IRS Form 8974 Instructions

At the federal level, the Internal Revenue Service gives many companies tax incentives for investing in their company’s future growth. While many companies may claim tax credits for increasing research and development activities, qualified small businesses are able to use some of this tax credit to offset their payroll tax liability using IRS Form 8974.

In this article, we’ll walk through what you need to know about IRS Form 8974, including:

- How to complete Form 8974 to claim the qualified small business payroll tax credit for increasing research activities

- How to file IRS Form 8974

- Frequently asked questions about the small business payroll tax credit

Let’s start with a step by step walkthrough of this federal form.

Table of contents

How do I complete IRS Form 8974?

Let’s start at the top of this tax form.

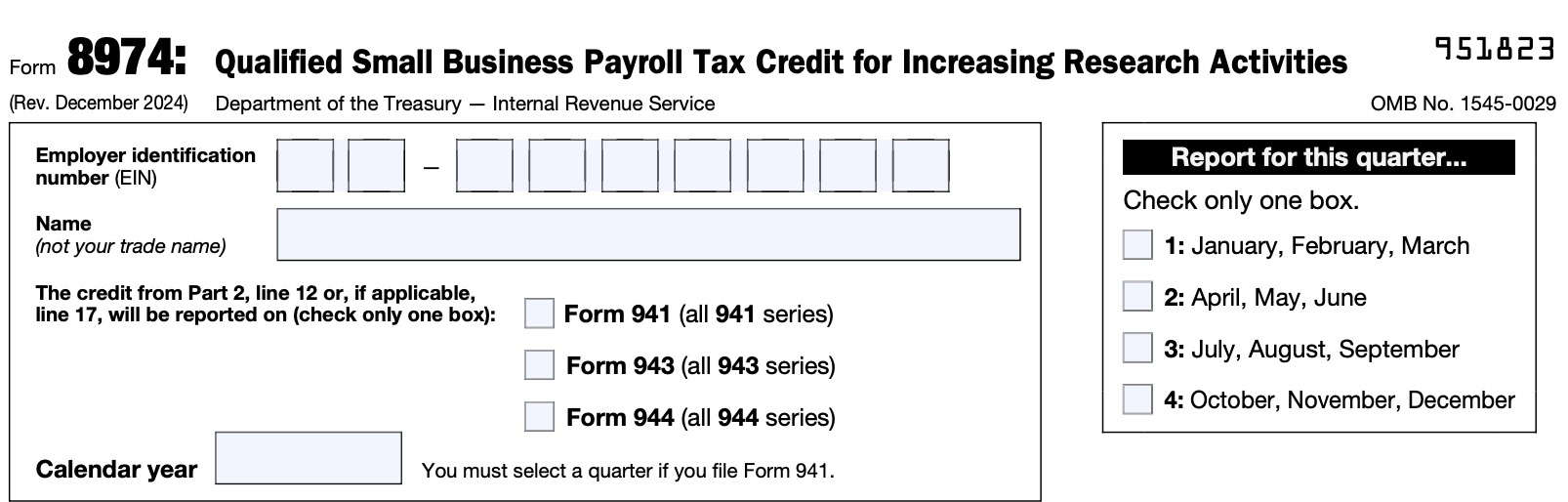

Top of form

At the top of Form 8974, you’ll need to enter the following business information:

- Employer identification number (EIN)

- Business name

- IRS form number for employment tax return

- Form 941 series: Employer’s quarterly tax returns

- Form 943 series: Employer’s annual tax returns for agricultural employees

- Form 944 series: Employer’s annual tax returns

- Calendar year of the tax return

You must also check one box selecting the appropriate quarter if you file any of the following:

- IRS Form 941, Employer’s QUARTERLY Federal Tax Return

- IRS Form 941-PR, Employer’s Quarterly Federal Tax Return-Puerto Rico

- IRS Form 941-SS, Employer’s Quarterly Federal Tax Return-American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. U.S. Virgin Islands

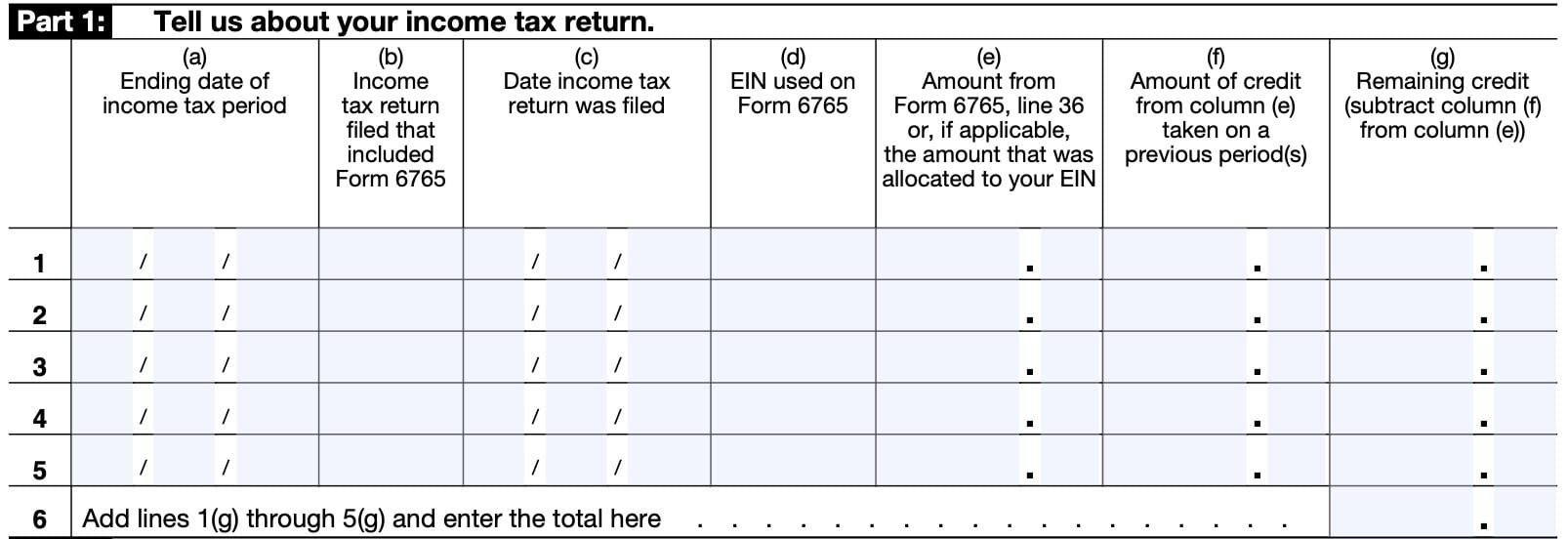

Part 1: Tell us about your income tax return

In Part 1, you’ll enter federal income tax return information for up to 5 tax years. This is based upon your payroll tax credit election on IRS Form 6765.

Enter the income tax years in chronological order with the first year on Line 1. You must continue to report each income tax year election until the remaining amount, Column (g), for the income tax year reaches zero.

For each line, you’ll need to complete the following information:

Column (a): Ending date of income tax period

In Column (a), enter the ending date of your income tax period as “MM/DD/YYYY.”

For example, if your 2023 income tax return was for a calendar year, enter “12/31/2023.” If your income tax return was for a fiscal year that ended on June 30, 2023, enter “06/30/2023.”

Column (b): Income tax return filed that included Form 6765

Indicate which income tax return you filed that elected a qualified small business payroll tax credit on Form 6765. Your options include:

- IRS Form 1040: U.S. Individual Income Tax Return

- IRS Form 1065: U.S. Return of Partnership Income

- IRS Form 1120: U.S. Corporation Income Tax Return

- IRS Form 1120-F: U.S. Income Tax Return of a Foreign Corporation

- IRS Form 1120-S: U.S. Income Tax Return for an S Corporation

Column (c): Date income tax return was filed

Indicate the date that you filed the tax return in Column (b).

Column (d): EIN used on Form 6765

Generally, the EIN used on IRS Form 8974 should be the same as the EIN used on IRS Form 6765.

If the EIN used on Form 8974 isn’t the same as the EIN used on Form 6765, enter the EIN that was used on Form 6765.

Controlled groups

If you’re a member of a controlled group of corporations (as defined in Internal Revenue Code Sections 41(f)(1)(A) and (f)(5)) or a member of a group of trades or businesses under common control (as defined in IRC Section 41(f)(1)(B) and Treasury Regulations Section 1.41-6(a)(3)(ii)), the EIN used on Form 6765 may be different from the EIN that you must use on Form 8974.

Column (e): Amount from Form 6765, Line 36, or amount allocated to your EIN

Enter the amount from Line 36 on IRS Form 6765. For income tax years beginning before January 1, 2024, this would be Line 44.

However, for members of a controlled group, or a group of trades or businesses under common control, you should enter the amount of research credit allocated to your EIN.

Your credit is determined on a proportionate basis to your share of the aggregate qualified research expenses for increasing research activities taken into account by the group for the research credit.

The amount entered in Column (e) may not exceed $250,000 for each income tax year beginning before January 1, 2023. For each income tax year beginning after December 31, 2022, the amount that you can enter in column (e) increases to $500,000.

Column (f): Amount of credit from Column (e) taken on a previous period

Enter the Column (e) amount that was taken in a prior year or prior period.

Column (g): Remaining credit

Subtract Column (f) from Column (e). Enter the difference in Column (g).

Add all of the amounts in Column (g) of Lines 1–5. Enter the result on Line 6, Column (g).

This is the total amount of tax credit you have available for either:

- The current quarter (if using IRS Form 941)

- The current year (if using IRS Form 943 or IRS Form 944)

Carryforward credit

Your qualified small business payroll tax credit for increasing R&D activities might be limited to the amount of employer share of Social Security tax. Beginning in 2023, this limitation also includes the employer share of Medicare tax.

If this limitation causes you to not use the full amount of qualified small business payroll tax credit for increasing research activities, you can carry forward any unused amount to the next quarter.

If, in the next quarter the amount of the credit carried over from the first quarter can’t be fully used, then you can carry forward any unused amount to subsequent quarters.

Additional years

If you claim the payroll tax credit on IRS Form 6765 on an additional year’s income tax return, you’ll

enter the additional payroll tax credit using the additional rows in Part 1, with the earliest year entered on Line 1.

There are five rows in Part 1 because the payroll tax credit election is limited to 5 tax years. The amount you enter in column (e) may not exceed:

- $250,000 per row for each income tax year beginning before January 1, 2023,

- $500,000 for each income tax year beginning after December 31, 2022

However, the total amount entered on Line 6, column (g), and Line 7 may exceed $500,000 if you claimed the credit in multiple years and you’re still carrying forward unused credit from earlier years.

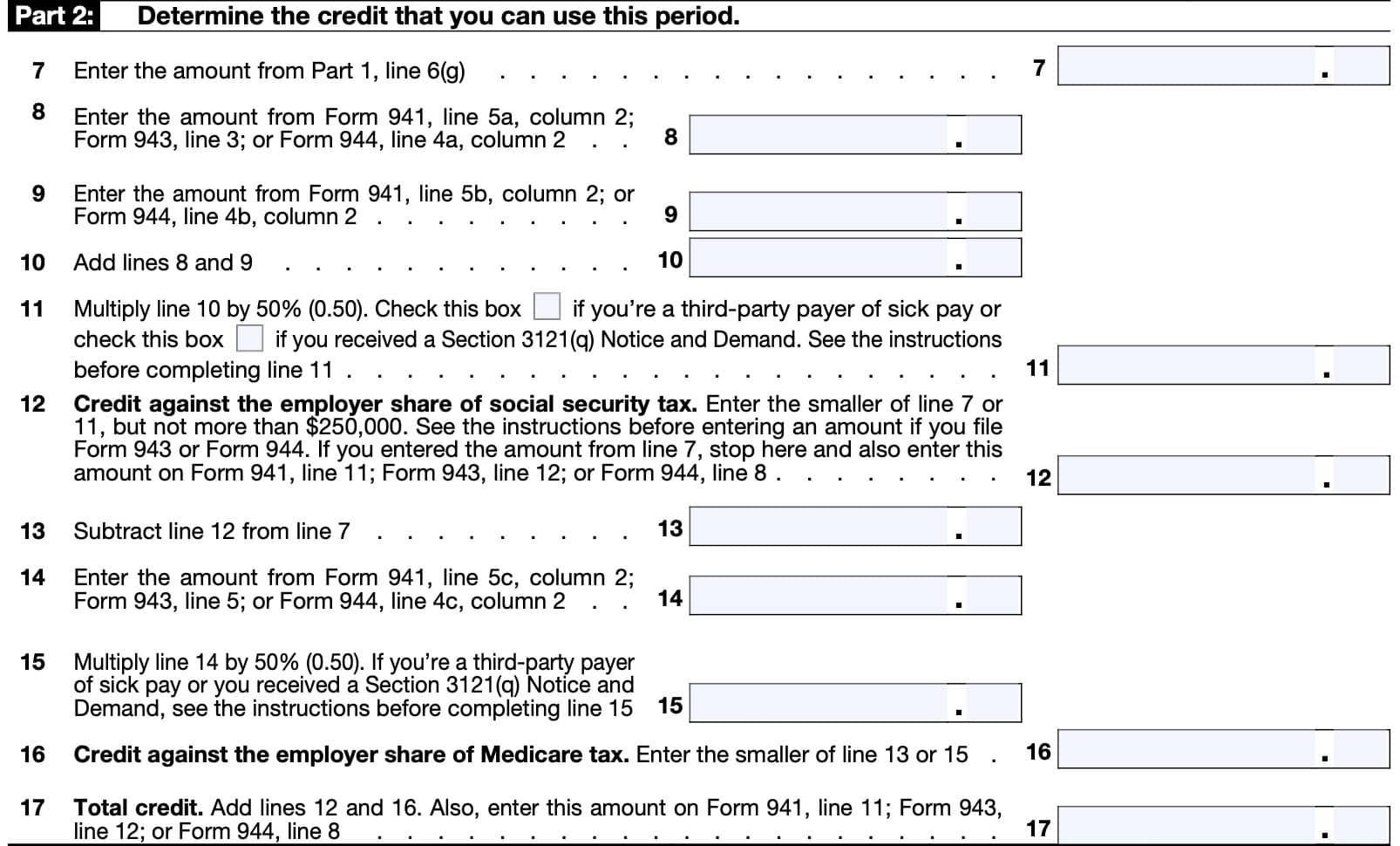

Part 2: Determine the credit that you can use this period

In Part 2, we’ll determine the payroll credit election amount you can use in this tax period. Let’s start with Line 7.

Line 7

Carry down the amount from Line 6(g), in Part 1.

Line 8

In Line 8, enter the amount of Social Security tax on wage income from the applicable form, listed below:

- IRS Form 941, Line 5a, Column 2

- IRS Form 943, Line 3

- IRS Form 944, Line 4a, Column 2

Line 9

In Line 9, enter the amount of Social Security tax for tip income from the applicable form, listed below:

- IRS Form 941, Line 5b, Column 2

- IRS Form 944, Line 4b, Column 2

This represents the total amount of Social Security tax on tips.

For taxpayers filing an aggregate Form 941: You must file a separate Form 8974 for each client that is taking the qualified small business payroll tax credit for increasing research activities.

Also, you can’t enter the amount from Form 941, Line 5b, Column 2, on Line 9 of any of the Forms 8974 that are attached to the aggregate Form 941. This portion of the credit is based on each employer’s liability for social security tax.

Instead, you must enter on Line 9 of each client’s Form 8974 the amount that the client would’ve reported on Form 941, Line 5b, Column 2, if the client filed a separate Form 941.

Line 10

Add Line 8 and Line 9. Enter the result here.

Line 11

Multiply the Line 10 amount by 50% (0.50).

The first $250,000 of the qualified small business payroll tax credit for increasing research activities can only be used against the employer’s share of Social Security tax reported. The amount on Line 10 is the total amount of social security tax (both the employer and employee share).

Therefore, you must multiply Line 10 by 50% to limit the credit to the employer’s share of social security tax.

Third-party payer of sick pay

If you’re a third-party payer of sick pay that files Form 944, check the appropriate box. You can follow the directions below by substituting references to Form 941, Line 8, with Form 944, Line 6. You can also substitute Form 941, Line 5a, Column 2, with Form 944, Line 4a, Column 2.

If you received a Section 3121(q) Notice and Demand

If you received a Section 3121(q) Notice and Demand for tax due on unreported tips (IRS Letter 3263 or IRS Letter 4520) during the quarter, you report the amount for the employer’s share of Social Security tax and Medicare tax on Form 941, Line 5f.

Letter 3263 or Letter 4520 will also include an attachment that shows the employer’s share of Social Security tax. You must add the employer’s share of Social Security tax to the amount reported on Line 11.

Line 11 adjustment for annual filers

Employers who report their payroll taxes on an annual basis on either IRS Form 943 or Form 944 may need to adjust the amount they reported on Line 11. The reason for this adjustment is that taxpayers cannot claim the qualified small business payroll tax credit for increasing research until the first calendar quarter that begins after the date on which you file your income tax return that makes the election to take the credit against payroll taxes.

To help you make the correct adjustments, the IRS form instructions contain specific guidance for the following scenarios:

- First year claiming the tax credit, or a subsequent tax year without a carryover

- Subsequent year of claiming the tax credit with a carryover from a previous taxable year

Line 12: Credit against the employer share of Social Security tax

Enter the smaller of the following:

However, this limit cannot exceed $250,000 in any tax quarter. For taxpayers filing Form 943 or Form 944, this limit is $1 million for an entire tax year.

If you entered the amount from Line 7, stop here. Enter this amount on one of the following, as applicable:

- IRS Form 941, Line 11

- IRS Form 943, Line 12

- IRS Form 944, Line 8

This is the total tax credit against the employer’s portion of Social Security tax. If Line 12 is less than Line 7, follow the instructions for Lines 13 through 17.

Any remaining elected credit or any previous credit carried forward is taken against the employer share of Medicare tax. After that, any unused credit is carried forward to:

- The next quarter, if filing Form 941

- The next year, if filing Form 943 or Form 944

Line 13

Subtract Line 12 from Line 7. Enter the difference here.

Line 14

In Line 14, enter the amount of Medicare tax on wages from the applicable form below:

- IRS Form 941, Line 5c, Column 2

- IRS Form 943, Line 5

- IRS Form 944, Line 4c, Column 2

Line 15

Multiply the Line 10 amount by 50% (0.50).

The amount of qualified small business payroll tax credit for increasing research activities can only be used against the employer’s share of Medicare tax reported. The amount on Line 14 is the total amount of Medicare tax (both the employer and employee share).

Therefore, you must multiply Line 14 by 50% to limit the credit to the employer’s share of Medicare taxes.

Third-party payer of sick pay

If you’re a third-party payer of sick pay that files Form 944, check the appropriate box.

You can follow the directions below by substituting references to Form 941, Line 8, with Form 944, Line 6. You can also substitute Form 941, Line 5c, Column 2, with Form 944, Line 4c, Column 2.

If you received a Section 3121(q) Notice and Demand

If you received a Section 3121(q) Notice and Demand for tax due on unreported tips (IRS Letter 3263 or IRS Letter 4520) during the quarter, you report the amount for the employer’s share of Social Security tax and Medicare tax on Form 941, Line 5f.

Letter 3263 or Letter 4520 will also include an attachment that shows the employer’s share of Medicare tax. You must add the employer’s share of Medicare tax to the amount reported on Line 15.

Line 16: Credit against employer’s share of medicare tax

Enter the smaller of:

Line 17: Total credit

Add Line 12 and Line 16. Also, enter this amount on the respective form:

- IRS Form 941, Line 11

- IRS Form 943, Line 12

- IRS Form 944, Line 8

This is the total qualified small business payroll tax credit for increasing research activities.

Video walkthrough

Watch this instructional video to learn about claiming the small business payroll tax credit for increasing research activities with IRS Form 8974.

Frequently asked questions

IRS Form 6765 is a tax form that allows taxpayers to take a research and development tax credit, or R&D tax credit, for research and development costs. IRS Form 8974 allows qualified small businesses to use this tax credit to offset part or all of their payroll tax liability.

No. By completing IRS Form 6765, a taxpayer elects the amount of R&D credit to offset their payroll tax liability. Since IRS Form 8974 relies Form 6765 to determine the elected amount, a taxpayer cannot file Form 8974 without filing Form 6765.

A qualified small business is a corporation or partnership with gross receipts of less than $5 million for the tax year, and no gross receipts for any tax year before the 5-tax-year period ending with the current tax year. A qualified small business can be an S-corporation, but not a tax-exempt organization.

Where can I find IRS Form 8974?

You may find this tax form on the Internal Revenue Service website. For your convenience, we’ve attached the latest version as a PDF file to this article, just below.