IRS Form 8892 Instructions

If you made a taxable gift in excess of the annual gift tax exclusion amount, you may need to file IRS Form 709 by April 15 of the following tax year. If you need a tax extension for filing Form 709, you can request one by filing IRS Form 8892 by your original due date.

In this article, we’ll walk through everything you need to know about IRS Form 8892, including:

- Situations that warrant filing IRS Form 8892, and those which do not

- How to complete IRS Form 8892

- Ways to pay any estimated gift tax when filing your extension request

Let’s start by going over the tax form itself.

Table of contents

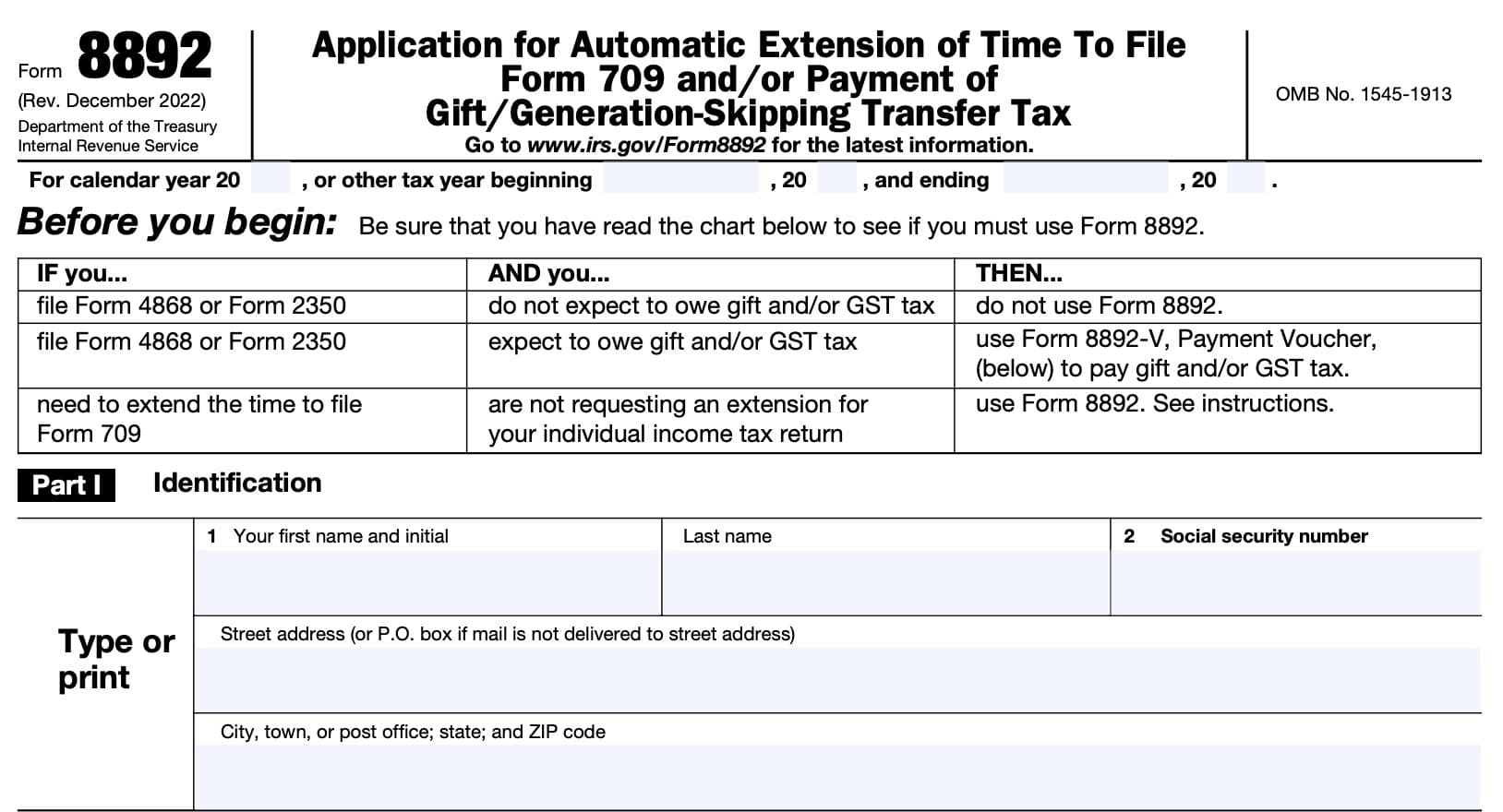

How do I complete IRS Form 8892?

This one-page tax form is divided into 3 parts:

- Part I: Identification

- Part II: Automatic Extension of Time to File Form 709 (Section 6081)

- Part III: Payment of Gift (and/or Generation-Skipping Transfer) Tax

Let’s start at the top of the form, with Part I.

Part I: Identification

At the top of the form, you’ll enter either the calendar year or a different tax year, if you do not use a calendar year as your tax year.

Before entering information in the identification fields, take a look at the table at the top of the tax form. There are three different scenarios, which warrant a closer look:

Do not use IRS Form 8892

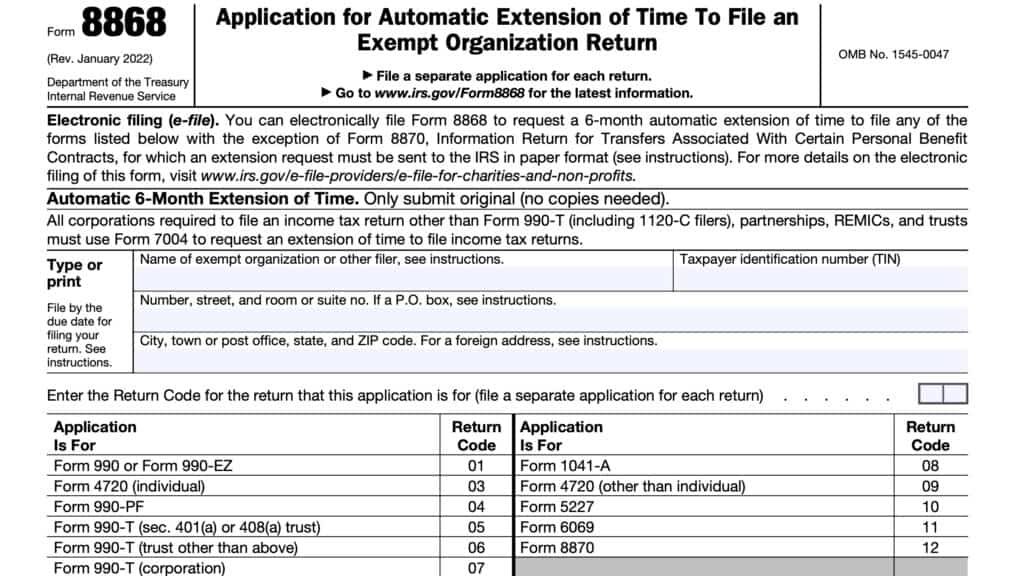

You do not need to make an extension request if you do not expect to owe gift tax or generation-skipping transfer taxes, and you’re already filing one of the following tax forms:

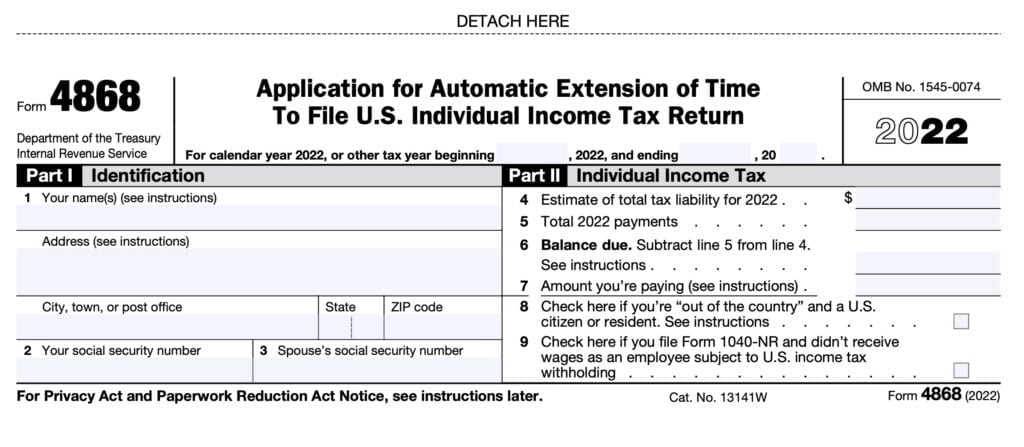

- IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, or

- IRS Form 2350, Application for Extension of Time To File U.S. Income Tax Return For U.S. Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment

In other words, if you’re already requesting an automatic extension of time for your federal income tax returns, and you do not expect to owe gift taxes, then you do not need to file IRS Form 8892.

File Form 8892-V, Payment Voucher

If you plan on filing Form 4868 or IRS Form 2350 to request an extension, and you do expect to owe either gift tax or GST tax, then you should plan to complete Form 8892-V, Payment Voucher. Submit this completed form with your payment of tax.

Use IRS Form 8892

If you need an extension request to file Form 709 – Gift Tax Return, but you are not already requesting an extension, then you should file Form 8892 as your extension request.

Let’s start with the taxpayer information fields, below.

Line 1: Taxpayer name

In Line 1, enter your first name, middle initial, and last name, as they appear on your individual federal income tax return.

Line 2: Social Security number

In Line 2, enter your complete Social Security number.

Below Lines 1 and 2, enter your complete mailing address, to include:

- Street address

- Enter your post office box number if mail is not delivered to your street address

- City & state

- ZIP code

If you’ve had a change of address since your last tax return, then you may need to file IRS Form 8822, Change of Address, to notify the IRS of the change.

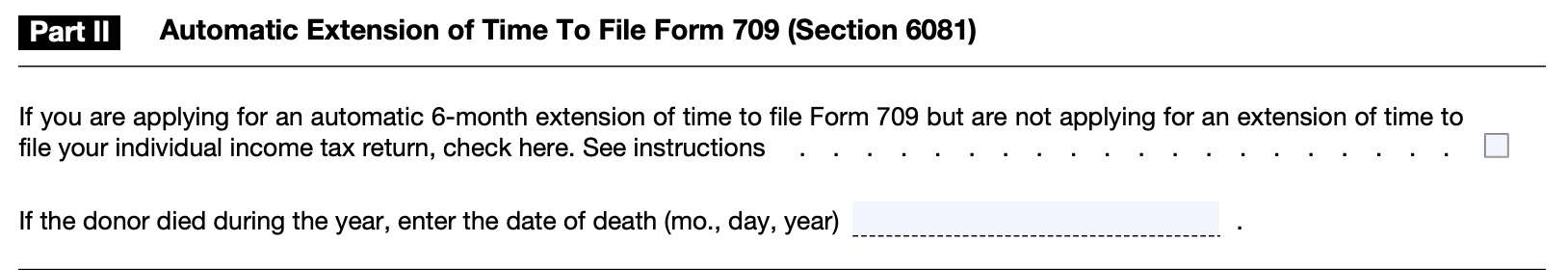

Part II: Automatic Extension of Time to File Form 709 (Section 6081)

Complete Part II if you are applying for an automatic 6-month extension of time to file your federal gift tax return, but you are not requesting additional time to file your federal individual income tax return.

To do this, check the box.

Unless the donor has died, in general, if the Internal Revenue Service grants an extension based on IRS Form 8892, that extension will end on October 15 of the applicable year. However, if the due date falls on a weekend or federal holiday, then the new filing deadline will be the following business day.

If you are making a payment along with the automatic extension request, also complete Part III, below. You will only need to complete Boxes 1 through 3.

Donor’s death

Normally, for gift taxes, federal tax returns are due April 15. However, if the donor died during the tax year, IRS Form 709 may be due before April 15, based on the IRS Form 709 instructions.

Based on Internal Revenue Code Section 6081, the maximum extension that the IRS will grant is 6 months from the initial due date.

Enter the date of the donor’s death in the following format: MM/DD/YYYY.

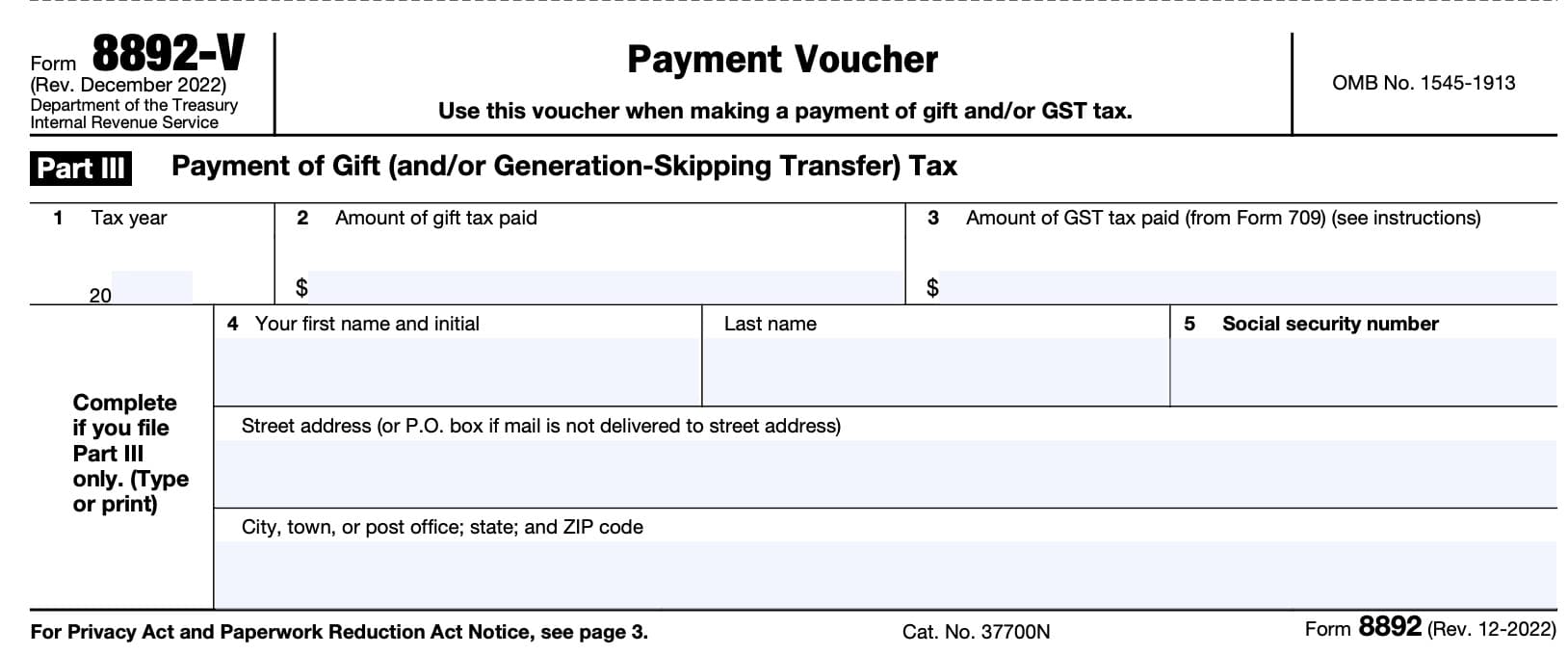

Part III: Payment of Gift (and/or Generation-Skipping Transfer) Tax

Use Part III, also known as IRS Form 8892-V, if you’re paying any estimated gift tax due with your extension request.

Payment deadlines

As a note, your tax return extension is not a payment extension. In other words, payment deadlines remain the same for gift tax returns and generation-skipping transfer tax returns, as well as federal income tax returns.

While you might receive additional time to file your tax return, you are expected to pay any gift tax due by the original tax filing deadline.

Line 1: Tax year

Enter the tax year in question. This is the calendar year for which you are paying gift taxes or GST taxes, not the year in which you are filing Form 8892.

Normally, you’ll file Form 8892 to request a tax extension based upon a taxable gift that you made in a prior year. For example, if you are filing IRS Form 8892-V in 2024 for a gift that you made in 2023, then you would enter 2023 in Line 1.

Line 2: Amount of gift tax paid

Enter the amount of gift tax paid with your payment voucher.

Line 3: Amount of GST tax paid

In Line 3, enter the amount of the GST tax paid from Form 709.

The only GST tax you can pay with IRS Form 8892 is the tax on a direct skip that you are reporting on IRS Form 709.

Line 4: Taxpayer name

You only need to include this personal information if you did not complete Part I, above.

In Line 4, enter your first name, middle initial, and last name, as they appear on your individual federal income tax return.

Line 5: Social Security number

In Line 5, enter your complete Social Security number.

Below Lines 4 and 5, enter your complete mailing address, to include:

- Street address

- Enter your post office box number if mail is not delivered to your street address

- City & state

- ZIP code

If you’ve had a change of address since your last tax return, then you may need to file IRS Form 8822, Change of Address, to notify the IRS of the change.

How to file IRS Form 8892

According to the form instructions, you should send your completed Form 8892, as well as your payment voucher, to the following IRS address:

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999

If you plan to use private delivery services such as UPS or FedEx, they may be able to help you confirm delivery of your form submission by the due date.

Paying by check or money order

If you are submitting your gift tax payment by check or money order, you should follow these steps:

- Make your check or money order payable to: “United States Treasury”

- Do not send cash

- Include the following information on your check:

- Social Security number

- Daytime telephone number

- Calendar year (from Box 1)

- ‘Form 709’

Enclose your payment with the completed payment voucher. However, do not staple or attach your check or money order to the voucher itself.

Video walkthrough

Watch this instructional video for more background on filing Form 8892 to request a gift tax return extension.

Frequently asked questions

You should file your tax return extension request and submit any estimated gift tax due, no later than the original tax filing deadline. For most taxpayers, this is April 15 of the following year, or the next business day, whichever is later.

You should pay estimated gift tax, as well as GST tax that you report on IRS Form 709. The only GST tax that you can submit with your payment voucher is a tax on a direct skip that you reported on Form 709.

You may pay your gift tax online, using the Treasury Department’s Electronic Federal Tax Payment System (EFTPS). You may also send a check or money order, payable to the U.S. Treasury, to the Kansas City IRS office when you file your extension request.

Where can I find IRS Form 8892?

As with other tax forms, you can download IRS Form 8892 from the IRS website. For your convenience, we’ve enclosed the latest version of this tax form right here.