IRS Form 8922 Instructions

When third-party sick pay is paid, employers or their third-party payer must reconcile federal and FICA taxes withheld from eligible sick pay with the information reported on their employment tax returns. This is done on IRS Form 8922, Third-Party Sick Pay Recap.

In this article, we’ll provide everything you need to know about this tax form, including:

- How to complete IRS Form 8922

- Important information on filing IRS Form 8922

- Frequently asked questions

Let’s start with a step-by-step guide on completing this tax form.

Table of contents

How do I complete IRS Form 8922?

This one-page tax form is relatively straightforward to fill out. Let’s start on the left-hand side of the form.

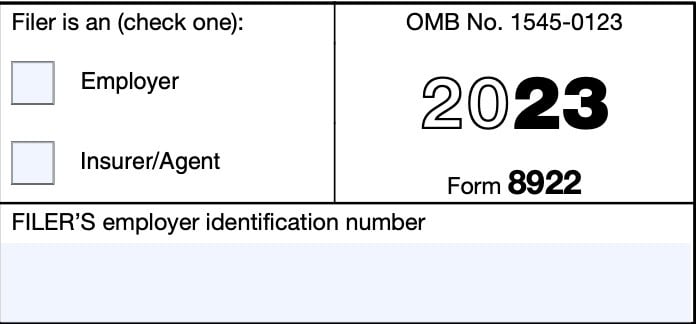

Filer is an (check one)

Check the applicable box, based upon who does the reporting of sick pay.

If the employer is responsible for sick pay recaps, check the Employer box. If an insurer or insurance agent is responsible for the payment of sick pay, then check the Insurer/Agent box.

Filer’s employer identification number

Enter the employer identification number (also known as employer ID number or EIN) of the responsible party.

If you checked the Employer box, enter the employer’s EIN. If you checked the box for Insurer/Agent, then enter the EIN for that party instead.

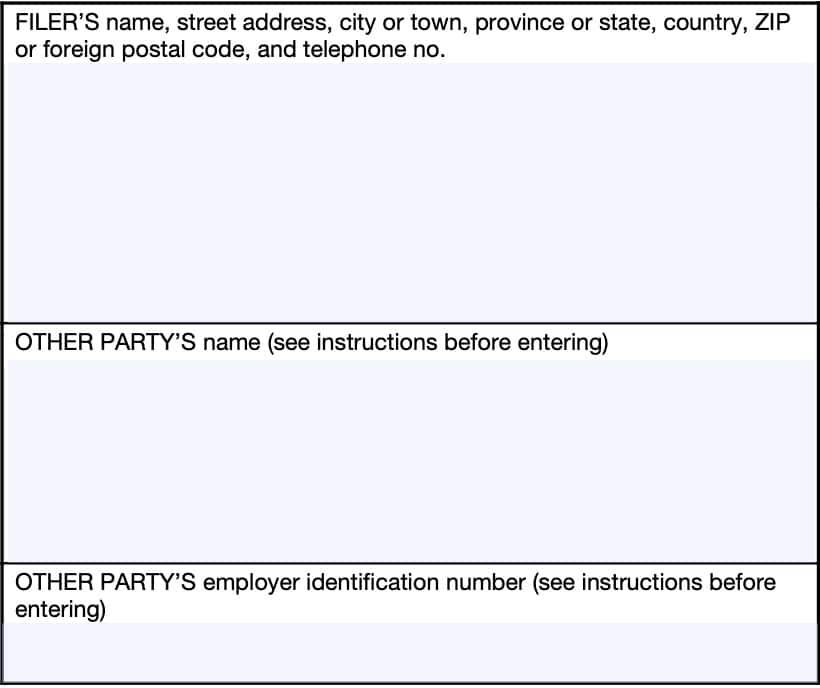

Filer’s name & address

The name and address that you enter in this box depends on whether you checked the employer box or the insurer/agent box.

the employer box is checked

If you check the Employer box, the employer for whom the sick pay was paid by the insurer or agent will complete the information with the following information:

- Employer’s name

- Employer’s complete address

- Employer’s telephone number

the insurer/agent box is checked

If the Insurer/Agent box is checked, the insurer or agent who paid the sick pay will complete the information with the insurer/agent’s name, address, and phone number instead.

Other party’s name & employer identification number

If you checked the employer box

If the Employer box is checked, the employer must provide the name and EIN of the third party insurer or agent.

When the employer has contracts with more than one insurer or agent, the employer must file a separate Form 8922 for the wages and taxes related to each contract.

If you checked the insurer/agent box

If you checked the Insurer/Agent box instead, the insurer or agent may, but isn’t required to, provide the name and EIN of the employer.

The insurer or agent must file a separate Form 8922 for the sick-pay wages and taxes related to each employer if the insurer or agent:

- Is responsible for providing this information, and

- Has contracts with more than one employer

Alternatively, the insurer or agent may:

- File a separate Form 8922 for such wages and taxes related to each employer for which it is supplying the name and EIN, then

- File one Form 8922 for the wages and taxes related to the employers for which it isn’t supplying the name and EIN

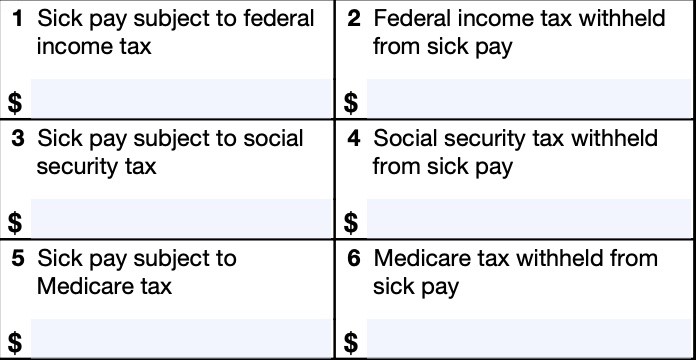

Box 1: Sick pay subject to federal income tax

Enter the total amount of sick pay subject to federal income tax withholding during the tax year.

Box 2: Federal income tax withheld from sick pay

Enter the total amount of federal income tax withheld from the sick pay in the taxable year.

Box 3: Sick pay subject to Social Security tax

In Box 3, enter the total amount of sick pay that is subject to Social Security tax.

Third-party payers filing on behalf of employers

If a third-party payer of sick pay payments is also paying qualified sick leave wages on behalf of an employer, the third party would be making these payments as an agent of the employer. The employer must do the reporting and payment of employment taxes with respect to the qualified sick leave wages, unless the employer has an agency agreement with the third-party payer that requires the third-party payer to collect, report, and/or pay or deposit employment taxes on the qualified sick leave wages.

If the employer has such an agency agreement in place, the employer’s agent includes the qualified sick leave wages in Box 3. When the third party files Form 8922, they must also attach a statement that specifies the amount of qualified sick leave wages included in Box 3.

Your employment tax return instructions should contain additional information about qualified sick leave wages.

Box 4: Social Security tax withheld from sick pay

Enter the total amount of Social Security taxes withheld from the sick pay.

Box 5: Sick pay subject to Medicare tax

Enter the total amount of sick pay subject to Medicare tax.

Box 6: Medicare tax withheld from sick pay

Enter the total amount of the Medicare taxes withheld from sick pay. This includes Additional Medicare Tax.

Corrected Form 8922

If you filed Form 8922 with the IRS and later discover that you made an error when completing that form, you must correct it as soon as possible.

Complete all entries on Form 8922 when making a correction. Enter an “X” in the “CORRECTED” checkbox only when correcting a Form 8922 that you previously filed with the Internal Revenue Service.

Filing IRS Form 8922

Once you’ve completed the form, there are some special rules you may need to know about actually filing it.

Purpose of filing Form 8922

Form 8922 is filed to reconcile employment tax returns, such as IRS Form 941, with Forms W-2 when third parties are involved in sick pay.

IRS Publication 15-A, Employer’s Supplemental Tax Guide, contains additional information, under Sick Pay Reporting.

For purposes of these instructions, all references to “sick pay” mean ordinary sick pay, not qualified sick leave wages. Refer to your employment tax return instructions for specific requirements about qualified sick leave wages.

Who must file IRS Form 8922?

As a general rule, if the liability for the employer’s share of social security tax and Medicare tax is reported on the employer’s employment tax return, IRS Form 8922 must be filed by either:

- The employer, if sick pay is reported on Forms W-2 under the name and employer identification number (EIN) of the insurer or agent; or

- The insurer or agent, if sick pay is reported on Forms W-2 under the name and EIN of the employer.

When to file IRS Form 8922

For the 2023 tax year, the IRS due date is February 29, 2024.

How to file IRS Form 8922

You cannot file IRS Form 8922 electronically. According to the IRS instructions, you must mail in your third party sick pay recap form to the IRS to the address that corresponds to your state.

Below is the IRS filing location, based upon your state.

| Business Location | Mailing address | Private delivery service (FedEx, UPS, etc.) |

| Alabama, Alaska, Arizona, Arkansas, Colorado, Florida, Georgia, Hawaii, Kansas, Louisiana, Mississippi, Missouri, Nevada, New Mexico, Oklahoma, Tennessee, Texas, Utah, Washington | Internal Revenue Service Memphis Service Center P.O. Box 87 Mail Stop 814 D6 Memphis, TN 38101-0087 | Internal Revenue Service 5333 Getwell Rd Stop 814 D6 Memphis, TN 38118 |

| California, Connecticut, Delaware, District of Columbia, Idaho, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Montana, Nebraska, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Vermont, Virginia, West Virginia, Wisconsin, Wyoming | Internal Revenue Service IRS SSA CAWR Philadelphia, PA 19255-0533 | Internal Revenue Service Mail Stop 4-G08 151 2970 Market St Philadelphia, PA 19104 |

Video walkthrough

Watch this informational video to learn more about how to reconcile your third-party sick pay by filing IRS Form 8922.

Frequently asked questions

The IRS requires employers to maintain employment tax returns for 6 prior years. These records, including IRS Form 8922, should be readily available for IRS review.

For individual employees, this depends on whether you paid for the cost of the policy or your employer paid for the policy. Third party sick pay benefits from a policy paid by an employee is not considered taxable income.

Where can I find IRS Form 8922?

You can find IRS forms on the Internal Revenue Service website. For your convenience, we’ve attached the latest copy of IRS Form 8922 to this article.