 5, use the same amount you previously entered on Line 4.

- Divide the refigured contribution limit equally between you and your spouse, unless you both agree on a different allocation (such as allocating nothing to one spouse).

- Enter your allocation in Line 6.

Line 7: Additional contribution amount

If you were age 55 or older at the end of the year, married, and you had family coverage at any time during the tax year, enter your additional contribution amount.

For taxpayers with coverage for the entire tax year, your additional contribution amount is $1,000.

If you did not have coverage the entire tax year, then you must calculate your additional contribution amount by dividing the number of months you did have coverage by 12. Multiply this number by $1,000.

For example, if you only had HDHP coverage for 6 months out of the year, then your additional coverage amount would be $500 (6/12 X $1,000 = $500).

Line 8

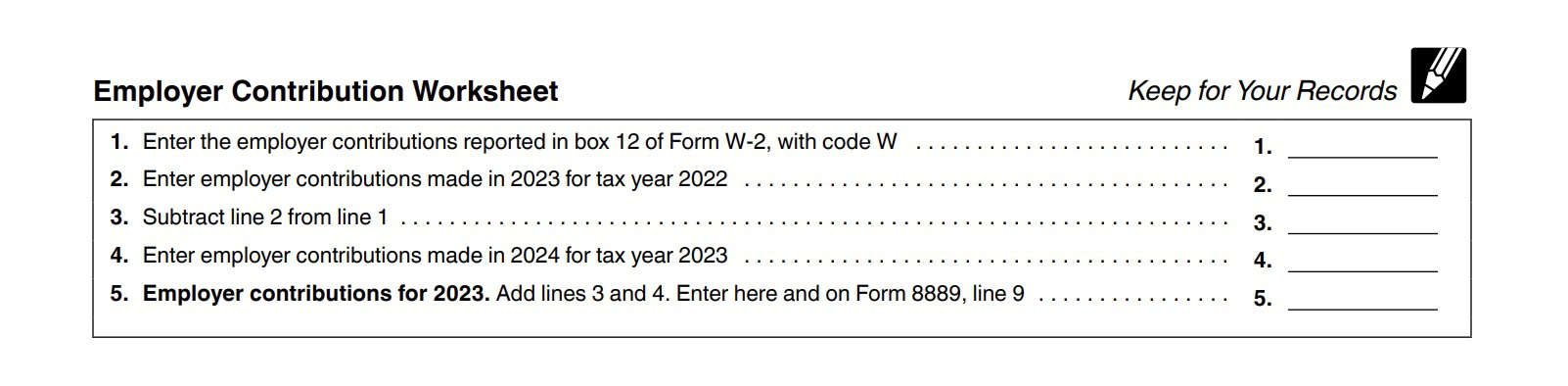

Line 9: Employer contributions

Include any contributions your employer made for the previous tax year. These contributions should be indicated on your Form W-2, Box 12, with Code ‘W.

If you received either of the following, you should complete the employer contribution worksheet (see below).

- Contributions for the given tax year, but received after the tax year (i.e. contributions for 2023 received in 2024)

- Contributions received in the given tax year for the previous tax year (i.e. contributions for 2022 received in 2023)

Line 10: Qualified HSA funding distribution

A distribution from your traditional IRA or Roth IRA to your HSA in a direct trustee-to-trustee transfer is called an HSA funding distribution.

Note that these funds are not being distributed from your HSA, but rather are being distributed from your IRA and contributed to your HSA.

The qualified HSA funding distribution:

- is not included in your taxable income

- Is not deductible, and

- Reduces the amount that can be contributed to your HSA by you and from other sources

Generally, you can only make 1 qualified HSA funding distribution in your lifetime.

Line 11

Add Line 9 and Line 10. This represents the total contributions to your HSA plan.

Line 12

Subtract Line 11 from Line 8. If this results in a negative number, enter ‘0.’

Line 13: HSA deduction

Enter the smaller of:

- Line 2

- Line 12

Enter this number on Line 13 and on Schedule 1 (IRS Form 1040), Part II, Line 13. If Line 2 is greater than Line 13, you may have to pay an additional tax and complete IRS Form 5329.

However, you may avoid the additional taxes by withdrawing excess contributions as follows:

- You withdraw the excess contributions no later than the due date, including extensions, of your annual tax return

- You can make the withdrawal during the 6-month period after the due date if you also file an amended tax return marked, “Filed pursuant to section 301.9100-2.”

- You do not claim a deduction for the amount of the withdrawn contributions

- You also withdraw any income earned on the withdrawn contributions and include the earnings in “Other income” on your tax return for the year you withdraw the contributions and earnings

- You will pay additional taxes on this other income

Part II: HSA distributions

In Part II, we’ll determine the following:

- Total HSA distributions for the year

- Total amount of taxable HSA distributions made during the year

- Tax liability (including additional taxes) you may owe on HSA distributions

Let’s begin with Line 14.

Line 14: Total distributions

In Line 14a, enter the total distributions you received during the tax year from all HSAs. This includes:

- Any amounts paid with a debit card that restricts payments to health care and

- Amounts withdrawn by other individuals that you have designated

These amounts should be shown in Box 1 of IRS Form 1099-SA. The 1099 SA form is one of the HSA tax forms you should receive from the financial institution managing your account.

In Line 14b, enter any HSA rollover amounts or any excess contributions that were properly withdrawn by the due date of your federal tax return.

In Line 14c, subtract Line 14b from Line 14a. Enter the total.

Line 15: Qualified medical expenses

Only include distributions from your HSA that were used to pay you for qualified medical expenses that were:

- Not reimbursed by insurance or other coverage, and

- Incurred after you established the HSA

qualified medical expenses

Generally, qualified medical expenses are unreimbursed medical expenses that you could otherwise deduct on Schedule A of your tax return.

Qualified medical expenses that you cannot include on Schedule A

For HSA purposes, the following items are reimbursable, even if they do not qualify for a medical and dental expenses deduction on Schedule A:

- Nonprescription medications

- Insulin is also deductible on Schedule A

- Menstrual care products

COVID expenses

Any unreimbursed amounts you pay for testing or preventing the spread of COVID-19 for yourself, your spouse, or your dependents are qualified medical expenses that you can reimburse from an HSA.

This includes:

- Masks

- Hand sanitizer

- Sanitizing wipes

- Home COVID-19 testing kits and supplies

Insurance premiums

As a general rule, you cannot treat insurance premiums as qualified medical expenses unless the premiums are for:

- Long-term care (LTC) insurance

- Health care continuation coverage

- Including coverage under COBR

- Health care coverage while receiving unemployment compensation under federal or state law, or

- Medicare and other health care coverage if you were 65 or older

- Not including premiums for a Medicare supplemental policy, such as Medigap

Line 16: Taxable HSA distributions

Subtract Line 15 from Line 14c. If zero or less, enter ‘0.’

Also include this number on Schedule 1, Part I, Line 8f.

Line 17: Tax

Check the box in Line 17a for any distributions that meet the exceptions to the additional 20% tax. This includes any distributions made after the account beneficiary dies, becomes disabled, or turns age 65.

For any amounts that don’t qualify for one of the exceptions, multiply that number by 20% and enter it in Line 17b.

Also include that amount on Schedule 2, Part II, Line 17c.

Part III: Income and additional tax for failure to maintain HDHP coverage

We will use Part III to figure the following amounts for failure to be an eligible individual during the testing period for either the last-month rule or a qualified HSA funding distribution:

- Any additional income and adjustments to income that must be reported on Schedule 1, and

- Additional taxes that must be reported on Schedule 2

Let’s start with Line 18.

Line 18: Last-month rule

You can use the Line 3 Limitation Chart and Worksheet in the Form 8889 Instructions for the year the contribution was made to determine the contribution you could have made if the last-month rule did not apply

Enter on Line 18 the excess of the amount contributed over the redetermined amount.

Last month rule

If you are an eligible individual on the first day of the last month of your tax year, you are considered to be an eligible individual for the entire year. However, you must remain an eligible individual during the testing period.

Testing period

The testing period is the 12 month period:

- Beginning with the last month of the tax year

- Ending on the last day of the 12th month following the last month of the tax year

If you fail to remain an eligible individual during this period, you will have to include the total contributions that would have been made as part of your income in the year in which you fail to be an eligible individual.

This amount is subject to a 10% additional tax.

Line 19: Qualified HSA funding distribution

Enter the total of any qualified HSA funding distribution, outlined in Line 10.

Line 20: Total income

Add Line 18 and Line 19. Include this amount on Schedule 1, Part I, Line 8f.

Line 21: Additional tax

Multiply Line 20 by 10%. Include this amount in the total on Schedule 2, Part II, Line 17d.

Frequently asked questions

IRS Form 8889, Health Savings Accounts, is the IRS tax form that a taxpayer will use when reporting certain activities to the Internal Revenue Service within their HSA from the prior year. These activities include: employee HSA contributions, employer HSA contributions, HSA tax deductions resulting from contributions to your HSA account, HSA distributions, and taxes and penalties, if applicable.

All taxpayers must file this form if you (or someone on your behalf) made contributions to your HSA in the prior year, you received HSA distributions in the prior year, you must include certain amounts because you became ineligible during the testing period, or you received an HSA interest due to a beneficiary’s death.

Only taxpayers with a high deductible health plan (HDHP) may contribute to an HSA. If you have an HSA, but no longer have an HDHP, you may keep the HSA, but can no longer contribute to the HSA.

Video walkthrough

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Where can I find IRS Form 8889?

You may find a copy of this tax form on the IRS website or by downloading the file below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!

What do you think?

Let me know what you think of this article in the comments. If you feel like this article helped you, please share it, pin it or tag me. And if you have any additional tips, please share them in the comments.