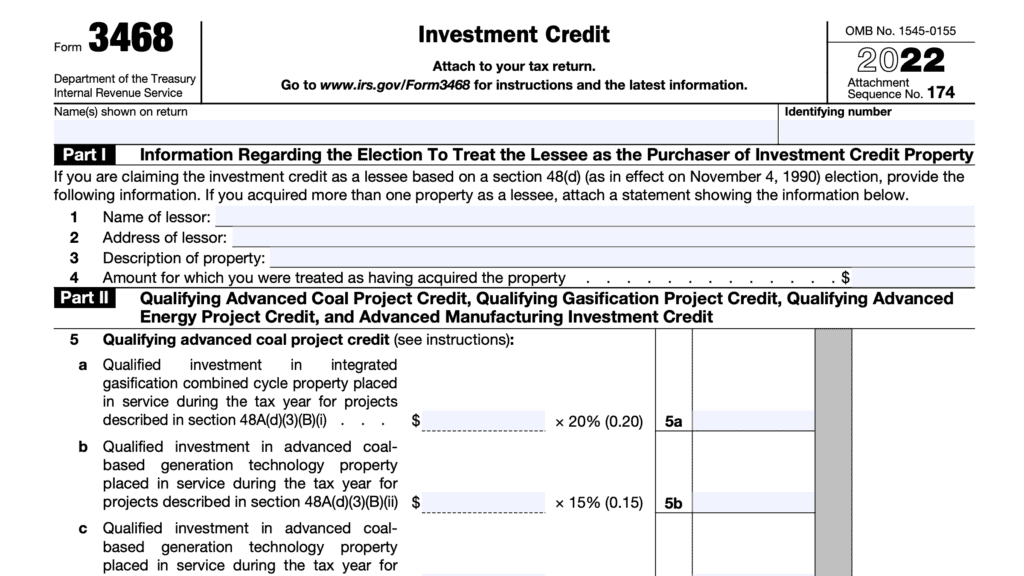

IRS Form 8941 Instructions

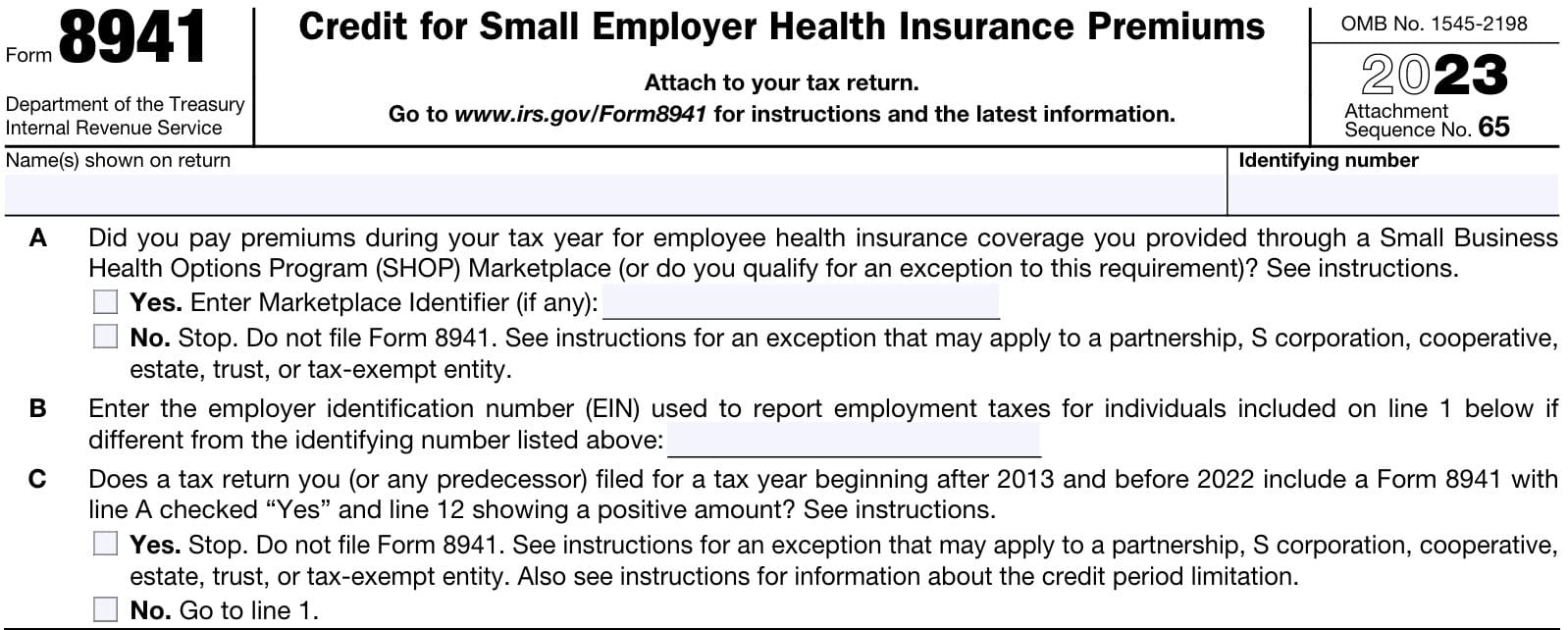

Small businesses who provide health coverage for their employees may be eligible for a tax credit. For many small business owners, claiming this credit on IRS Form 8941 could provide a direct tax benefit on their individual income tax return.

In this article, we’ll go over this tax form, including:

- How to complete IRS Form 8941

- Eligibility requirements for the small employer health insurance premium tax credit

- Frequently asked questions about the credit

Let’s start with step by step instructions on completing IRS Form 8941.

Table of contents

How do I complete IRS Form 8941?

This one-page tax form contains 7 worksheets, located in the IRS form instructions. As we walk through the form, we’ll post images of each worksheet, as well as its intended purpose.

Let’s start at the top of the form.

Line A

Before answering the question in Line A, enter the following information at the top of the form:

- Name of the entity as listed on the applicable income tax return

- Identifying number

For Line A, answer Yes/No to the following question:

Did you pay premiums during the tax year for employee health insurance coverage that you provided through a Small Business Health Options Program (SHOP) Marketplace, or do you qualify for an exception to this requirement?

If you did, then enter the Marketplace marker, if applicable. Otherwise, you cannot file Form 8941 to calculate a tax credit.

If you are a partnership, S-corporation, cooperative, estate, trust, or tax-exempt eligible small employer, you may still use this form if you received a credit from another entity that you must report on Line 15.

In this case, proceed to Line 15. Otherwise, do not complete this form.

Line B

Enter the employer identification number (EIN) that you use for employment tax purposes if it is different from the EIN at the top of the form. Otherwise, go to Line C.

Line C

In Line C, indicate whether you have previously completed Form 8941 for a previous tax year (after 2013), but before the year immediately preceding the tax year for which you are filing a tax return.

For example, if you are filing for tax year 2023, you would indicate ‘Yes’ if you previously filed Form 8941 for a taxable year between 2014 and 2021. If applicable, you may not be able to file Form 8941 unless you are claiming a tax credit in Line 15, below.

If not applicable, simply check ‘No’ and proceed to Line 1.

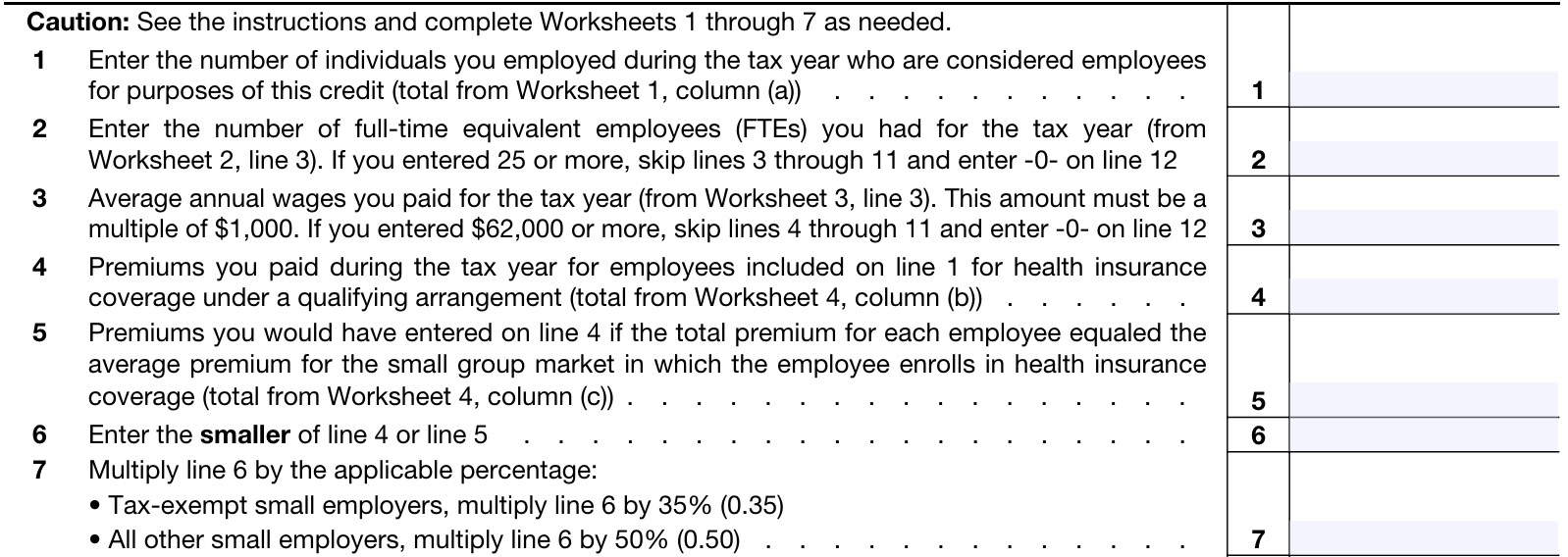

Line 1: Number of individuals employed during the tax year

To complete Line 1, you will need to complete Worksheet 1, which is contained in the IRS Form 8941 instructions.

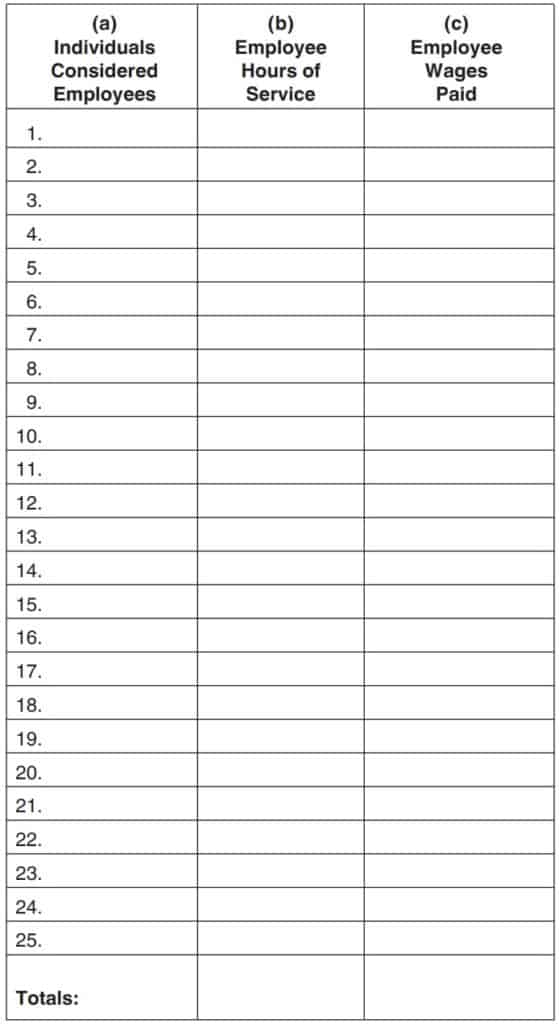

Worksheet 1

In Worksheet 1, enter the following information for each individual that you consider to be an employee. This includes all employees who performed services during the tax year, regardless of how many hours they worked during the year.

However, this does not include:

- The owner of a sole proprietorship

- Partners in a partnership

- S-corporation shareholder who holds more than 2% of S corporation stock

- Shareholder who holds more than 5% of corporation stock in a corporation (not S-corporation)

- Person who owns more than 5% of capital or profits in any business that is not a corporation

- Family members or household members who qualify as a dependent for any person listed above

For all eligible employees, enter the following information:

- Column (a): Employee name

- Column (b): Employee hours of service

- Column (c): Employee wages paid

- Complete Worksheet 2 before completing column (c).

- Do not complete column (c) if Worksheet 2 calculations result in a number of 25 or more full time equivalent employees (FTE).

After completing Worksheet 1, enter the total of employees (from column (a)) into Line 1, then proceed to Line 2.

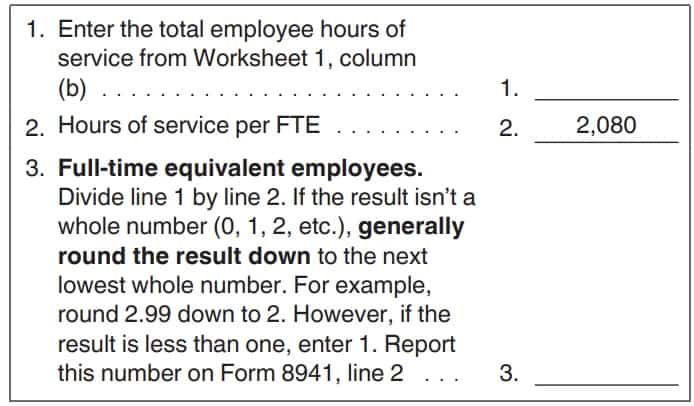

Line 2: Number of FTEs in the Tax year

In Line 2, you will enter the number of full-time equivalent employees (FTEs) that you employed throughout the tax year. To complete Line 2 (and before completing Worksheet 1), you will need to complete Worksheet 2.

Worksheet 2

In Worksheet 2, perform the following:

- Total hours of service: Enter the total employee hours of service from Worksheet 1, column (b)

- Divide by 2080. This number represents the number of hours of service per FTE over the course of a full year.

- Round down the result to the nearest whole number. For example, 2.99 rounds down to 2.

Once you’ve completed Worksheet 2, enter the result on Line 2. If the number is 25 or more, do not complete column (c) of Worksheet 1.

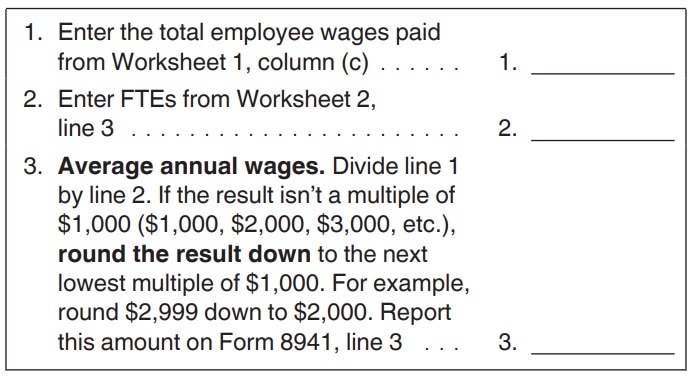

Line 3: Average annual wages for the tax year

In Line 3, you’ll enter the average wages of employees paid during the tax year. To arrive at this number, you’ll need to complete Worksheet 3.

Worksheet 3

In Worksheet 3, complete the following steps:

- Enter the total employee wages paid during the tax year. This is the total wages paid to each employee, from Worksheet 1, column (c).

- Enter the number of FTEs from Worksheet 2, Line 3

- Divide the total employee wages paid by the number of FTEs. This will result in your average annual wages per employee

- Round the number down to the nearest $1,000. For example, $2,999 rounds down to $2,000.

Enter the result from Worksheet 3 into Line 3 on your Form 8941.

Line 4: Premiums paid during the tax year

In Line 4, you will enter the total amount of employees’ health insurance premiums paid during the tax year. To arrive at this number, you will need to complete Worksheet 4.

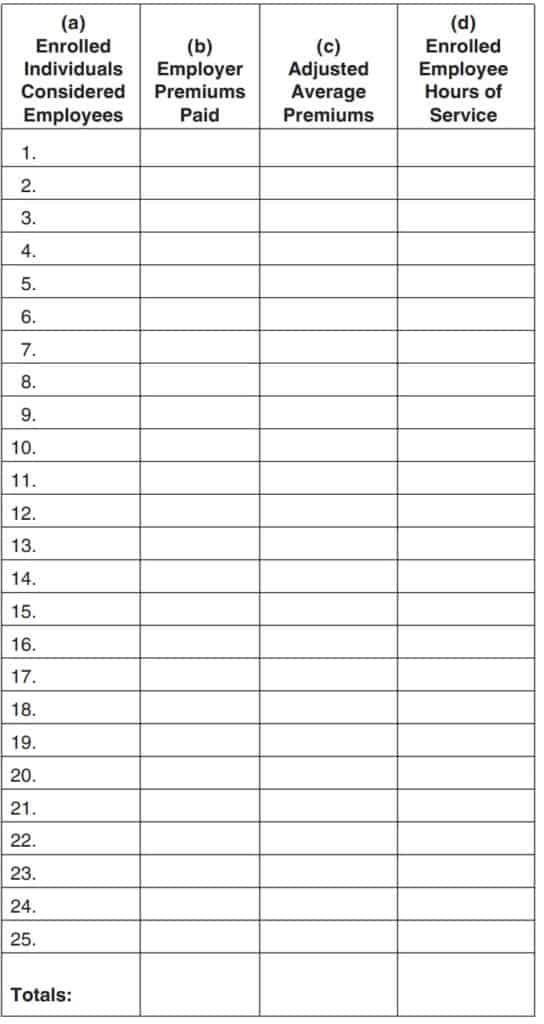

Worksheet 4

In Worksheet 4, enter the following information:

- Column (a): Employee name

- Column (b): Total employer premiums paid for the tax year

- Column (c): Adjusted average premiums: The amount you would have paid for the employee’s health care premiums based upon the average premium tables, located in the form instructions.

- Column (d): Hours of service

- Do not complete column (d) if Line 12 equals zero.

At the bottom of Worksheet 4, add the totals of columns (b), (c), and (d). Enter the results in the Totals row at the bottom. If you require more than 25 rows, enter the total of all lines at the bottom of Worksheet 4.

In Line 4, enter the total that appears at the bottom of column (b). This is the total employee health insurance premiums paid during the tax year.

Line 5: Adjusted average premiums

For Line 5, enter the total adjusted average premiums for the tax year. This is the total at the bottom of Worksheet 4, column (c).

Line 6

In Line 6, enter the smaller of either Line 4 or Line 5.

Line 7: Applicable percentage

Multiply the Line 6 amount by the applicable percentage, based upon your entity’s tax status:

- Small tax-exempt employers: 35%

- All other small employers: 50%

Enter the result in Line 7.

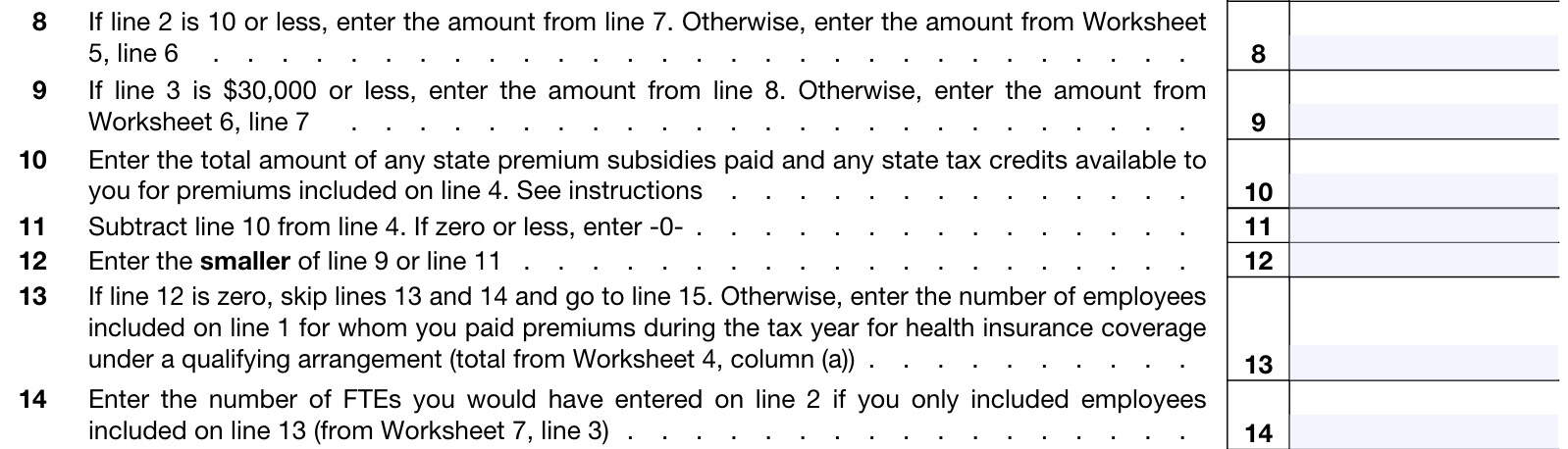

Line 8

If Line 2 is 10 or less, enter the amount from Line 7. Otherwise, enter the amount from Worksheet 5, Line 6.

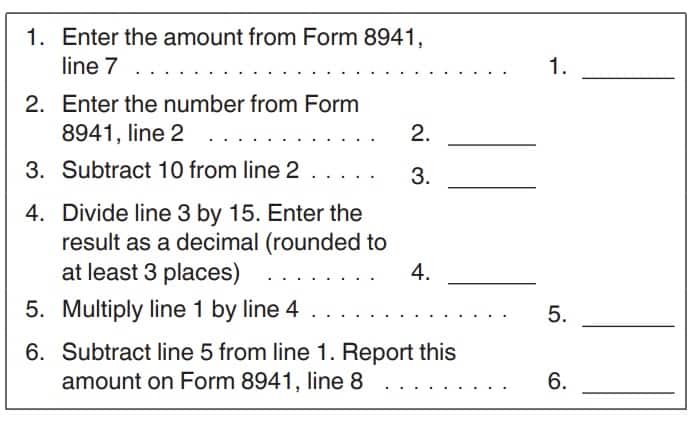

Worksheet 5

Employers with 10 or fewer employees are generally eligible for full credit, not subject to phaseout based on FTEs. For eligible small business employers, there is a phaseout between 11 FTEs and 25 FTEs. Employers with 25 or more FTEs are generally ineligible for this federal tax credit.

In Worksheet 5, you will calculate the amount of the tax credit phaseout based on the number of full-time employees you employed during the tax year.

To calculate the phaseout, follow these steps:

- Line 1: Enter the amount from Line 7

- Line 2: Enter the number of FTEs from Line 2

- Line 3: Subtract 10 from the Line 2 number

- Line 4: Divide the number in Worksheet 5, Line 3 by 15

- Line 5: Multiply the number in Worksheet 5, Line 1 by the result in Line 4, directly above

- Line 6: Subtract the Line 5 number from Line 1.

Enter this result in Line 8. This represents the remaining credit amount your business is eligible for, after the FTE-based phaseout.

Line 9

If Line 3 is $28,000 or less, enter the amount from Line 8. Otherwise, enter the amount from Worksheet 6, Line 7.

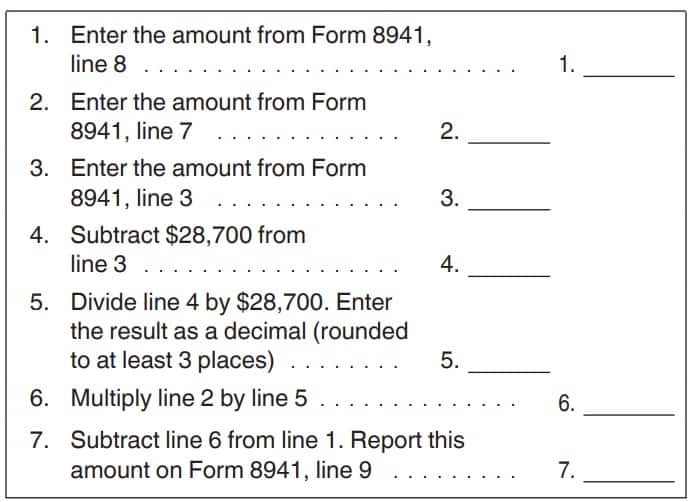

Worksheet 6

For eligible employers, there is a phaseout when the average annual wages of employees is between $28,000 and $58,000. Employers with an average annual employee salary greater than $58,000 are generally ineligible for this federal tax credit.

In Worksheet 6, you will calculate the amount of the tax credit phaseout based on the average employee wages paid during the tax year.

To calculate the phaseout, follow these steps:

- Line 1: Enter the amount from Line 8

- Line 2: Enter the amount from Line 7

- Line 3: Enter the amount from Line 3

- Line 4: Subtract $28,700 from the Line 3 number

- Line 5: Divide the number in Worksheet 5, Line 4 by $28,700

- Enter the result as a decimal, rounded to 3 places

- Line 6: Multiply the number in Worksheet 5, Line 2 by the result in Line 5, directly above

- Line 7: Subtract the Line 6 number from Line 1.

Enter this result in Line 9. This represents the remaining amount of credit your business is eligible for, after the average employee salary phaseout.

Line 10: state premium subsidies paid or state tax credits available

If applicable, enter the total amount of either:

- State premium subsidies paid

- State tax credits available to you for premiums included on Line 4.

If not applicable, enter ‘0’ and move to Line 11.

Line 11

Subtract Line 10 from Line 4. Enter the result here. If the result is zero or less, enter ‘0.’

Line 12

Enter the smaller of:

Line 13

If Line 12 equals zero, skip Line 13 and Line 14. Proceed directly to Line 15.

Otherwise, enter the number of employees included on Line 1 for whom you paid health care premiums during the tax year under a qualifying arrangement. This is the total from Worksheet 4, column (a).

Line 14

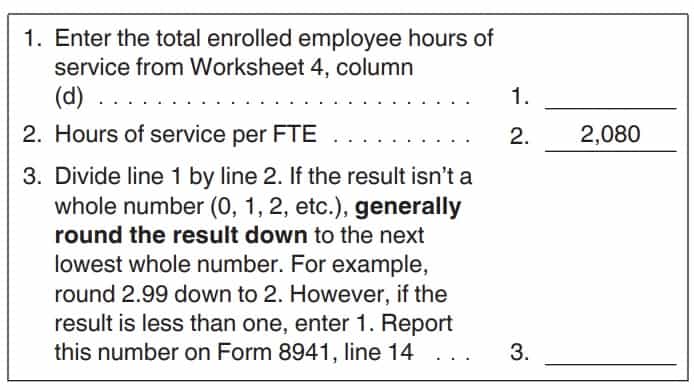

In Line 14, you may need to use Worksheet 7. To do this, let’s take a look at Worksheet 7.

Worksheet 7

In Worksheet 7, enter the total enrolled employee hours of service from Worksheet 4, column (d). Divide this number by 2,080, then round down to the nearest whole number.

Enter this result on IRS Form 8941, Line 14.

Line 15: Credit for small employer health insurance premiums

If applicable, enter any applicable tax credit for small employer health insurance premiums from any of the following:

- Partnerships

- S corporations

- Cooperatives

- Estates & trusts

Credits for small employer health insurance premiums should appear on the following:

- Partnerships: Schedule K-1 (Form 1065), Box 15, Code P

- S-corporations: Schedule K-1 (Form 1120-S), Box 13, Code P

- Estates & trusts: Schedule K-1 (Form 1041), Box 13, Code G

- Cooperatives: Form 1099-PATR, Box 12

For partnerships, S-corporations, cooperatives, estates, trusts, and tax-exempt eligible small employers: Report these credits on Line 15.

All other filers calculating a separate credit on earlier lines should also report these credits on Line 15.

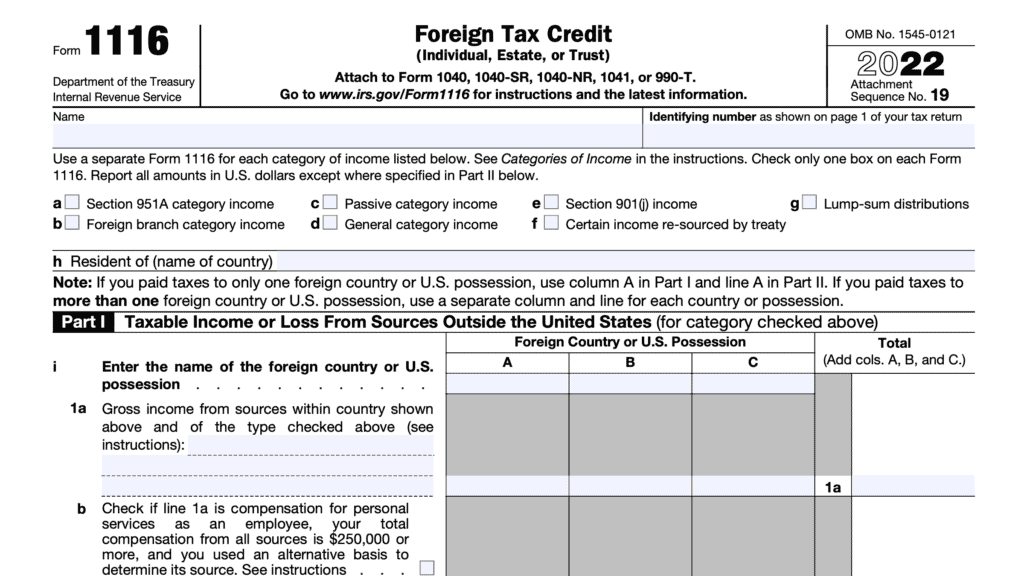

All other taxpayers not using earlier lines to figure a separate credit must report these tax credits directly on IRS Form 3800, General Business Credit, Part III, Line 4h.

Line 16

Add Lines 12 and 15, then enter the total in Line 16.

Cooperatives, estates, and trusts: Go to Line 17.

Tax-exempt small employers: Skip Lines 17 & 18, then go directly to Line 19.

Partnerships and S-corporations: Stop here, and report this amount on Schedule K.

All other taxpayers: stop here & report this amount on Form 3800, Part III, Line 4h.

Line 17

If applicable, enter any amount allocated to patrons of the cooperative, or beneficiaries of the estate or trust.

Cooperatives must allocate any credit in excess of their tax liability to their patrons.

Estates & trusts must allocate any credits between the estate or trust & their beneficiaries in the same proportion as income was allocated. The beneficiaries’ share goes in Line 17.

Line 18

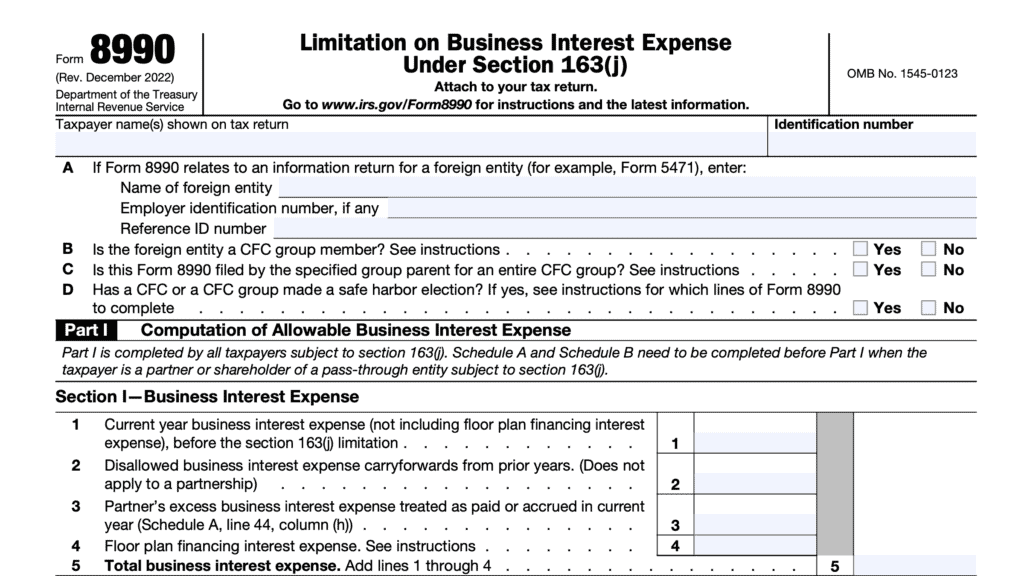

Subtract Line 17 from Line 16. Stop here, then report this amount on Form 3800, Part III, Line 4h as part of the general business credit.

Line 19

Enter the total amount of the following payroll taxes:

- Federal income taxes that the tax-exempt employer was required to withhold from employee wages in the tax year

- Medicare taxes that the tax-exempt employer was required to withhold from employee wages in the tax year

- Medicare taxes that the tax-exempt employer was required to pay in the tax year

Line 20

For tax-exempt small employers, enter the smaller of:

Enter this number here and on IRS Form 990-T, Part III, Line 6f.

Video walkthrough

Watch this instructional video to learn more about how to use IRS Form 8941 to calculate and claim tax credits for health insurance premiums you paid for your employees.

Do you use TurboTax?

If you use TurboTax, and you’re completing this tax form for the first time, you might be ready to try TurboTax Federal Premium instead of the free or deluxe versions. TurboTax Federal Premium comes in two offerings, DIY or Live Assisted.

Do it yourself

To learn more about using TurboTax Federal Premium’s DIY option, click here.

Live Assisted

If you feel more comfortable having a tax expert guide you for the first time through this new form (or any other new forms), get started here.

Ready to hand the reins over to someone else completely? Go here to learn more about TurboTax’s Live Assisted Full Service offering!

Frequently asked questions

IRS Form 8941, Credit for Small Employer Health Insurance Premiums, is the tax form that small business owners may use to claim the credit for small employer health insurance premiums for tax years beginning after 2009.

For eligible tax-exempt employers, the maximum credit is 35% of premiums paid. For all other eligible small employers, the maximum tax credit is 50% of premiums paid. The small business health care credit is only available to eligible for two consecutive years.

For purposes of the small business health care tax credit, an eligible employer must have paid premiums for employee health insurance under a qualifying arrangement, have fewer than 25 FTEs, and have paid average annual wages of less than $58,000 for the tax year.

A qualifying arrangement generally requires the employer to pay a uniform percentage of the premium cost for each enrolled employee’s health insurance coverage. This percentage must be at least half of their health insurance premiums.

How do I find IRS Form 8941?

You may find IRS Form 8941 on the IRS website. For your convenience, the most recent version of this form is available below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!