IRS Form 8945 Instructions

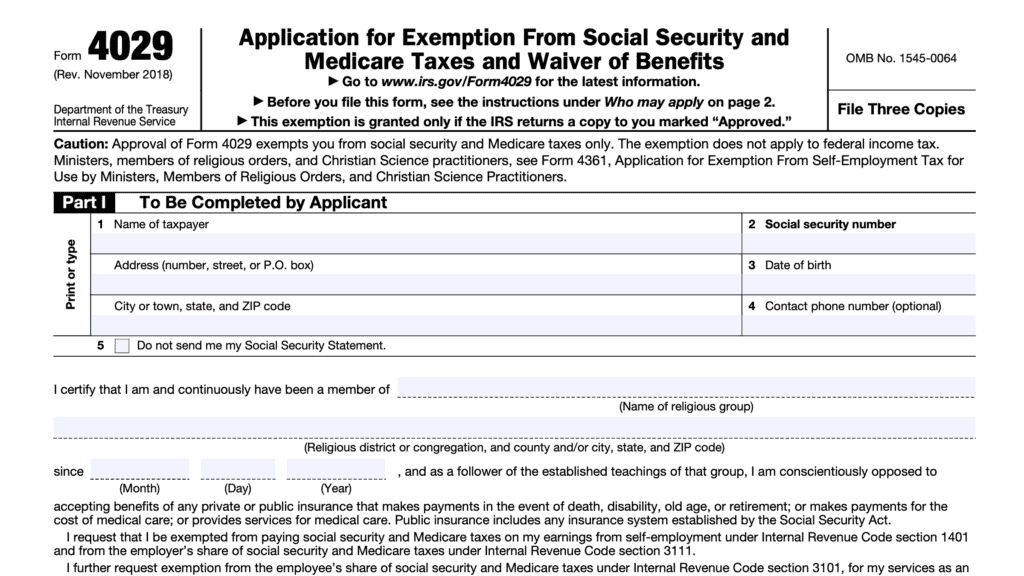

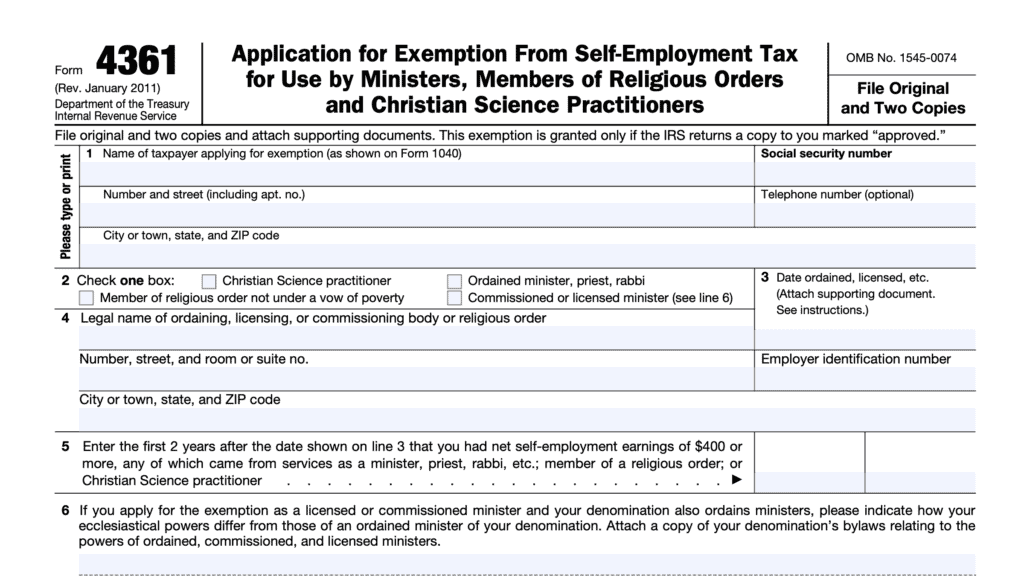

If you’re applying for a preparer tax identification number, known as a PTIN, you’ll need to register with the Internal Revenue Service. Although your PTIN application usually requires a Social Security number, you may apply for an exemption as a conscientious religious objector by filing IRS Form 8945, PTIN Supplemental Application For U.S. Citizens Without a Social Security Number Due To Conscientious Religious Objection.

In this article, we’ll walk you through everything you need to know about IRS Form 8945, including:

- How to complete and file IRS Form 8945

- Eligibility requirements

- Required supporting documentation

Let’s begin by going over how to complete this tax form.

Table of contents

How do I complete IRS Form 8945?

There are two parts to this one-page tax form:

- Part I: To be completed by preparer

- Part II: To be completed by authorized representative of religious group

Let’s take a look at each part, beginning at the top of the form.

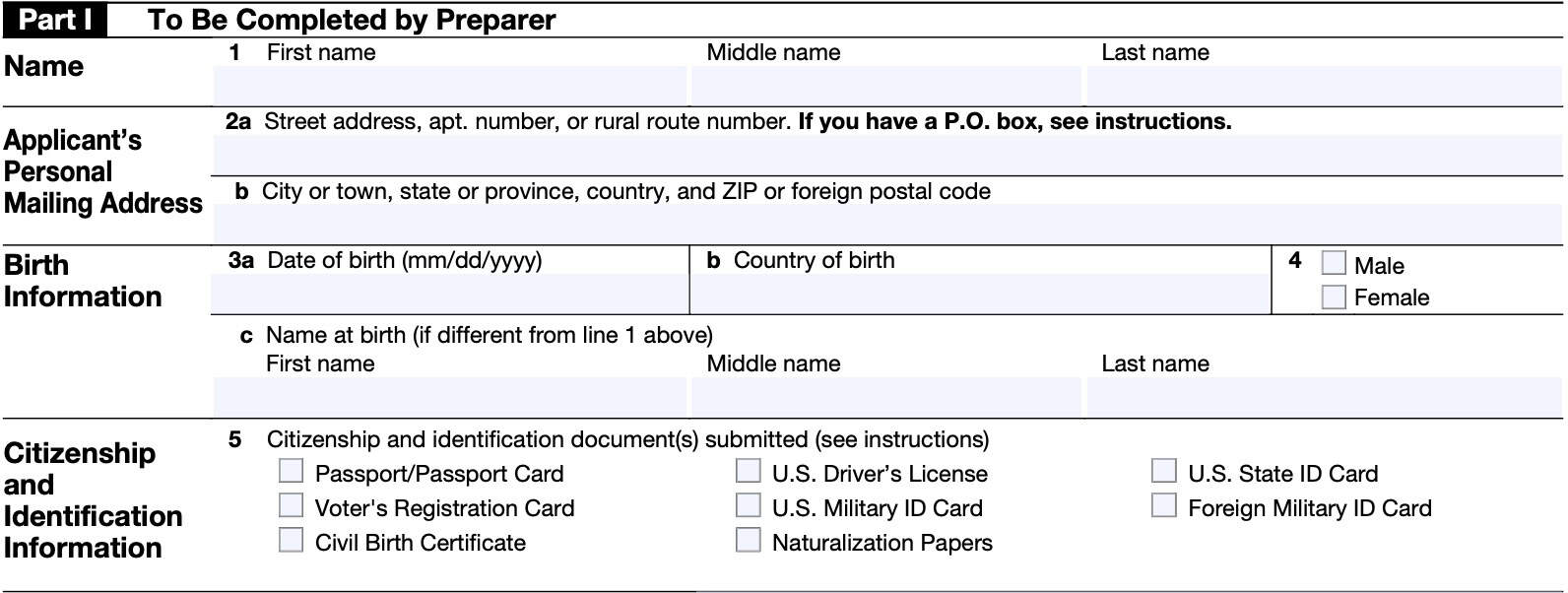

Part I: To be completed by preparer

In Part I, we’ll enter the tax return preparer’s information. Before you start, keep in mind that you should not submit IRS Form 8945 to the Internal Revenue Service if you already have a Social Security number, or SSN.

Before we begin, we’ll cover a couple of other items related to SSNs, from the form instructions.

Social Security numbers

With regards to SSNs, there a few things you should keep in mind.

When you should not file IRS Form 8945

According to the IRS instructions, you should not complete Form 8945 if any of the following conditions apply:

- You already have an SSN

- You are not a member of a religious group with a conscientious objection to obtaining an SSN

- You have an outstanding SSN application pending

- You received Social Security benefits or Social Security payments

- Also, if anyone else received these benefits or payments based on your wages or self-employment income

If you already have an SSN

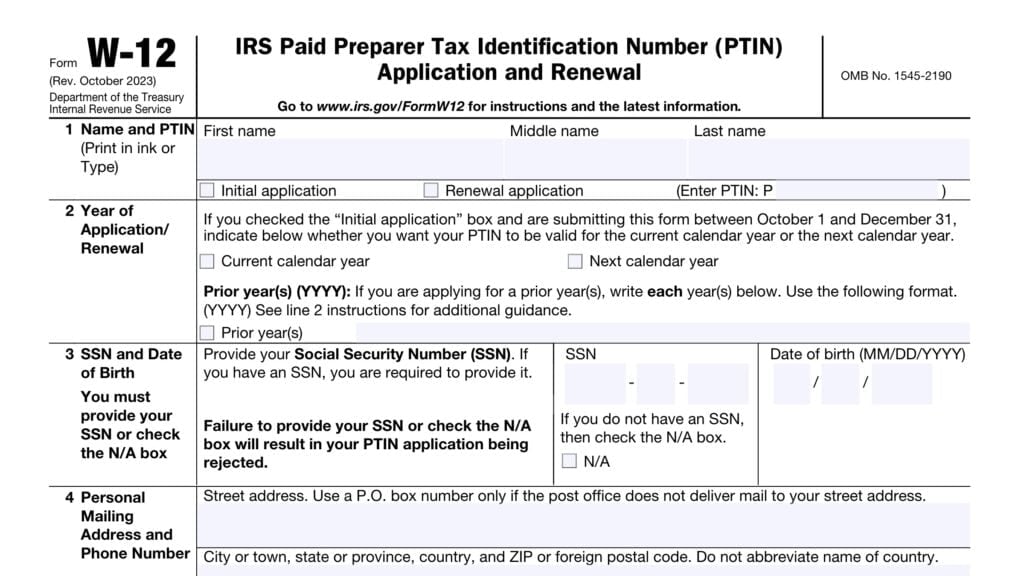

If you already have an SSN, then you should complete IRS Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal. On your Form W-12, you would enter your SSN in Line 3.

How to obtain an SSN

To get an SSN, you should complete Form SS-5, Application for Social Security Card, and submit your completed application to the Social Security Administration.

For step by step guidance on completing your Social Security card application, watch this informative YouTube video.

Let’s proceed to the rest of the application, beginning with Line 1.

Line 1: Name

Enter your first name, middle name, and last name in Line 1.

Your legal name should appear the same in Line 1 as it does on your identity documents. This entry should reflect your name as it will be entered on tax returns that you are paid to prepare.

Line 2: Applicant’s personal mailing address

In Line 2a, enter your street address.

In Line 2b, enter your city or town, followed by state or province, country name, and zip code or foreign postal code.

Your original documents will be returned to the address you enter on Line 2.

If you have a post office box

If the U.S. Postal Service will not deliver mail to your physical location, enter the U.S. Postal Service’s post office box number for your mailing address. Do not use a post office box owned by a private firm or company.

Line 3: Birth information

In Line 3, enter your birth information as it corresponds to your identification documents. Only complete Line 3c if your name at birth is different from the name you entered on Line 1.

Line 4: Gender

Check the appropriate box, based upon your gender identity.

Line 5: Citizenship and identification information

In Line 5, check the appropriate box, based upon the type of citizenship and identification documents you are choosing to submit. You may select from the following options:

- Passport or passport card

- Voter registration card

- Civil birth certificate

- U.S. driver’s license

- U.S. military ID card

- Naturalization papers

- U.S. State ID card

- Foreign military ID card

For more information about supporting documentation requirements, see the filing considerations section, below.

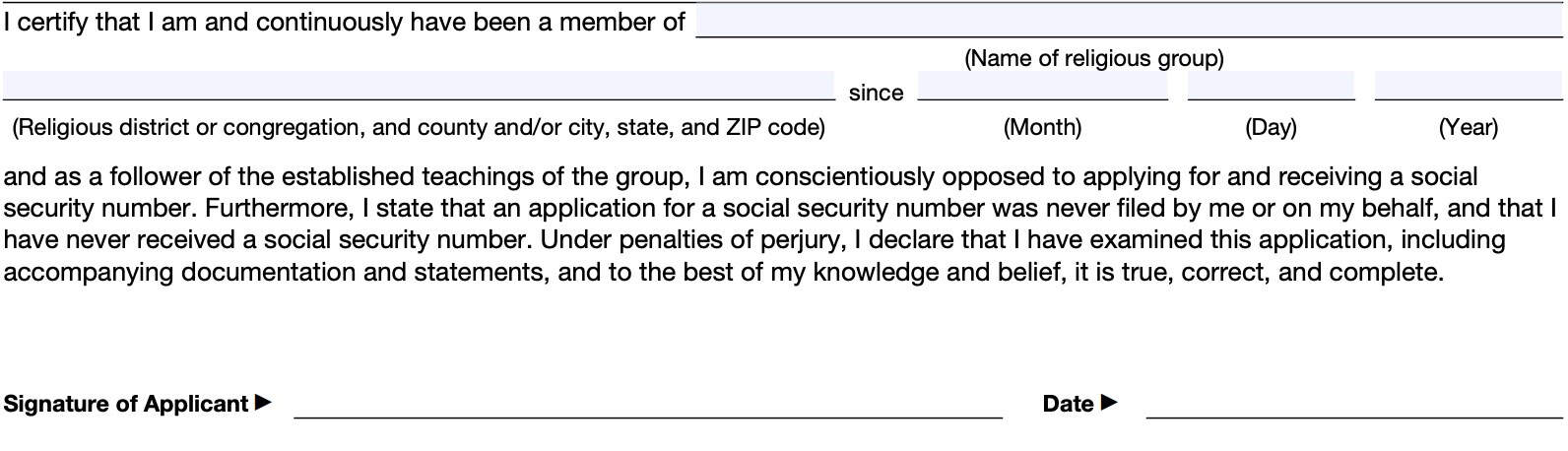

Statement of certification

In order to complete the certification portion above the signature of applicant, you need to enter the following information:

- First line: Name of the religious group that you are a member of

- Second line:

- Religious district or congregation

- City or county, state, and ZIP code

- Date that you joined the religious organization

Examples

To help better understand how to complete this section, here are some examples from the IRS form instructions.

If you enter “Old Order Amish” as your religious group on the first line, then you would enter “Conewango Valley North District,” or “Conewango Valley West District,” etc., on the second line as the name of the district.

However, if you are Anabaptist or Mennonite, enter the name of your religious group as “Unaffiliated Mennonite Churches,” or “Eastern Pennsylvania Mennonite Church,” etc., as your religious group. Your congregation would be: “Antrim Mennonite Church (Anabaptist),” or “Bethel Mennonite Church (Mennonite),” which you would enter on the second line.

Applicant signature

Below your certification, sign and date the form as you would sign your federal tax return.

Let’s go to Part II to see what your religious group must enter.

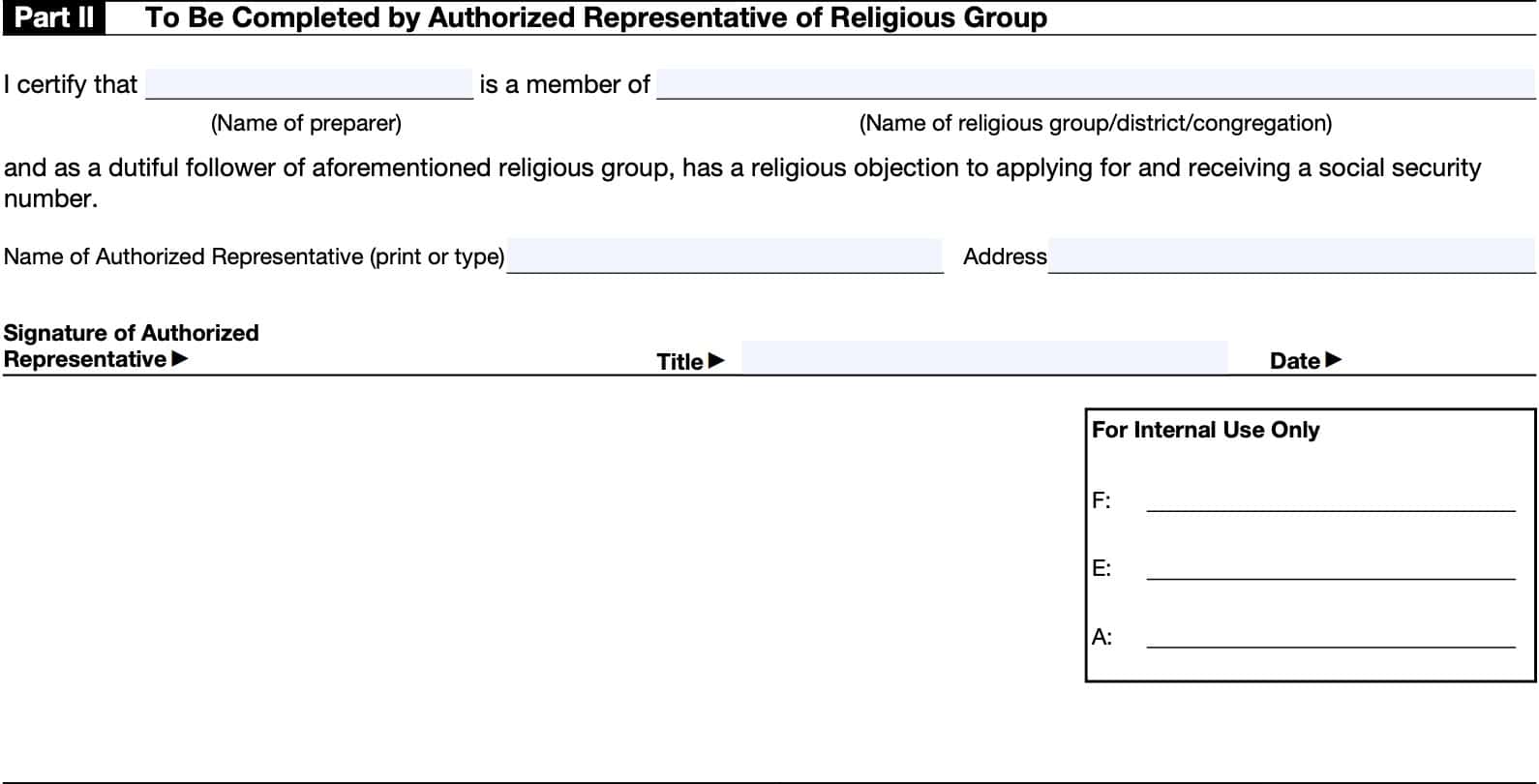

Part II: To be completed by authorized representative of religious group

In Part II, your religious organization must provide a certification that you are indeed a conscientious religious objector and a member of a recognized religious group that has a religious or conscientious objection to applying for or receiving a Social Security number.

Let’s take a closer look at what religious groups may make this certification.

Recognized Religious group requirements

A recognized religious group must meet the following requirements:

- It is conscientiously opposed to its members applying for and receiving SSNs.

- It has existed continuously since December 31, 1950

If both conditions apply, then an authorized representative of the religious group may certify your application.

Certification

In this section, your authorized representative should enter the following information:

- Name of tax return preparer (This is YOU!)

- Name of the religious group, district, or congregation

Below these fields, your representative should enter his or her printed name and the religious group’s address.

Signature

The authorized representative must sign and date your completed Form 8945 in the space provided. Let’s move onto filing considerations.

Filing considerations

Below are some additional filing considerations when it comes to IRS Form 8945.

How do I file?

You may file your PTIN request online or by mail. In either case, you will need to submit your completed Form 8945 by mail.

Online application

You may find additional information about the PTIN application on the IRS website. Below is a brief summary of the PTIN requirements you’ll find on the IRS PTIN page.

During the PTIN application process, you will be prompted to complete and mail Form 8945 and supporting documents to:

IRS Tax Professional PTIN Processing Center

PO Box 380638

San Antonio, TX 78268

PTIN Application or renewal requirements

As part of the PTIN application process or renewal process, you will need to provide the IRS with the following:

- Personal information, such as your name and mailing address

- Business information (i.e. name, mailing address)

- Explanations for felony convictions (if any)

- Felony convictions do not automatically preclude your ability to obtain a PTIN. However, the type of felony conviction may be a deciding factor on whether the IRS will grant or renew your PTIN.

- Explanations for problems with your U.S. individual or business tax obligations (if any)

- Your inability to fulfill tax obligations may negatively impact your ability to obtain a PTIN

- Credit/Debit/ATM card for the $19.75 PTIN user fee.

- The user fee is non-refundable.

- If applicable, any U.S.-based professional certification information recognized by the IRS, including certification number, jurisdiction, and expiration date

- The IRS recognizes the following professional certifications:

- Certified public accountant (CPA)

- Attorney

- Enrolled agent

- Enrolled retirement plan agent

- Enrolled actuary

- Certified acceptance agent

- State license (where applicable)

- The IRS recognizes the following professional certifications:

Applying by mail

If you are applying for a PTIN by mail, then complete both IRS Form W-12 and Form 8945.

Send your completed forms and supporting documentation to the following address:

IRS Tax Professional PTIN Processing Center

PO Box 380638

San Antonio, TX 78268

The IRS asks that you allow 4-6 weeks to process your PTIN application. Let’s now take a look at documentation requirements.

Documentation requirements

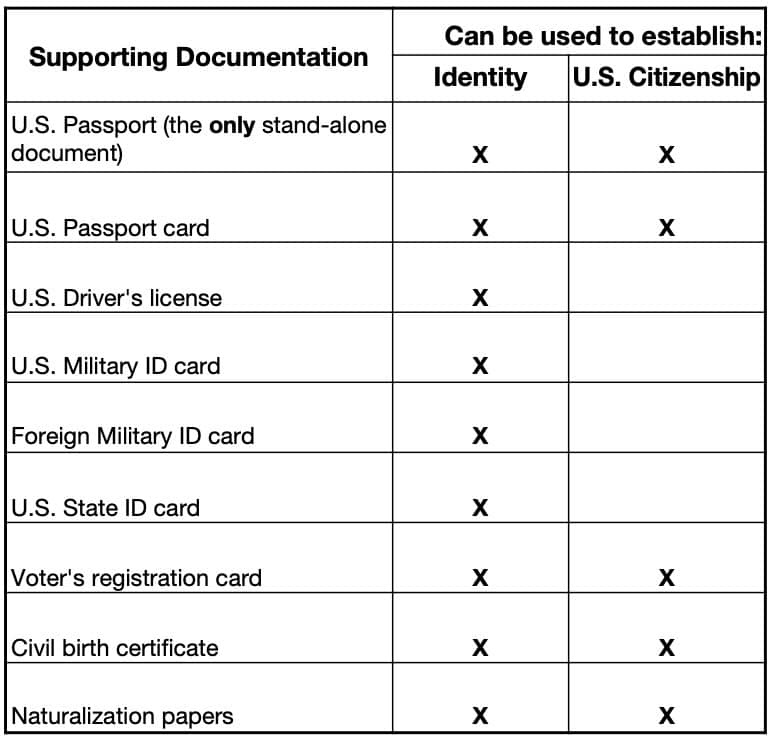

As part of your application, the IRS requires submission of supporting documentation to establish both your identity and status as a U.S. citizen.

Generally, the IRS requires two separate documents. One document must establish your identity, while the other document must establish your United States citizenship status.

This chart identifies which documents you may use to establish identity and citizenship. As indicated in the chart, a U.S. passport (or a notarized or certified copy) is the only document that does not require a second form of identification.

Your supporting documentation may consist of:

- Original documents

- Certified copies

- Notarized copies

Let’s take a look at each type of supporting documentation.

Original documents

You may submit original versions of any identity document. According to the form instructions, the Internal Revenue Service will return any original documents that you submit. You do not need to provide a return envelope with your application.

If you do not receive your original documents within 60 days of your application, you may call the IRS from 8:00 AM to 5:00 PM, Central Time, at one of the following telephone numbers:

- IRS phone number: (877) 613-PTIN (7846)

- TTY/TDD: (877) 613-3686

- International: +1 (915) 342-5655

Certified copies

A certified document is one that the original issuing agency provides and certifies as an exact copy of the original document and contains an official seal from the issuing agency.

All certifications must stay attached to the copies of the documents when they’re sent to the IRS. Certified documents have a stamp and/or an ink seal, which may or may not be raised.

According to the form instructions, the IRS will not return copies of documents.

Foreign documents

Any document certified by a foreign official must be issued by the agency or official custodian of the original record. The foreign certification must clearly certify that each document is a true copy of the original.

All certifications must stay attached to the copies of the documents when they are sent to the IRS.

Notarized copies

A notarized document is one that has been notarized by one of the following:

- U.S. notary public

- U.S. government military officer (JAG Officer)

- U.S. State Department

- U.S. Consul/Embassy Employee, or

- A foreign notary legally authorized within his or her local jurisdiction to certify that each document is a true copy of the original.

To do this, the notary must see the valid, unaltered, original documents and verify that the copies conform to the original. All of the notarized copies must bear the notary’s mark (stamp, signature, etc.).

Notarized documents may or may not have a signature but will have a stamp and usually a raised seal.

As with certified copies, the IRS will not return notarized copies of supporting documents.

Video walkthrough

Watch this YouTube video for a walkthrough on completing IRS Form 8945.

Frequently asked questions

IRS Form 8945 is a supplemental PTIN application for U.S. citizens who are members of certain recognized religious groups to obtain a preparer tax identification number (PTIN). IRS Form 8945 allows paid tax preparers to obtain a PTIN without a Social Security number.

No. You may submit your PTIN application online. However, you must submit IRS Form 8945 to the IRS via U.S. Postal Service.

Where can I find IRS Form 8945?

You can find most tax forms on the IRS website. For your convenience, we’ve enclosed the latest version of IRS Form 8945 here, in our article.