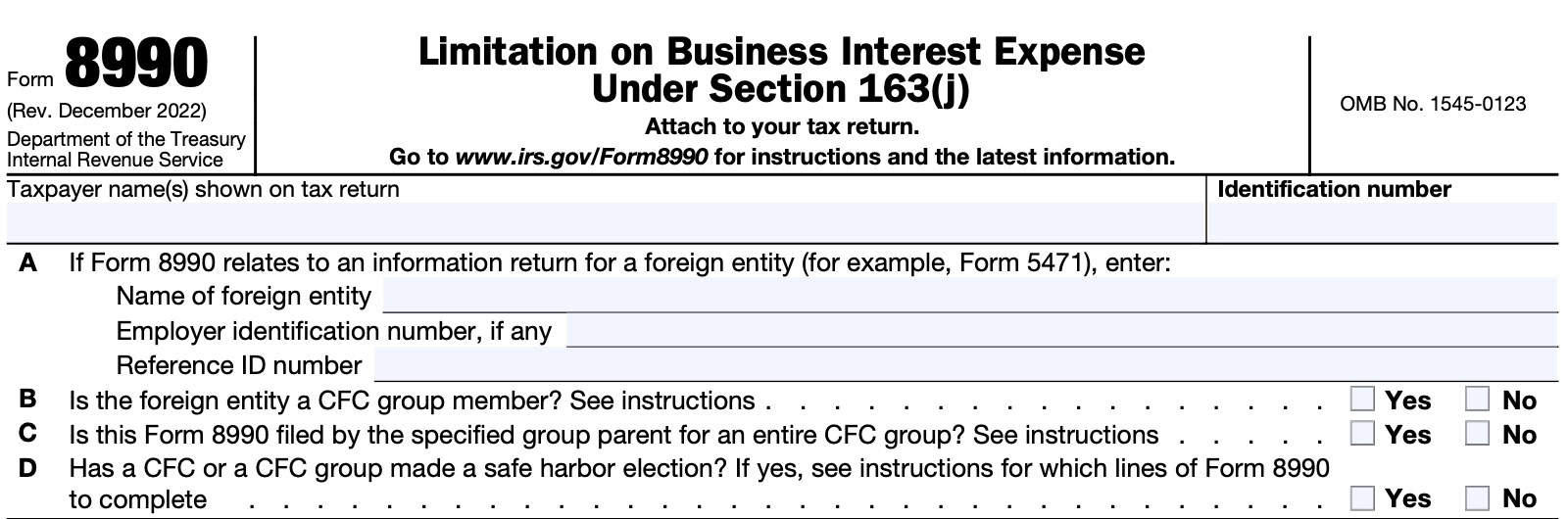

IRS Form 8990 Instructions

Although interest expense has long been tax deductible for businesses, there is a limit to the amount of business interest expense that the Internal Revenue Service will allow each year. Taxpayers must calculate their business interest expense deductions on IRS Form 8990 to comply with the business interest limitation requirements outlined in Internal Revenue Code Section 163(j).

This article will walk you through this tax form, including:

- How to use IRS Form 8990 to calculate deductible business interest expense

- How to determine what to do with disallowed business interest expense deductions

- How to file IRS Form 8990

Let’s start with a step-by-step guide on how to complete IRS Form 8990.

Table of contents

How do I complete IRS Form 8990?

There are 3 parts to this 3 page form, and two schedules:

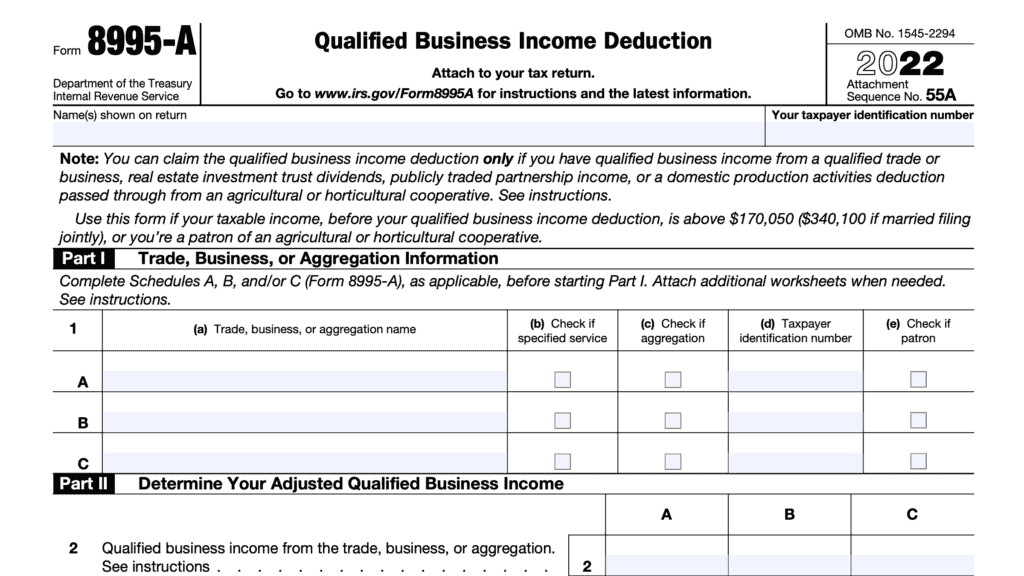

- Part I: Computation of Allowable Business Interest Expense

- Part II: Partnership Pass-Through Items

- Part III: S Corporation Pass-Through Items

- Schedule A: Summary of Partner’s Section 163(j) Excess Items

- Schedule B: Summary of S Corporation Shareholder’s Excess Taxable Income and Excess Business Interest Income

We’ll walk through everything, line by line, starting with the taxpayer information fields above Part I.

Taxpayer information

At the very top of Form 8990, enter the taxpayer name as shown on the tax return. Also enter the identification number indicated on the taxpayer’s return.

For individuals, this should be a Social Security number or individual tax identification number (ITIN). For corporate entities, this will be the company’s employer identification number.

Line A

If IRS Form 8990 relates to an information return for a foreign entity, such as IRS Form 5471, then you should enter the following information:

- The name of the foreign entity

- Employer identification number, if applicable

- Reference ID number

Line B: Is the foreign entity a CFC group member?

Check Yes or No.

Special considerations apply to controlled foreign corporations (CFC). You can find more information about the limitation on business interest deductions for CFCs in the Form 8990 instructions.

Line C: Is this Form 8990 filed by the specific group parent for an entire CFC group?

Check Yes or No.

A separate Form 8990 must be completed in order to report the combined limitation of the CFC group.

Line D: Has a CFC or a CFC group made a safe harbor election?

Check Yes or No.

Safe harbor election

If a safe-harbor election is in effect with respect to a tax year of a stand-alone applicable CFC or a specified tax year of a CFC group member, then no portion of the applicable CFC’s business interest expense is disallowed under the Section 163(j) limitation.

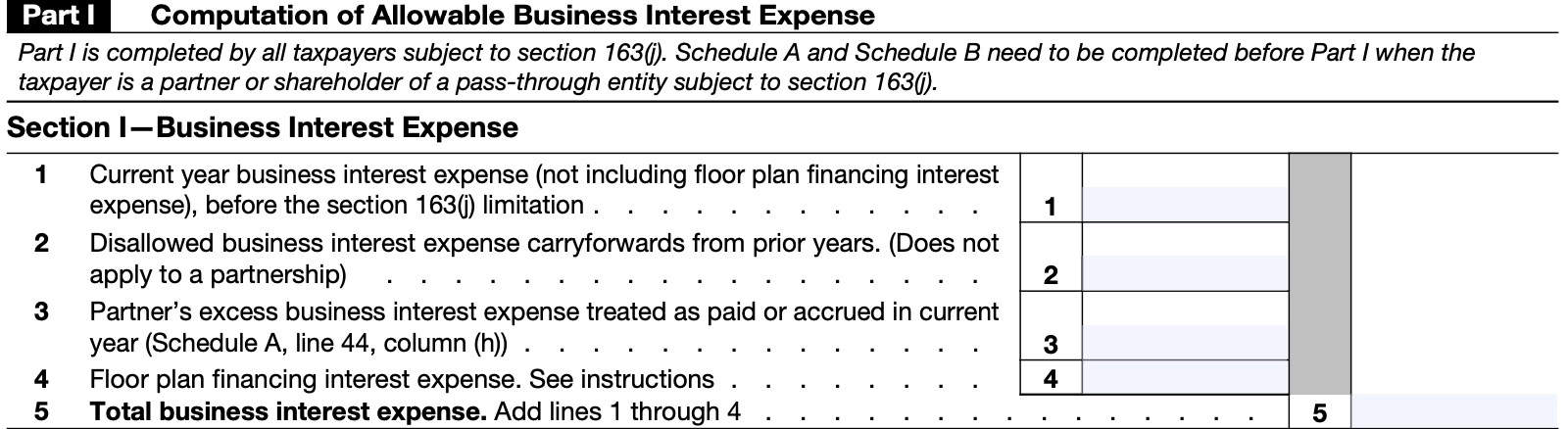

Part I: Computation of Allowable Business Interest Expense

All taxpayers subject to Section 163(j) must complete Part I.

If the taxpayer is a partner or shareholder of a pass-through entity, he or she must complete either of the following schedules before completing Part I:

- Schedule A (for a partnership interest)

- Schedule B (for S corporation shareholders)

A regulated investment company that paid Section 163(j) interest and has no business interest expense in the current tax year only needs to complete Parts I and III.

There are 4 sections in Part I:

- Section I: Business Interest Expense

- Section II: Adjusted Taxable Income

- Section III: Business Interest Income

- Section IV: 163(j) Limitation Calculations

Let’s begin with calculating the business interest expense before limitations.

Section I: Business Interest Expense

Here, we’ll calculate the total business interest expense.

Line 1: Current Year Business Interest Expense Before Section 163(j) Limitation

Enter the total taxpayer’s business interest expense that would have been deductible in the current year without Section 163(j) limitations.

This does not include floor plan financing interest expense or disallowed business expense carryforwards from earlier years.

Line 2: Disallowed business interest expense carryforwards from prior years

Enter the prior year disallowed business interest expense carryover. You’ll find this on the prior year’s Form 8990, Line 31.

Limitations outlined in Treasury Regulations Section 1.163(j)-5 may apply for consolidated groups with members joining or leaving in the tax year.

This does not apply to partnerships.

Line 3: Partner’s excess business interest expense treated as paid or accrued in the current year

Enter any excess business interest expense treated as paid or accrued in the current tax year, if applicable.

Line 4: Floor plan financing interest expense

Floor plan financing interest expense is interest on debt used to finance the acquisition of motor vehicles held for sale or lease where the debt is secured by the acquired inventory. Section 163(j) limitations do not apply to floor plan financing interest.

Line 5: Total business interest expense

Add Lines 1 through 4. This represents the total business interest expense without regard to Sect ion 163(j) limits.

Section II: Adjusted Taxable Income

In Section II, we’ll make adjustments to the taxpayer’s taxable income to arrive at adjusted taxable income.

Let’s start with Line 6.

Line 6: Taxable income

The form instructions indicate that taxable income should be calculated as if all business interest expense is otherwise allowable.

Consider all other applicable limitations, such as:

- Section 163(f): Denial of deduction for interest on certain obligations not in registered form

- Section 267: Losses, expenses, and interest with respect to transactions between related taxpayers

- Basis limitations as outlined in:

- Section 465: At-risk activity loss

- Section 469: Passive activity loss

- Section 461(l): Excess business loss

Enter this amount in Line 6.

Line 7

Enter any item of loss or deduction that is not properly allocable to a trade or business of the taxpayer.

This includes the taxpayer’s loss or deduction from any excepted trades or businesses. The amount of the addition is limited to the amount the additional item affected tentative taxable income.

Do not include amounts from pass-through entities, which you will enter on Line 12.

Line 8

Add all business interest expense, to the extent included in tentative taxable income, that is not from a pass-through entity.

Interest expense that is allocable to an excepted trade or business is not treated as business interest expense.

Line 9

Enter any Section 172 net operating loss deduction carried forward or carried back to the current tax year.

Line 10

Enter the amount of any qualified business income (QBI) deduction allowed under Internal Revenue Code Section 199A.

Line 11: Reserved for future use

Leave this line blank.

Line 12

Enter any amount of loss or deduction items from pass-through entities, regardless of Section 163(j) limitations.

Line 13

Enter any capital loss carryback or carryover.

C corporations

A C corporation should include investment income from a pass-through entity as other additions.

Estates and trusts

Estates and trusts subject to Section 163(j) should add back any of the following:

- Section 651 income distribution deduction

- Section 661 income distribution deduction

- Section 642(c) deduction

The ATI of a beneficiary (including a tax-exempt beneficiary) of a trust or a decedent’s estate is reduced by any income (including any distributable net income) received from the trust or estate by the beneficiary to the extent such income was necessary to permit a deduction under Section 163(j)(1)(B) and Treasury Regulations section 1.163(j)-2(b) for any excess business interest expense of the trust or

estate over the trust or estate’s business interest income.

Line 14

Take the total current year partner’s excess taxable income from Schedule A, Line 44, Column (f).

Line 15

Enter the total current year S-corporation shareholder’s excess taxable income, which you’ll find on Schedule B, Line 46, Column (c).

Line 16

Add Lines 7 through 15. Enter this amount in Line 16.

For Lines 17 through 21, enter these amounts as negatives, to be subtracted from the total income amount to arrive at ATI.

Line 17

Enter any item of income or gain which is not properly allocable to a trade or business of the taxpayer.

For example, a taxpayer would enter the sale of a personal residence here, since that gain or loss is not allocable to a trade or business.

Do not include amounts from pass-through entities. You will enter these amounts on Line 19, below.

Line 18

Enter all business interest income that does not come from a pass-through entity in Line 18.

Line 19

Enter any amount of income or gain items from a pass-through entity here.

Line 20

Include other reductions, such as:

- Floor plan financing interest expense

- If filing Form 8990 for an applicable CFC, related party dividend income

- For property sold or disposed of in the taxable years starting after December 31, 2017 and before January 1, 2022, the greater of:

- Allowed depreciation, amortization, or depletion of the property, as noted in IRC Section 1016(a)(2)

- Allowable depreciation, amortization, or depletion of the property

- For U.S. shareholders of an applicable CFC: Include the sum of any specified deemed inclusions that were included in the computation of tentative taxable income, reduced by the portion of the deduction allowed under Section 250(a)

- For additional guidance, see Treasury Regulations Section 1.163(j)-1(b)(ii)(G)

- C corporations should include investment interest expenses from a pass-through entity as other reduction

Line 21

Add Lines 17 through 20.

Line 22

Add Lines 6, 16, and 21. If this is a negative number, enter zero in Line 22.

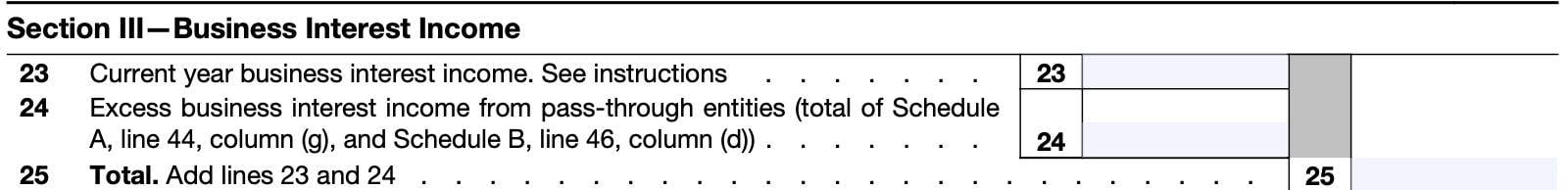

Section III: Business Interest Income

Line 23

Enter the amount of business interest income directly paid to or accrued by the taxpayer, not including interest income from excepted trades or businesses.

For C corporations with an interest in a partnership, any investment interest income allocated to the C corporation is treated as business interest income of the C corporation from a non-excepted trade or business.

Line 24

Enter excess business interest income from pass-through entities, which you’ll find by combining the total of:

- Schedule A, Line 44, Column (g), and

- Schedule B, Line 46, Column (d)

Line 25

Add Line 23 and Line 24. This represents total business interest income.

Section IV: 163(j) Limitation Calculations

Line 26: ATI limitation

Multiply the ATI, from Line 22, by the applicable percentage. This percentage is 30%, which is the statutory ATI limitation.

Line 27: Business interest income

Enter the total business interest income from Line 25.

Line 28: Floor plan financing interest expense

Enter floor plan financing interest expense from Line 4.

Line 29: Total limitation on business interest expense

Combine Lines 26 through 28. This represents the total allowable business interest expense.

Line 30: Total current year business interest expense deduction

If subject to Section 163(j) limits, enter the smaller of:

If the taxpayer is not subject to Section 163(j) limits, and has partnership excess business interest expense treated as paid or accrued in the current year, enter the amount from Schedule A, Line 44, Column (h).

This amount will not be reduced by Section 163(j) limits.

Line 31

Subtract Line 29 from Line 5. If negative, enter ‘0.’ This number will be carried forward to the next tax year.

If the taxpayer completing this form is a partnership, carry the amount on Line 31 to Part II, Line 32, of the current year Form 8990.

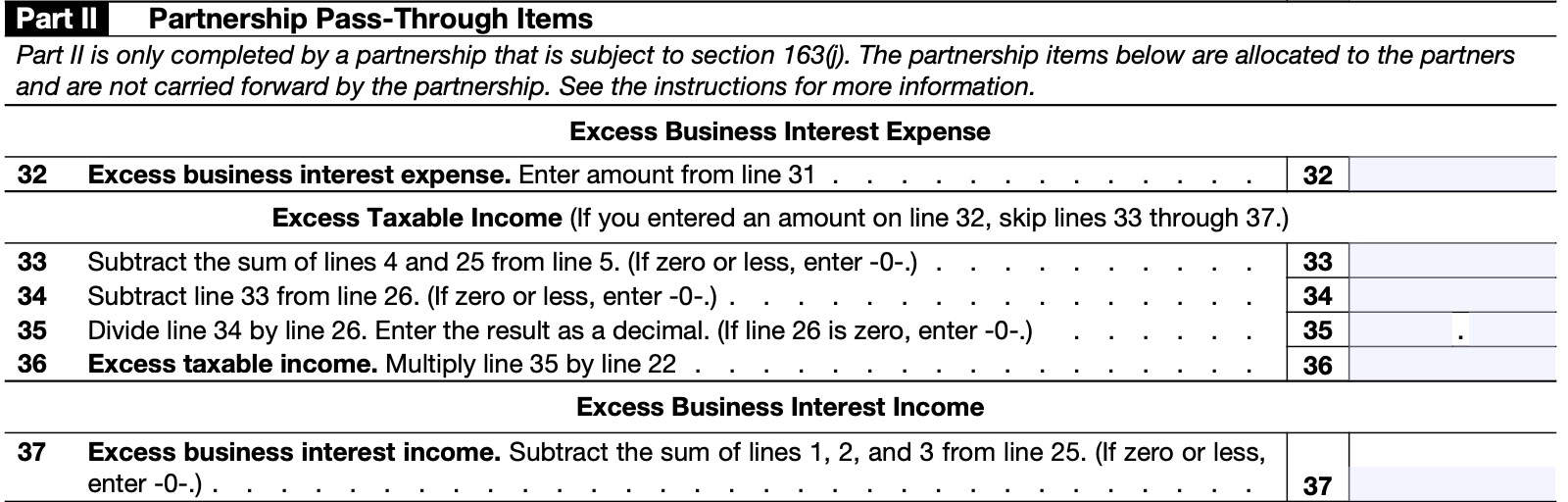

Part II: Partnership Pass-Through Items

Part II is only completed by a partnership subject to Section 163(j) limits and is required to file Form 8990. The partnership items are allocated to the partners and not carried forward by the partnership.

Refer to IRS Form 1065 instructions on how to report:

- Excess business interest expense

- Excess taxable income

- Excess business interest income to partners

Line 32: Excess business interest expense

Enter the excess business interest expense from Line 31, above.

Line 33

Subtract this sum from the Line 5 amount. If the result is zero or a negative number, enter zero.

Line 34

Subtract Line 33 from Line 26. If the result is zero or a negative number, enter zero.

Line 35

Divide Line 34 by Line 26, then enter the result as a decimal. If Line 26 is zero, then enter zero.

Line 36: Excess taxable income

Multiply Line 35 by Line 22. This represents your excess taxable income.

Line 37: Excess business interest income

Add the following lines:

- Line 1

- Line 2

- Line 3

Subtract this amount from Line 25. This is your excess business interest income.

Part III: S Corporation Pass-Through Items

Only S corporations subject to Section 163(j) limits need to complete Part III. The S corporation’s excess taxable income and excess business interest income are allocated to shareholders pro rata after the limitation is determined. They are not carried forward by the S-corporation.

See instructions for IRS Form 1120-S on how to report:

- Excess taxable income

- Excess business interest income to shareholders

Line 38

Subtract this sum from the Line 5 amount. If the result is zero or a negative number, enter zero.

Line 39

Subtract Line 38 from Line 26. If the result is zero or a negative number, enter zero.

Line 40

Divide Line 39 by Line 26, then enter the result as a decimal. If Line 26 is zero, then enter zero.

Line 41: Excess taxable income

Multiply Line 40 by Line 22. This represents your excess taxable income.

Line 42: Excess business interest income

Add the following lines:

- Line 1

- Line 2

- Line 3

Subtract this amount from Line 25. This is your excess business interest income.

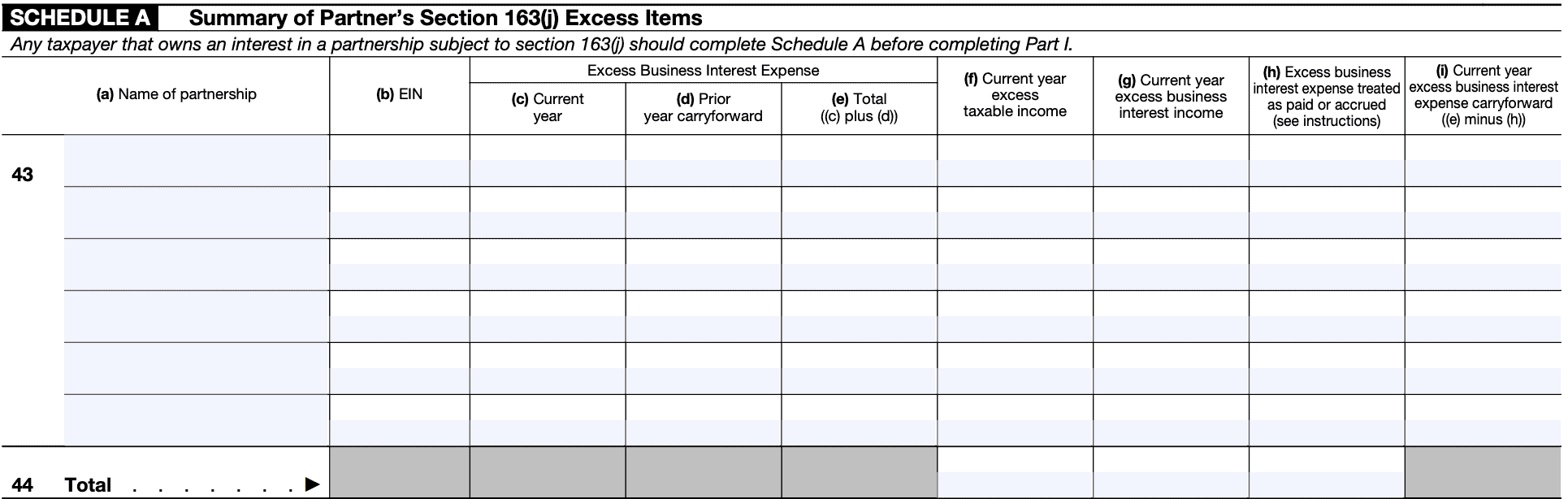

Schedule A: Summary of Partner’s Section 163(j) Excess Items

Any taxpayer that is required to complete Part I and is a partner in a partnership subject to the Section 163(j) limitation must complete Schedule A before completing Part I.

For each partnership, enter the following information into each column:

- Column (a): Partnership’s name

- Column (b): Employer identification number

- Column (c): Amount of current year excess business interest expense (see notes below)

- Column (d): Prior year carryforward

- Column (e): Total excess business interest expense (Column (c) plus Column (d))

- Column (f): Current year excess taxable income

- Column (g): Current year excess business interest income

- Column (h): Excess business interest expense treated as paid or accrued

- Column (i): Current year excess business interest expense carryforward

Column (c)

Reduce the current year excess business interest expense by the amount of negative Section 163(j) expense that relates to the current year excess business interest expense.

Attach a statement to the Form 8990 identifying the partnership name and amount of negative 163(j) expense

Column (d)

From the prior year’s Form 8990, enter the amount from Line 43, column (i). See the instructions for more detail.

Column (h)

Enter the lesser of:

- Total excess business interest expense amount in Column (e), or

- Current year excess taxable income in Column (f) plus the current year excess business interest income in Column (g) from the same partnership

Column (i)

Columns 43(e) minus (h), less any excess business interest expense that previously reduced basis that you are required to make a basis adjustment upon disposition of partnership interest.

Line 44

Add the totals of column (f), column (g), and column (h).

Enter the sums in the respective column on Line 44.

For partners subject to Section 163(j) limitations, see the instructions.

Column (f): Current year excess taxable income

Once calculated, enter the total amount in Line 14, located in Part I, above.

Column (g): Current year excess business interest income

Combine this total amount with Schedule B, Line 46, column (d). Enter the combined amount in Line 24, in Part I.

Column (h): Excess business interest expense treated as paid or accrued

Enter this total amount on Part I, Line 3.

For partners not subject to the Section 163(j) limitation, include this amount on Part I, Line 30.

Watch this video for step by step guidance on completing Schedule A.

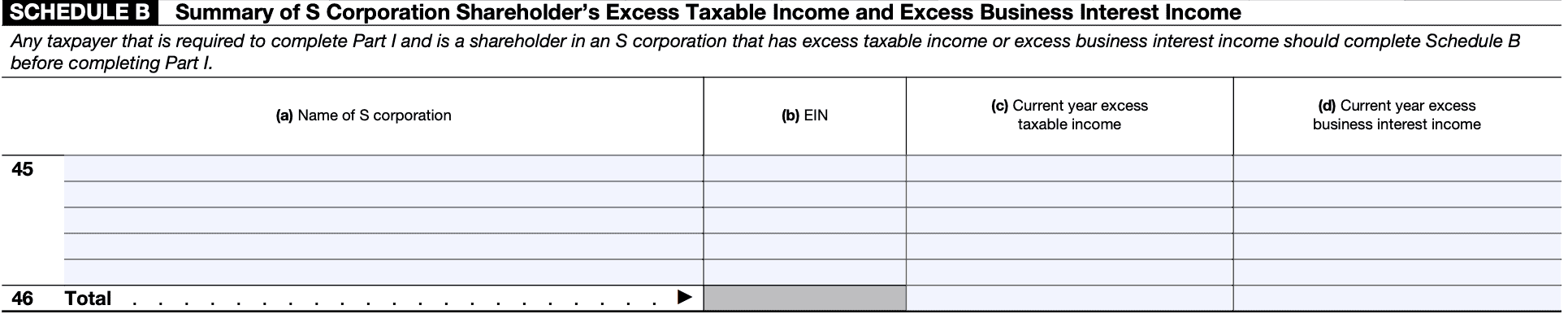

Schedule B: Summary of S Corporation Shareholder’s Excess Taxable Income and Excess Business Interest Income

Any taxpayer that is required to complete Part I and is a shareholder in an S corporation subject to Section 163(j) limitation must complete Schedule B before completing Part I.

For each S corporation, list:

- Column (a): S-corporation name

- Column (b): Employer identification number

- Column (c): Current year excess taxable income

- Column (d): Current year excess business interest income

Column (c): Total current year excess taxable income

Add the amounts of Column (c) from Line 45, for all S-corporations. Enter the total in Line 46, and in Part I, Line 15.

Column (d): Total current year excess business interest income

Add the amounts of Column (d) from Line 45, for all S-corporations. Enter the total of all Column (d) amounts in Line 46.

Also, add this amount to any amounts in Column (g), Line 44 from Schedule A. Enter the combined total in Part I, Line 24.

Who must file IRS Form 8990?

Generally speaking, taxpayers with one or more of the following must file IRS Form 8990, unless an exclusion applies:

- Business interest expense

- Disallowed business interest expense carryforward

- Current year or prior year excess business interest expense

Pass-through entities allocating excess taxable interest income to their owners must file Form 8990, regardless of whether they have interest expense.

A regulated investment company paying Section 163(j) interest dividends must file Form 8990. For further information, please see Regulations Sections 1.163(j)-1(b)(22)(iii)(F) and 1.163(j)-1(b)(35).

Any U.S. shareholder of any applicable controlled foreign corporations (CFC) that has business interest expense, disallowed business interest carryforward, or is part of a CFC group must attach a Form 8990 with each IRS Form 5471 they file.

However, there are exemptions and safe harbor provisions for certain entities, such as small businesses.

Exemptions and safe harbor provisions

A taxpayer engaged in one of the following activities may elect not to limit business interest expense under Section 163(j):

- Real property trade or business

- Farming business

- Non-automatically excepted regulated public utilities

However, an electing real property trade or business must use alternative depreciation system (ADS) for certain depreciable property. This includes:

- Nonresidential real property

- Residential rental property

- Qualified improvement property used in the company’s trade or business

They cannot use special depreciation for the same property. IRS Publication 946, How to Depreciate Property, contains more details.

Two safe harbor provisions exist to allow the taxpayer to treat their trade as a real property trade or business:

Residential living facility

Under certain circumstances, a business that manages or operates a residential living facility may treat their trade as a real property trade or business, and elect not to use Section 163(j) business interest expense limitations. Revenue Procedure 2021-9 contains more details.

Certain real estate investment trusts (REITS)

Under certain conditions, a REIT (and a partnership controlled by one or more REITs) can elect to be a real property trade or business. See Regulations Section 1.163(j)-9(h).

Video walkthrough

Watch this instructional video for step by step guidance on completing Form 8990.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

IRS Form 8990, Limitation on Business Interest Expense Under Section 163(j), is the form business taxpayers must use to calculate the amount of interest they can claim in the current tax year, and how much business interest expense to carry forward to the next year.

For purposes of determining a small business taxpayer, the taxpayer passes the gross receipts test if average annual gross receipts do not exceed $26 million for the three prior tax years. This is determined by finding the sum of the prior 3 years gross receipts, then dividing the sum by 3. In addition to the exemption for small businesses, a taxpayer may elect not to use Section 163(j) limitations under certain circumstances.

Small business taxpayers are not subject to Section 163(j) limitations. As a result, they generally do not need to file Form 8990.

To meet the small business exemption criteria, a small business taxpayer must meet the gross receipts test and not be a tax shelter, as defined in Internal Revenue Code Section 448(d)(3).

In 2017, the Tax Cuts and Jobs Act (TCJA) imposed a business interest expense deduction limitation on corporate taxpayers. The new section of the tax code, Section 163(j), limits the current year deduction to the sum of the following:

-Taxpayer’s business interest income for the tax year

-30% of the adjusted taxable income (ATI) for the year, plus

-Floor plan financing interest for the taxpayer in the given year

Any current year excess is carried forward to the next tax year.

Where can I find IRS Form 8990?

You can download this tax form from the IRS website or by selecting the file below.