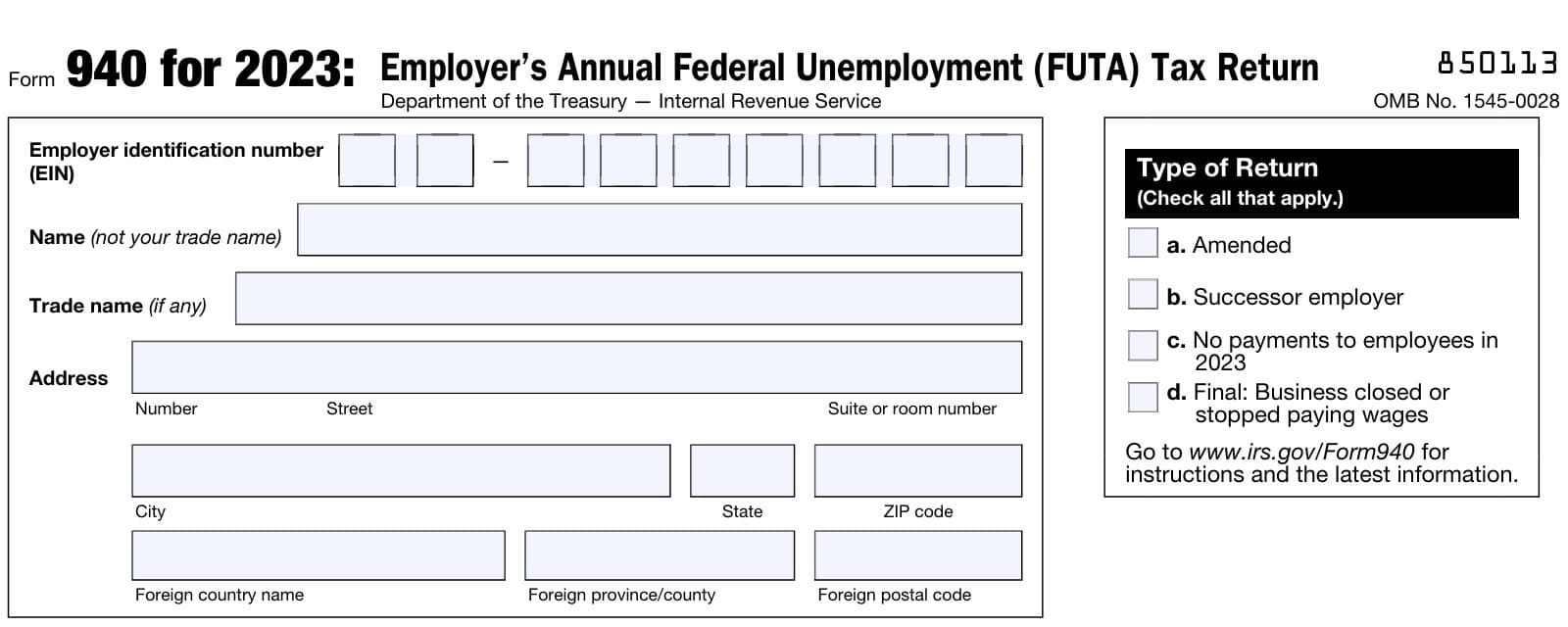

IRS Form 940 Instructions

If you’re an employer who pays wages and compensation that are subject to federal tax withholding or payroll taxes, then you may need to report wages and withheld taxes on IRS Form 940, Employer’s ANNUAL Federal Unemployment (FUTA) Tax Return.

In this article, we’ll help you better understand everything you need to know about this tax form, including:

- How to complete IRS Form 940

- Filing considerations

- Frequently asked questions

Let’s begin with step by step guidance on completing IRS Form 940.

How Do I Complete IRS Form 940?

There are 7 parts to this two-page IRS tax form:

- Part 1: Tell us about your return

- Part 2: Determine your FUTA tax before adjustments

- Part 3: Determine your adjustments

- Part 4: Determine your FUTA tax and balance due or overpayment

- Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500

- Part 6: May we speak with your third-party designee?

- Part 7: Sign here

Before we start with Part 1, let’s take a look at the taxpayer information at the very top of IRS Form 940.

Top Of Form

At the very top, you’ll include information about the employer, as any specific situations about the employer.

Employer Identification Number

In this field, enter the 9-digit employer ID number, or EIN, for the business. If you do not already have an EIN, you may apply for one online through the IRS website or by filing Form SS-4, Application for Employer Identification Number.

Do not enter your Social Security number (SSN) or individual taxpayer identification number (ITIN) in this field.

Name

Enter the name that you used when applying for your EIN. If you are a sole proprietor, you may enter your personal name here, then enter the name of your business under Trade Name, below.

Trade Name

If applicable, enter your trade name here. If your trade name and the name you used to apply for your EIN are the same, then leave this field blank.

For example, Ronald Jones is a sole proprietor who operates a business called Ron’s Ice Cream Shop. Ronald would enter her information as follows:

- Name: Ronald Jones

- Trade name: Ron’s Ice Cream Shop

Address

Enter your business address here. Include the following information:

- Street name and number

- Suite or room number, if applicable

- City, state, and ZIP code

If your business is located in a foreign country, then enter the foreign country’s name, province or county, and postal code in the space provided.

Change Of Business Name, Address, Or Responsible Party

Immediately notify the IRS if you change your business name, business address, or responsible party. You can do this in one of two ways:

- Write to the IRS office where you file your returns to notify the IRS of any business name change.

- Complete and mail IRS Form 8822-B, Change of Address or Responsible Party – Business, to notify the IRS of a business address or responsible party change.

- Don’t mail your completed Form 8822-B with your Form 940.

Type of Return

On the right hand side of the form, you may check one or more of the following options:

- Box a: Amended

- Box b: Successor employer

- Box c: No payments to employees during the tax year

- Box d: Final: Business closed or stopped paying wages

Let’s take a closer look at each option so we can better understand when they apply.

Amended

If this is an amended return that you’re filing to correct a return that you previously filed, check this box.

Successor employer

Check this box if you’re a successor employer and one of the following applies:

- You’re reporting wages paid before you acquired the business by a predecessor who was required to file a Form 940 because the predecessor was an employer for FUTA tax purposes, or

- You’re claiming a special credit for state unemployment tax paid before you acquired the business by a predecessor who wasn’t required to file a Form 940 because the predecessor wasn’t an employer for FUTA tax purposes.

Successor employer definition

A successor employer is an employer who:

- Acquires substantially all the property used in a trade or business of another person (predecessor) or used in a separate unit of a trade or business of a predecessor; and

- Immediately after the acquisition, employs one or more people who were employed by the predecessor.

No payments to employees during the tax year

If you’re not liable for FUTA tax for 2023 because you made no payments to employees in 2023, check Box c.

Then, go to Part 7, sign the form, and file it with the Internal Revenue Service.

Final: Business closed or stopped paying wages

If this is a final return because you went out of business or stopped paying wages and you won’t be liable for filing Form 940 in the future, check Box d.

Complete all applicable lines on the form, sign it in Part 7, then file it with

the IRS. Also attach a statement to your return showing the name of the person keeping the payroll records and the mailing address where those records will be kept.

Now that we’ve entered the employer’s information, let’s go to Part 1.

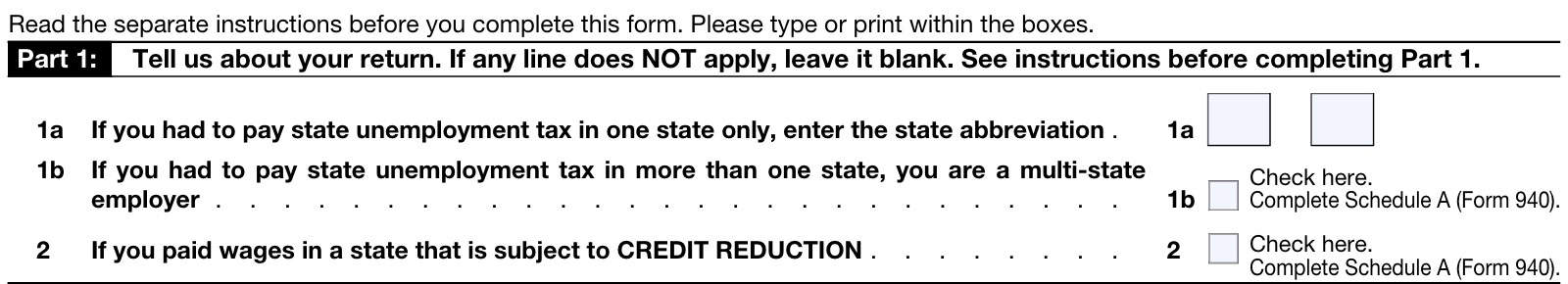

Part 1: Tell us about your return

In Part 1, answer the questions to indicate the number of states where you paid state unemployment tax, and to determine whether you must complete Schedule A.

You must complete either Line 1a or Line 1b even if you weren’t required to pay any state unemployment tax because your state unemployment tax rate(s) was zero. You may leave lines 1a and 1b blank only if all of the wages you paid to all employees in all states were excluded from state unemployment tax.

If you leave Lines 1a and 1b blank, and Line 7 is more than zero, you must complete Line 9 because all of the taxable FUTA wages you paid were excluded from state unemployment tax.

Line 1a

If you only paid unemployment tax in one state, enter the state abbreviation in Line 1a.

Line 1b

Check the box if you paid unemployment tax in multiple states. You will have to complete Schedule A (Form 940), Multi-State Employer and Credit Reduction Information.

Line 2

If you paid wages in a state subject to credit reduction, then check the box in Line 2 and complete Schedule A.

For 2023, the following states are considered credit reduction states:

- California: 0.6%

- New York: 0.6%

- U.S. Virgin Islands: 3.9%

Credit reduction states

A state that hasn’t repaid money it borrowed from the federal government to pay unemployment benefits is called a credit reduction state, as determined by the U.S. Department of Labor.

If an employer pays wages that are subject to the unemployment tax laws of a credit reduction state, that employer must pay additional federal unemployment tax when filing its Form 940.

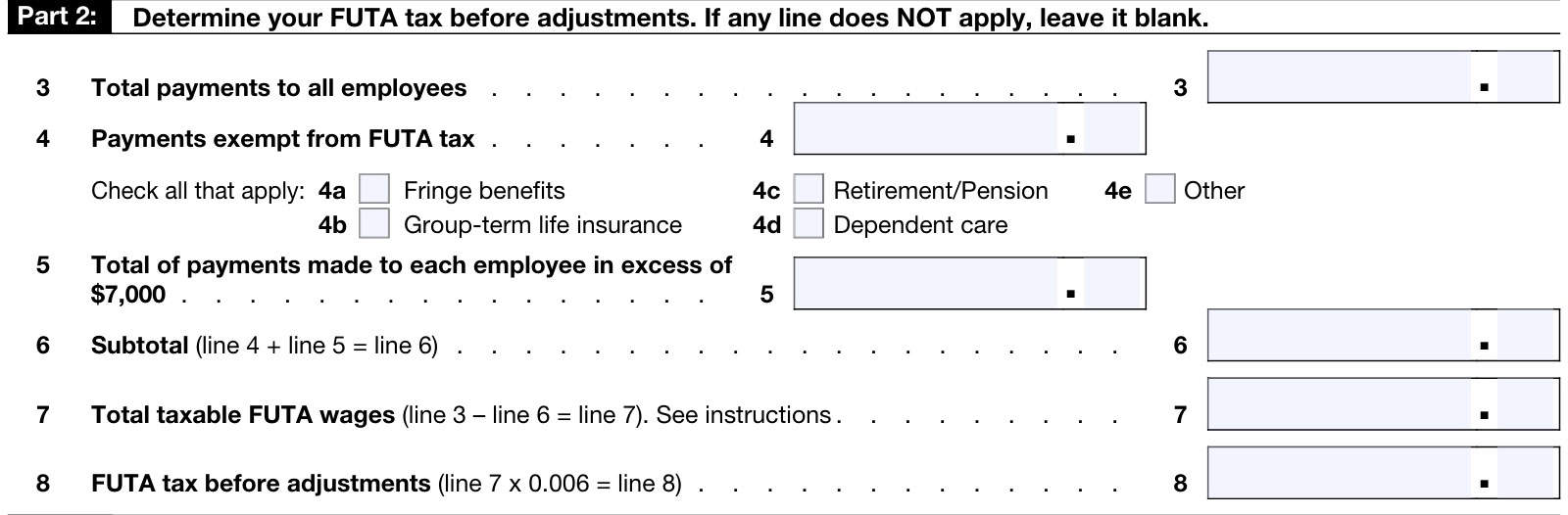

Part 2: Determine your FUTA tax before adjustments

In Part 2, you will calculate your FUTA tax before any adjustments. If there is a line that does not apply to you, leave that line blank.

Line 3: Total payments to all employees

Report the total payments you made during the calendar year on Line 3. Include payments for the services of all employees, even if the payments aren’t taxable for FUTA.

Your method of payment doesn’t determine whether payments are wages.

Include the following:

- Compensation: This includes salaries, wages, commissions, fees, bonuses, vacation allowances, and amounts you paid to full-time, part-time, or temporary employees

- Fringe benefits, such as:

- Sick pay, including third-party sick pay if liability is transferred to the employer

- Value of goods, lodging, food, clothing, and other non-cash fringe benefits

- Section 125 plan benefits (cafeteria plan)

- Retirement or pension payments, such as:

- Employer contributions to a 401(k) plan

- Payments to an Archer MSA plan or a health savings account (HSA) plan

- Payments under adoption assistance programs

- Contributions to SIMPLE retirement accounts, including elective salary reductions

- Amounts deferred under a non-qualified deferred compensation plan

- Other payments, such as:

- Tips of $20 or more in a month that your employees reported to you on IRS Form 4070

- Payments made by a predecessor employer to employees of a business that you acquired

- Payments made to nonemployees who are treated as your employees by the state unemployment agency

Line 4: Payments exempt from FUTA Tax

Enter the amount of payments that are exempt from from FUTA tax payments in Line 4, if applicable.

If you enter an amount on Line 4, check the appropriate box or boxes on Lines 4a through 4e to show the types of payments exempt from FUTA taxes. Only report a payment as exempt from FUTA tax liability if you included the payment on Line 3.

- Line 4a: Fringe benefits

- Line 4b: Group-term life insurance

- Line 4c: Retirement/Pension

- Line 4d: Dependent care

- Line 4e: Other

Other payments exempt from FUTA tax

According to the Form 940 instructions, the following payments are also exempt from FUTA tax:

- Noncash payments and certain cash payments for agricultural labor

- All payments to H-2A visa workers made by agricultural employers

- Payments made under workers’ compensation law due to a work-related injury or sickness

- Payments for domestic services if you did not pay cash wages of $1,000 or greater in any calendar quarter, or if you file IRS Schedule H with your individual income tax return

- Payments for services provided to you by your parent, spouse, or child under the age of 21.

- Payments for certain fishing activities

- Payments to certain statutory employees

- Payments to nonemployees who are treated as your employees by the state unemployment tax agency

Line 5: Total of payments made to each employee in excess of $7,000

Only the first $7,000 you paid to each employee in a calendar year, after subtracting any payments exempt from FUTA tax, is subject to FUTA tax. This $7,000 is called the FUTA wage base.

On Line 5, enter the total of the payments over the FUTA wage base you paid to each employee during the tax year after subtracting any payments exempt from FUTA tax shown on Line 4.

Example

In 2023, let’s imagine that John Doe had three employees. John paid the following amounts to each employee:

- Joan Rose: $44,000

- Sara Blue: $8,000

- John Green: $16,000

There is a total of $4,500 in payments exempt from FUTA tax for all three employees as outlined here:

- Joan Rose: $2,000

- Sara Blue: $500

- John Green: $2,000

You would subtract both the FUTA exempt payments and the FUTA wage base from each employee’s payments:

- Joan Rose: $35,000 ($44,000 – $2,000 – $7,000)

- Sara Blue: $500 ($8,000 – $500 – $7,000)

- John Green: $7,000 ($16,000 – $2,000 – $7,000)

You would enter a total of $42,500 in Line 5.

Successor employers

If you’re a successor employer, when calculating payments made in excess of the FUTA wage base, you may include payments your predecessor made to employees who continue to work for you only if your predecessor:

- Was an employer for FUTA tax purposes, and

- Was required to file Form 940

Line 6: Subtotal

Add Lines 4 and 5, then enter the total in Line 6.

Line 7: Total taxable FUTA wages

Subtract Line 6 from Line 3. This is your total taxable FUTA wages.

Line 8: FUTA tax before adjustments

Multiply Line 7 by the FUTA tax rate. The FUTA tax rate is currently 0.6%. Enter the result here.

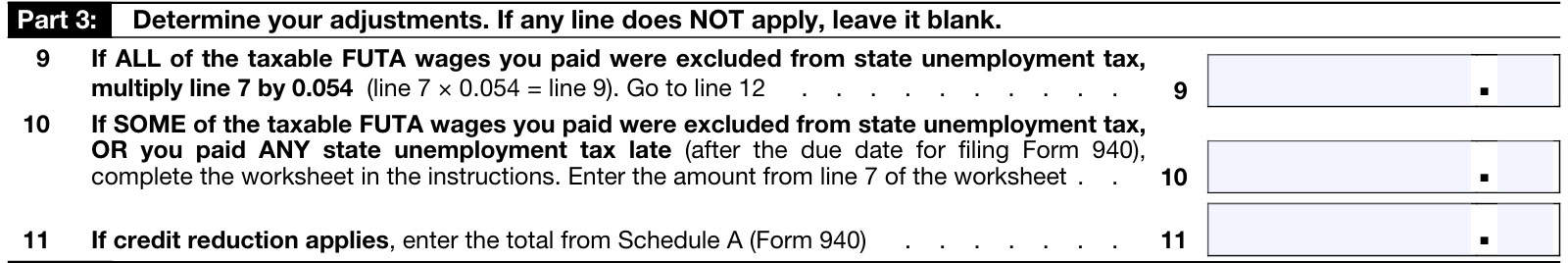

Part 3: Determine your adjustments

Use Part 3 to calculate any adjustments that you may need to make to your FUTA tax liability. If there is a line that does not apply, leave it blank.

Line 9

If all of the taxable FUTA wages you paid were excluded from state unemployment tax, then multiply Line 7 by 0.054 (5.4%), then enter the total here.

Skip to Line 12 in Part 4. You do not need to complete Line 10 or Line 11.

Line 10

Complete Line 10 if either of the following apply:

- Some of the taxable FUTA wages that you paid were excluded from state unemployment tax, or

- You paid any state unemployment tax late

If this applies, then you will need to complete the Line 10 worksheet located in the form instructions. Below is a brief video going over the Line 10 worksheet to help better understand the calculations.

Line 11

If a credit reduction rate applies and you completed Schedule A (Form 940), then enter the total credit reduction here.

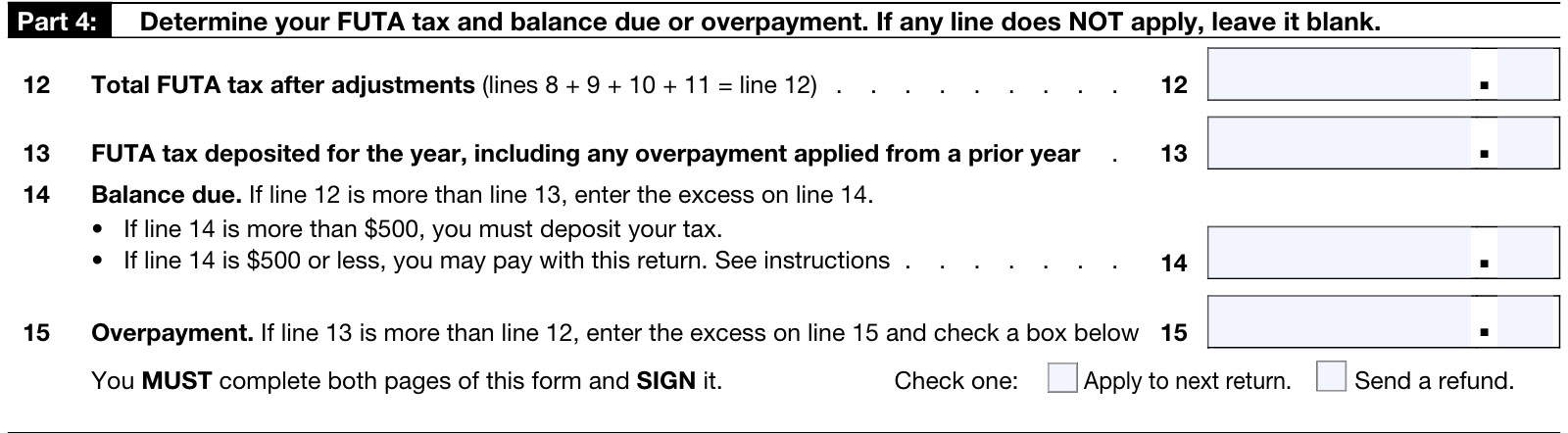

Part 4: Determine your FUTA tax and balance due or overpayment

In Part 4, you’ll calculate your total FUTA tax bill and determine whether you have a balance due or if the IRS owes you a tax refund.

Line 12: Total FUTA tax after adjustments

Add the following to calculate your total federal unemployment taxes, after adjustments:

Enter the total liability in Line 12. If you did not make any adjustments in Part 3, then you can carry down the Line 8 figure here.

Line 13: FUTA tax deposited for the year, including any overpayment applied from a prior year

Enter the amount of FUTA tax that you deposited for the year. This includes any overpayment that you applied from a previous year.

If Line 12 is greater than Line 13, then go to Line 14. If Line 13 is more than Line 12, then go to Line 15.

Line 14: Balance due

Subtract Line 13 from Line 12. Enter the excess here.

If Line 14 is greater than $500

You must deposit your unpaid tax.

Federal tax deposits

You must use EFT to make all federal tax deposits.

Generally, an EFT is made using the Electronic Federal Tax Payment System (EFTPS).

If you don’t want to use EFTPS, you can arrange one of the following to make electronic deposits on your behalf:

- Tax professional

- Financial institiution

- Payroll service provider

- Other trusted third party

Your financial institution may also initiate a same-day wire payment on your behalf. However, you may pay fees for going through a third party. EFTPS is a free service provided by the Department of the Treasury.

If Line 14 is $500 or less

You may pay your outstanding bill with your Form 940. You can do this by any of the following:

- Deposit via EFTPS

- Credit card or debit card

- Electronic funds withdrawal (if filing Form 940 electronically)

- Check or money order with your tax return

- Use the enclosed payment voucher, IRS Form 940-V, located in the file below

If Line 14 is $1.00 or less

You do not have to pay any amounts less than $1.00.

Line 15: Overpayment

If you are due to receive a tax refund, then subtract Line 12 from Line 13, then enter the difference here.

Check one of the following as you prefer:

- Apply tax refund to the next tax return

- Send a tax refund

Regardless of your selection, the IRS may apply your tax overpayment to any past due tax account as shown in IRS records under your EIN.

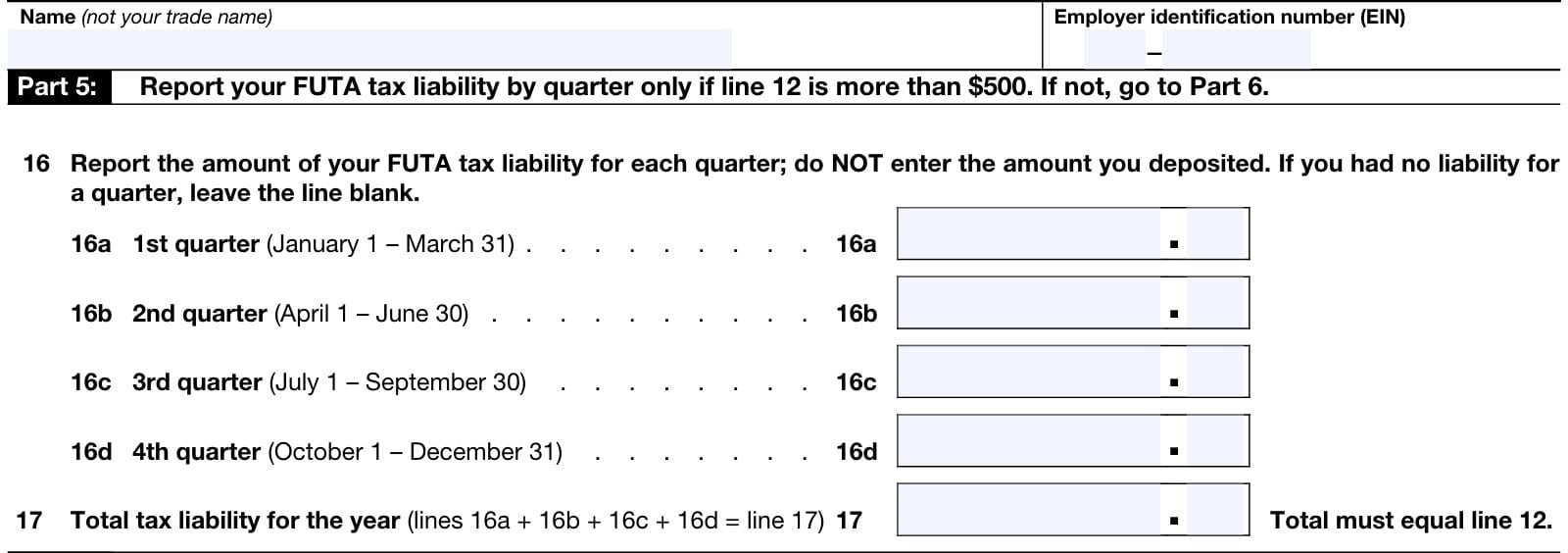

Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500

If Line 12 is less than $500, then you do not need to complete Part 5. Skip this section and go to Part 6. Otherwise, proceed to Line 16.

Line 16

Enter the amount of your FUTA tax liability for each quarter on Lines 16a–d. Don’t enter the amount of your quarterly deposits. If you had no liability for a quarter, leave the line blank.

- Line 16a: 1st quarter (January 1 – March 31)

- Line 16b: 2nd quarter (April 1 – June 30)

- Line 16c: 3rd quarter (July 1 – September 30)

- Line 16d: 4th quarter (October 1 – December 31)

Line 17: Total tax liability for the year

Add Lines 16a through 16d, then enter the total here. The total amount must equal the amount reported in Line 12.

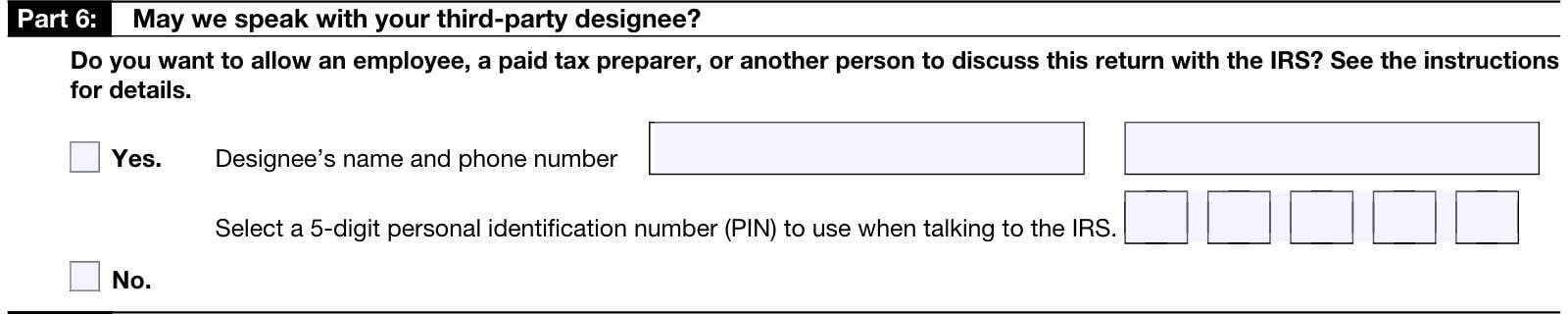

Part 6: May we speak with your third-party designee?

If you want to allow an employee, a paid tax preparer, or another person to discuss your Form 940 with the IRS, check the “Yes” box in Part 6. If you check “Yes,” then enter the following information for the specific person:

- Name

- Phone number

- Five-digit personal identification number (PIN)

Do not use the name of your tax preparation firm. Your designee may choose any five numbers as the PIN.

By checking “Yes,” you authorize the IRS to talk to the person you named (your designee) about any questions that come up while processing your tax return. You also authorize your designee to do all of the following:

- Provide the IRS any missing information from your return

- Call the IRS for information about processing your return

- Respond to certain IRS notices that you’ve shared with your designee about math errors and return preparation.

The IRS will not send notices to your designee. You are not authorizing your designee to bind your company to any additional obligations or to represent you before the IRS. If you wish to expand your designee’s authorization, you can find additional details in IRS Publication 947, Practice Before the IRS and Power of Attorney.

This authorization automatically expires 1 year from the due date for filing your Form 940.

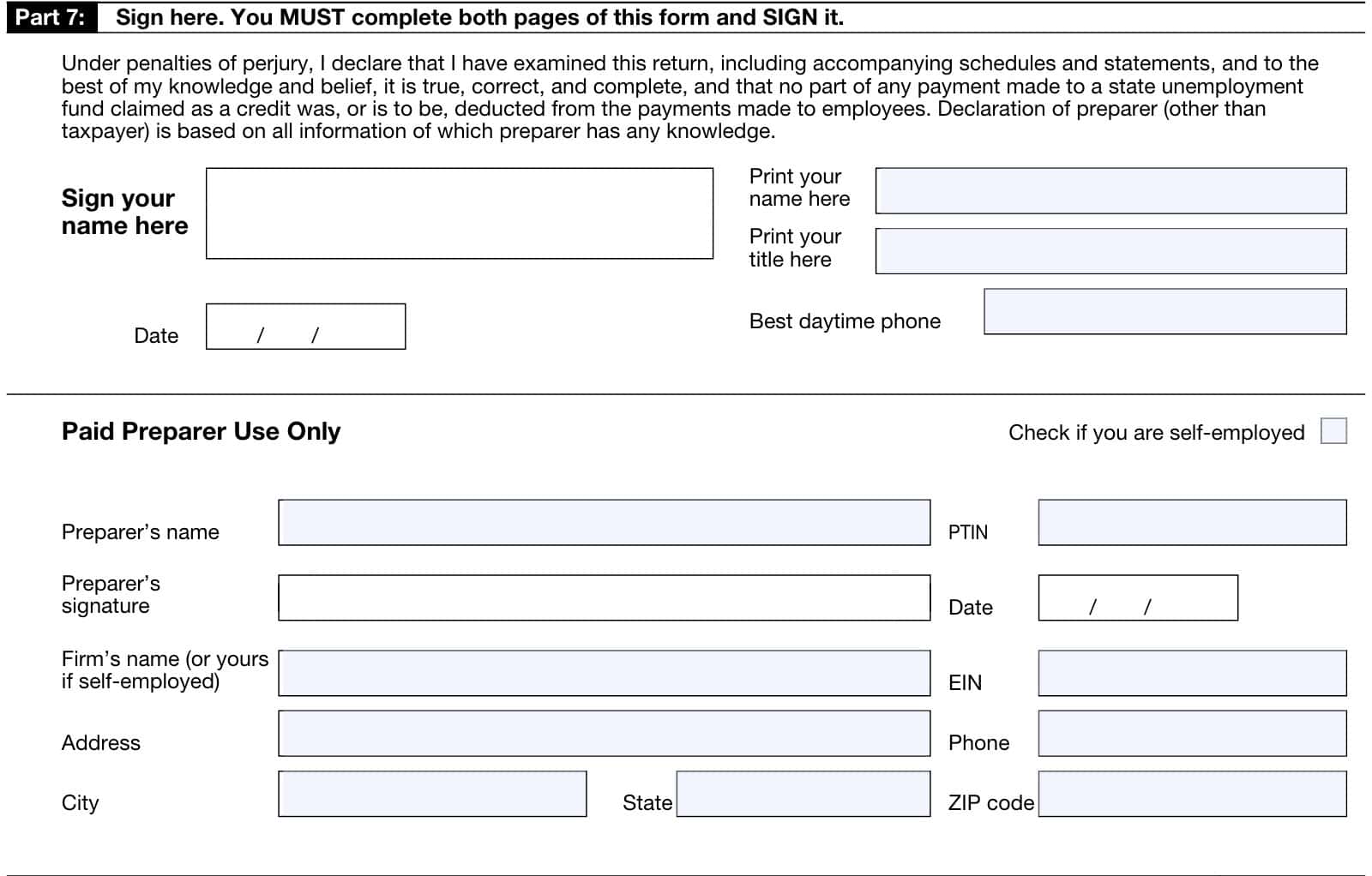

Part 7: Sign here

Under penalties of perjury, sign and date the form in Part 7. On the right-hand side, print your name and title, and enter a daytime telephone number.

At the bottom, your tax preparer will complete the Paid Preparer Use Only section of Part 7.

Filing considerations

Below are some filing considerations for taxpayers when filing IRS Form 940.

Who Must File IRS Form 940?

Except as noted below, if you answer “Yes” to either one of these questions, you must file Form 940.

- Did you pay employee wages of $1,500 or more to employees in any calendar quarter during the previous two tax years?

- Did you have one or more employees for at least some part of a day in any 20 or more different weeks in the prior two tax years?

Count all full-time, part-time, and temporary employees. However, if your business is a partnership, don’t count your business partners.

If your business was sold or transferred during the tax year

If your business was sold or transferred during the year, each employer who answered “Yes” to at least one question above must file Form 940.

However, don’t include any employees’ wages paid by the predecessor employer on your Form 940 unless you’re a successor employer.

If you made no payments to employees during the tax year

If you’re not liable for FUTA tax for the taxable year because you made no payments to employees in during the year then do the following:

- Check Box C in the top right corner of the form

- Go to Part 7

- Sign the form & file it with the IRS

you won’t be liable for filing Form 940 in the future

If you won’t be liable for filing Form 940 in the future because your business has closed or because you

stopped paying wages, then do the following:

- Check Box D in the top right corner of the form

- Go to Part 7

- Sign the form & file it with the IRS

Specific guidance based upon taxpayer situation

Below is specific guidance based upon the employer’s status.

Employers of Household Employees

If you’re a household employer, you must pay FUTA tax on wages that you paid to your household employees only if you paid cash wages of $1,000 or more in any calendar quarter within the past 2 years.

Household employees

A household employee performs household work in a:

- Private home,

- Local college club, or

- Local chapter of a college fraternity or sorority

Usually, employers of household employees file Schedule (Form 1040) instead of Form 940. However, if you have other employees in addition to household employees, you can choose to include the FUTA taxes for your household employees on Form 940 instead of filing Schedule H (Form 1040).

If you choose to include household employees on your Form 940, you must also file one or more of the following to report Social Security, Medicare, and other withheld federal income taxes:

- IRS Form 941, Employer’s QUARTERLY Federal Tax Return

- IRS Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees

- IRS Form 944, Employer’s ANNUAL Federal Tax Return

For Agricultural Employers

File Form 940 if you answer “Yes” to either of these questions:

- Did you pay cash wages of $20,000 or more to farmworkers during any calendar quarter in the past two tax years?

- Did you employ 10 or more farm workers during some part of the day during any 20 or more different weeks in either of the previous two tax years?

Count wages that you paid to aliens admitted to the United States on a temporary basis under an H-2A visa. However, wages paid to H-2A visa workers are not subject to FUTA tax.

Indian Tribal Governments

Services rendered by employees of a federally recognized Indian tribal government employer (including any subdivision, subsidiary, or business enterprise wholly owned by the tribe) are exempt from FUTA tax. No Form 940 is required.

However, the tribe must have participated in the state unemployment system for the full tax year and be in compliance with applicable state unemployment law. For more information, see Internal Revenue Code Section 3309(d).

Tax-exempt organizations

Religious, educational, scientific, charitable, and other organizations described in IRC Section 501(c)(3) and exempt from tax under section 501(a) generally aren’t subject to FUTA tax.

However, a tax-exempt organization is subject to FUTA tax when paying wages to employees on behalf of a non-Section 501(c)(3) organization.

State and local governments

Services rendered by employees of a state, or a political subdivision or instrumentality of the state, are exempt from FUTA tax and no Form 940 is required.

When Is IRS Form 940 Due?

The due date for filing Form 940 is January 31 of the year following the previous tax year. For example, the due date for filing IRS Form 940 for tax year 2023 was January 31, 2024. However, for taxpayers who deposited all of the outstanding FUTA tax on or before the due date, the deadline was February 12, 2024.

How do I file IRS Form 940?

The IRS encourages taxpayers to file IRS Form 940 electronically through the IRS website.

Paper Filing

If filing by hard copy, use the following schedule based on location and whether or not you are submitting payment:

| If you’re filing in… | Without a payment | With a payment |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0046 | Internal Revenue Service P.O. Box 806532 Cincinnati, OH 45280-6531 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0046 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| The U.S. Virgin Islands and Puerto Rico | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| If the location of your legal residence, principal place of business, office, or agency is not listed | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| Special filing address for exempt organizations: federal, state, and local governmental entities; and Indian tribal governmental entities, regardless of location | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0046 | Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

What schedules do I need to file?

There are two schedules that taxpayers may need to file with Form 940:

- Schedule A (Form 940), Multi-State Employer and Credit Reduction Information

- Schedule R, Allocation Schedule for Aggregate Form 940 Filers

Although we do not cover these schedules here, we can take a closer look at when you might need to file each one.

Schedule A (Form 940), Multi-State Employer and Credit Reduction Information

Use Schedule A (Form 940) to figure your annual Federal Unemployment Tax Act (FUTA) tax for states that have a credit reduction on wages that are subject to the unemployment compensation laws.

Schedule R, Allocation Schedule for Aggregate Form 940 Filers

Use this schedule to allocate the aggregate information reported on Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, to each home care service recipient client.

Video walkthrough

Check out this instructional video as we go through IRS Form 940, step by step.

Frequently asked questions

Employers use Form 940 to report the employer’s annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs.

Employers who paid wages of $1,500 or more to employees in any calendar quarter during the prior two tax years, or who had one or more employees for at least some part of a day for 20 or more different weeks in either of the prior two years must file Form 940. Some exceptions may apply based upon the employer’s situation.

FUTA is the federal unemployment tax. Currently, the FUTA tax rate is 6.0% and applies to the first $7,000 you paid to each employee as wages during the year. The $7,000 is often referred to as the federal or FUTA wage base.