IRS Form 945-X Instructions

If you previously filed IRS Form 945, but need to make adjustments to correct administrative errors, then you may need to complete IRS Form 945-X to update your business tax records.

In this article, we’ll walk you through everything you need to know about IRS Form 945-X, including:

- How to complete IRS Form 945-X

- Filing considerations

- Frequently asked questions

Let’s begin with a step by step review of the tax form.

Table of contents

How do I complete IRS Form 945-X?

This two-page tax form contains 4 parts:

- Part 1: Selecting the process

- Part 2: Corrections

- Part 3: Written explanation

- Part 4: Signature

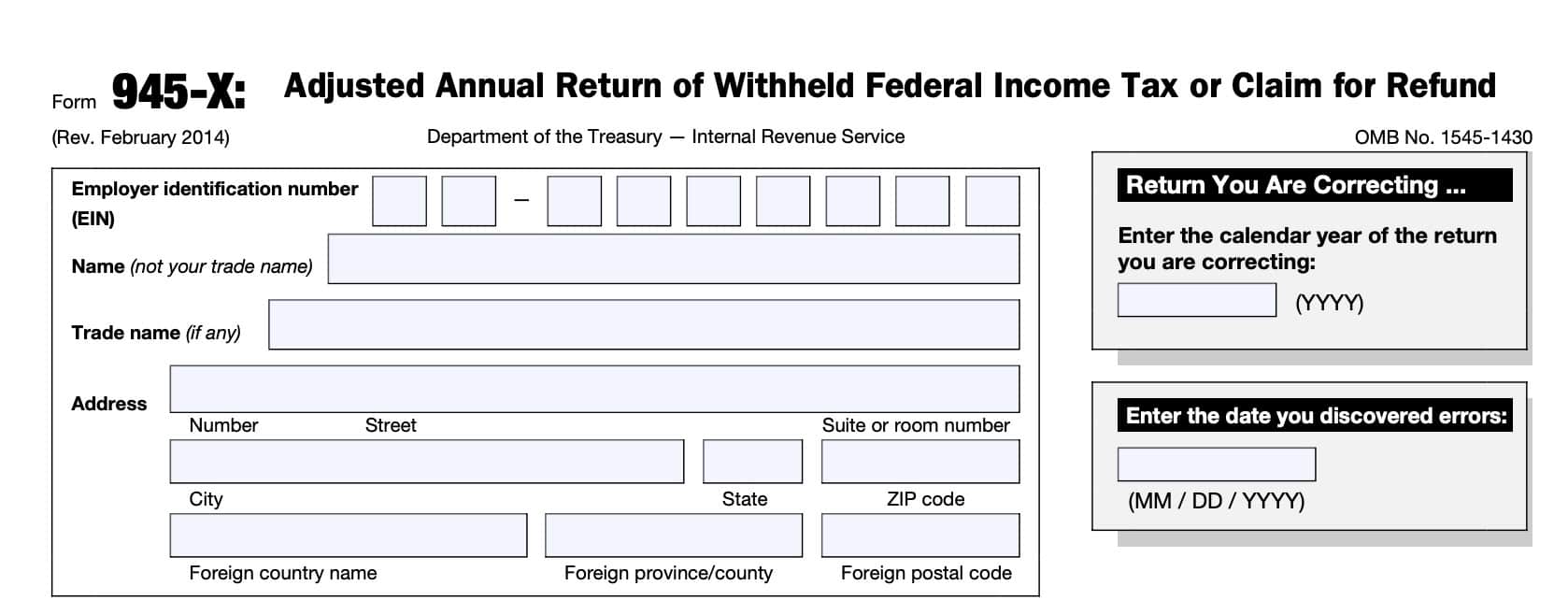

Before we go to Part 1, let’s take a closer look at the taxpayer information fields at the top of the form.

Taxpayer information

At the very top, you will enter the information related to your business, the tax return that you are correcting, and when you discovered the errors.

Employer identification number (EIN)

Enter your company’s employer identification number in this field. You will also need to enter this information on Page 2, at the top of the form.

Do not enter a Social Security number in this field, even if your business is a sole proprietorship.

Name

Enter your company’s trade name in this field. Do not enter your trade name here. You will also need to enter this information on Page 2, at the top of the form.

Trade name

If applicable, enter your trade name in this field. This may also be known as a doing business as, or DBA name.

Address

Enter your company’s address in this field.

If you have recently moved

If your business address has changed since you filed your Form 945, enter the corrected information and the IRS will update your address of record.

Be sure to include the following information:

- Street number and street name

- City

- State

- Zip code

If your business is located overseas, be sure to include:

- Foreign country name

- Province or county

- Foreign postal code

Return that you are correcting

Enter the calendar year of the previously filed form that you are correcting.

Date you discovered errors in your return

In this field, enter the date that you first discovered the errors that caused you to complete Form 945-X.

Discovering tax return errors

You discover an error when you have enough information to be able to correct it.

Multiple errors: If you are reporting several errors you discovered at different times, enter the earliest date you discovered an error in this field. Report any subsequent dates and related errors on Line 7, below.

After this, proceed to Part 1.

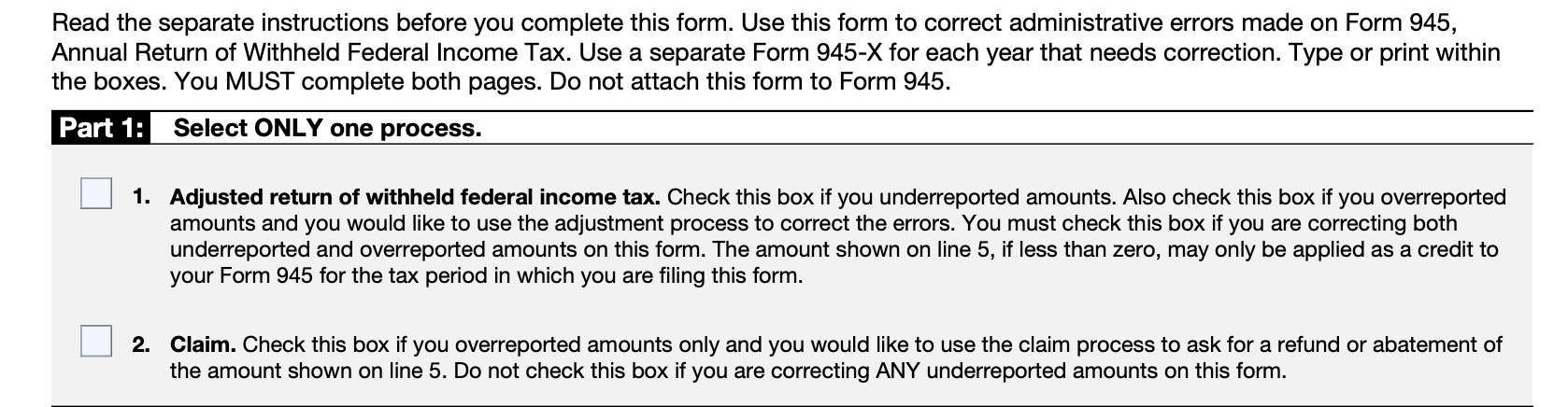

Part 1: Selecting the process

There are a couple of key points to note at the top of Part 1:

- Use this form to correct administrative errors made on Form 945, Annual Return of Withheld Federal Income Tax.

- Use a separate Form 945-X for each year that needs correction.

- Type or print within the boxes.

- You MUST complete both pages.

- Do not attach this form to Form 945.

In Part 1, you must select only one process. We’ll go over each one separately.

Line 1: Adjusted return of withheld federal income tax

Check this box if you underreported amounts. Also check this box to correct errors in cases where you you overreported and would like to use the adjustment process. You must check this box if you are correcting both underreported and overreported amounts on this form.

The amount shown on Line 5, if less than zero, may only be applied as a tax credit to your Form 945 for the tax period in which you are filing this form.

If you owe tax

Pay the amount of your tax liability shown on Line 5 by the time you file Form 945-X.

Generally, the Internal Revenue Service will not charge you interest on these federal taxes if you:

- File your tax return on time

- Pay your tax bill on time

- Enter the date that you discovered any errors, and

- Provide an adequate explanation on Line 7.

If you expect a tax refund

If you overreported withheld federal income tax (meaning, you have a negative amount on Line 5), you may select the first option if you want the IRS to apply the credit to Form 945 for the year during which you filed Form 945-X.

The IRS will apply your credit on the first day of that year. However, the credit you show on Line 5 of Form 945-X may not be fully available on your current year Form 945 if the IRS corrects it during processing or you owe other taxes, penalties, or interest.

The IRS will notify you if your claimed credit changes or if the amount available as a credit on Form 945 was reduced because of unpaid federal income taxes, penalties, or interest.

Line 2: Claim

Select the box on Line 2 to use the claim process if you are

- Correcting overreported amounts only, and

- Are also claiming a refund or abatement for the negative amount (or tax credit) on Line 5

Do not check this box if you are correcting any underreported amounts on this form.

When you must select this box

You must check the box on Line 2 if you have a credit and the period of limitations on credit or refund for Form 945 will expire within 90 days of the date you file Form 945-X.

The IRS usually processes claims shortly after they are filed. IRS will notify you if your claim is denied, accepted as filed, or selected to be examined.

Unless the IRS corrects Form 945-X during processing or you owe other taxes, penalties, or interest, IRS will refund the amount shown on Line 5, plus any interest that applies.

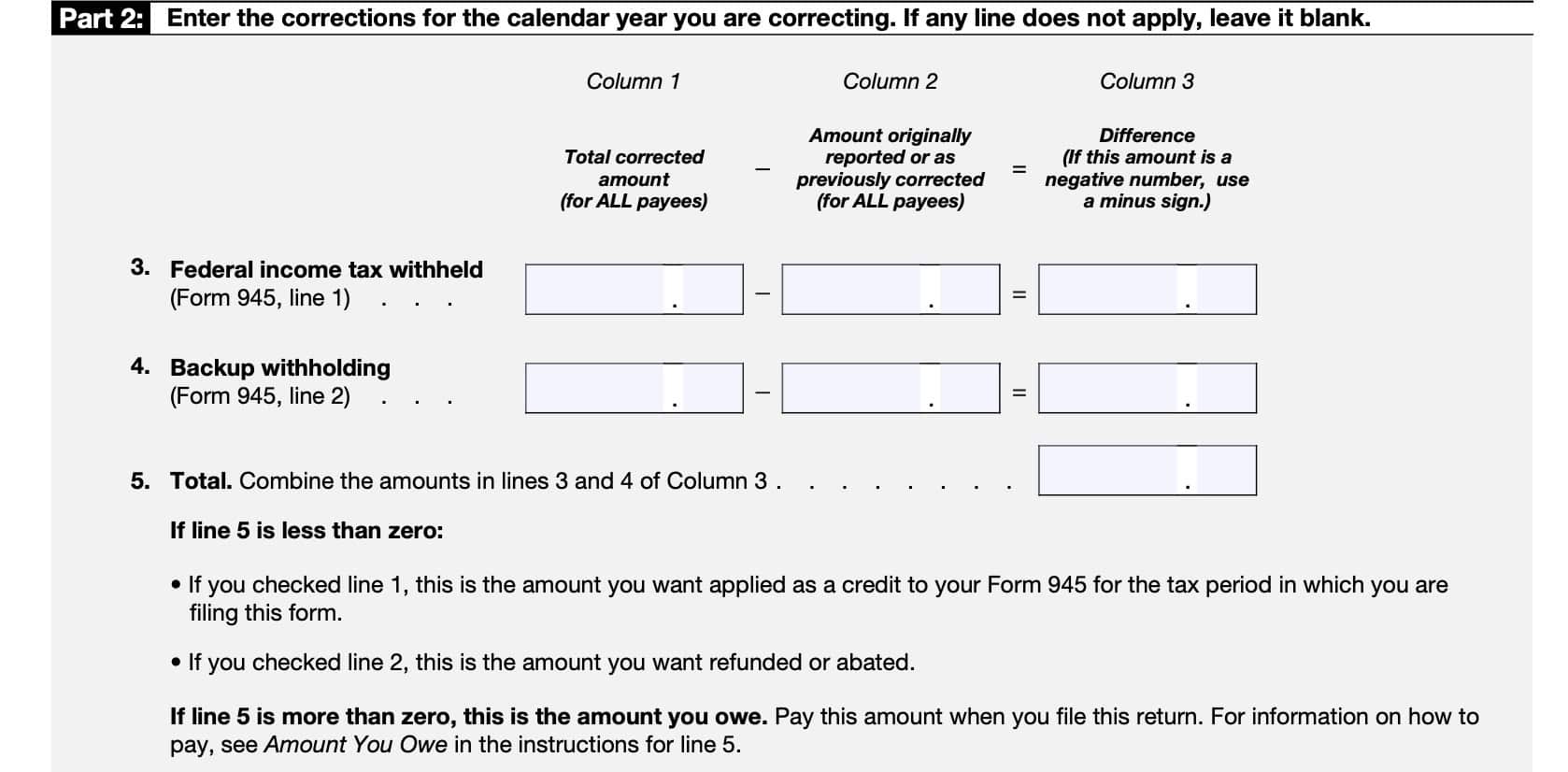

Part 2: Corrections

In Part 2, you will report corrected amounts for the tax year of your amended return. You’ll see 3 columns:

- Column 1: Total corrected amount (for ALL payees)

- Column 2: Amount originally reported or as previously corrected (for ALL payees)

- Column 3: Difference

In columns 1 and 2 of Lines 3 and 4, show amounts for all of your payees, not just for those payees whose amounts you are correcting.

If a correction that you report in Column 3 includes both underreported and overreported amounts you’ll need to provide additional information on each error in Line 7.

You may correct federal income tax withholding errors for prior years if the amounts shown on Form 945 do not agree with the amounts you actually withheld. This is considered an administrative error.

Line 3: Federal income tax withheld

If you are correcting the federal income tax withheld you reported on Form 945, Line 1, enter the total corrected amount for all payees in Column 1.

In Column 2, enter the amount you originally reported or as previously corrected. In column 3, enter the difference between Columns 1 and 2. If the amount in Column 2 is larger than the amount in Column 1, use a minus sign in Column 3.

Below are several examples, based on different tax situations.

Example: Federal income tax withheld increased

You reported $9,000 as federal income tax withheld on Line 1 of your 2022 Form 945. In July of 2023, you discovered that you had overlooked $1,000 in federal income tax actually withheld from one of your payees.

To correct the error, figure the difference on Form 945-X as shown below:

Column 1 (corrected amount): $10,000.00

Column 2 (original amount from Form 945, Line 1): $9,000.00

Column 3 (difference): $1,000.00

Example: Federal income tax withheld decreased

You reported $9,600 as federal income tax withheld on Line 1 of your 2022 Form 945. In December of 2023, you discovered that you actually withheld $6,900 but reported the higher amount due to a typographical error.

To correct the error, figure the difference on Form 945-X as shown:

Column 1 (corrected amount): $6,900.00

Column 2 (original amount from Form 945, Line 1): $9,600.00

Column 3 (difference): -$2,700.00

Example: Failure to withhold income tax when required

You were required to withhold $400 of federal income tax from a new payee in December of 2022 but withheld nothing. You discovered the error on March 15, 2023.

You cannot file Form 945-X to correct your 2022 Form 945 because the error involves a previous year and the amount previously reported for the new payee (zero) represents the actual amount withheld from the new payee during 2022.

Example: Administrative error

You had three payees. In 2022, you withheld income tax from each payee as follows:

- Payee A: $1,000

- Payee B: $2,000

- Payee C: $6,000

- Total federal income tax withholding: $9,000

You mistakenly reported $6,000 on Line 1 of your 2022 Form 945. On March 15, 2023, you discovered the error.

This is an example of an administrative error that may be corrected in a later calendar year because the amount actually withheld from payees differs from the amount reported on Form 945. Use Form 945-X

to correct the error.

Enter $9,000 in Column 1 of Line 3 and $6,000 in Column 2 of Line 3. Subtract the Column 2 amount from the Column 1 amount. Enter the difference ($3,000) in Column 3.

Be sure to explain the reasons for this correction on Line 7.

Line 4: Backup withholding

If you are correcting the federal backup withholding of income taxes you reported on Form 945, Line 2, enter the total corrected amount in Column 1.

In Column 2, enter the amount you originally reported or as previously corrected.

In Column 3, enter the difference between Columns 1 and 2.

Line 5: Total

Combine the amounts from Lines 3 and 4 of Column 3. Enter the result here. This will either result in a tax credit or a tax amount that you owe.

Tax credit

If the amount entered on Line 5 is less than zero, you have a tax credit because you overreported the amount of withheld taxes.

If you Selected Line 1

If you checked the box on Line 1, then include this amount on Line 4 (Total deposits) of Form 945 for the year during which you file Form 945-X. Do not make changes to your Monthly Summary of Federal Tax Liability on Form 945 or on Form 945-A. The amounts reported on the record should reflect your actual tax liability for the period.

If you selected Line 2

If you checked the box on Line 2, you are filing a claim for refund or abatement of the amount shown.

If your credit is less than $1, the IRS will send a refund or apply it only if request this in writing.

Tax amount owed

If the Line 5 amount is a positive number, you must pay the amount you owe by the time you file Form 945-X. There is no separate filing deadline or payment deadline for Form 945-X.

You may not use any credit that you show on another Form 945-X to pay for the amount you owe, even if you filed for the amount you owe and the credit at the same time.

Payment Methods

You may pay the Line 5 amount in any of the following ways:

- Electronic deposits through the Electronic Federal Tax Payment System (EFTPS)

- Credit card or debit card

- Check or money order

The federal government’s preferred payment method is by electronic funds transfer through EFTPS. You may enroll through the EFTPS website or by filing IRS Form 9779, Electronic Federal Tax Payment System Enrollment Form.

For more information on paying by credit or debit card, visit the IRS website.

To pay by check or money order, follow these steps:

- Make the check or money order payable to United States Treasury

- Include the following information on the check or money order:

- Employer identification number

- Form 945-X

- Tax year corrected

You do not have to pay if the amount you owe is less than $1.

Previously assessed FTD penalty

If Line 5 reflects overreported tax and the IRS previously assessed a failure-to-deposit (FTD) penalty, you may be able to reduce the penalty. Additional information is available in the instructions for IRS Form 945-A, Annual Record of Federal Tax Liability.

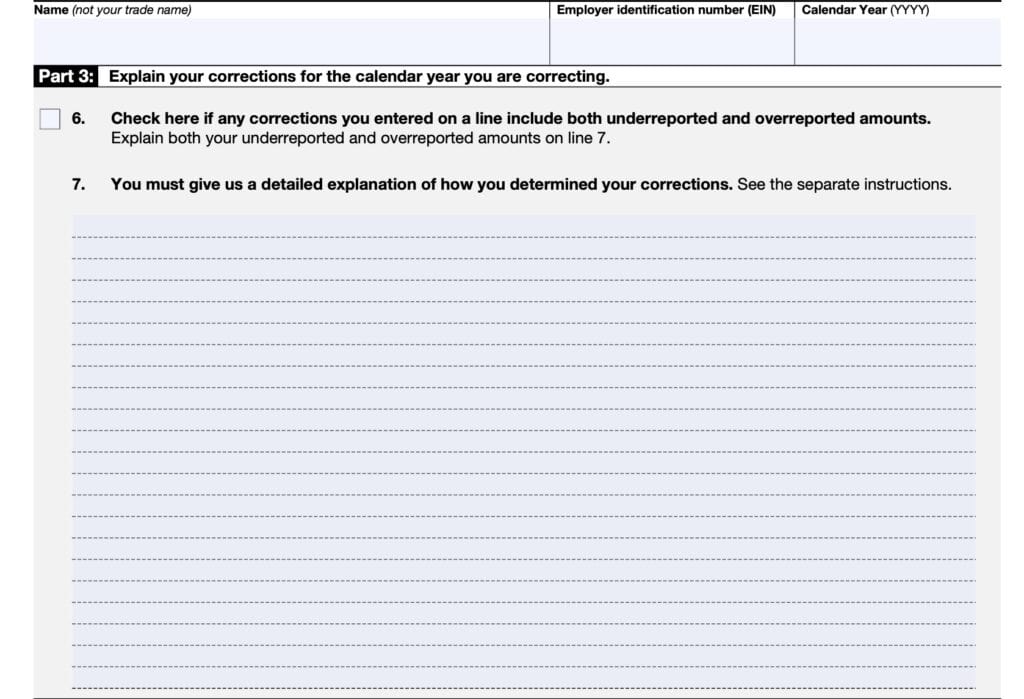

Part 3: Written explanation

In Part 3, you provide additional information about why you are filing Form 945-X, and about any corrections that you’re making to the reporting of federal tax deposits.

At the top, be sure to enter the following information:

- Name

- Employer ID number

- Calendar year

Line 6

Check the box in Line 6 if you are reporting corrections to both underreported and overreported amounts. You’ll need to provide a more complete explanation in Line 7.

Line 7

In this section, you’ll provide a detailed explanation about your corrections. Treasury regulations require you to explain in detail the grounds and facts relied upon to support each correction.

On Line 7, describe in detail each correction you entered in Column 3 on Lines 3 and 4. If you need more space, you may attach additional sheets. However, write your name, EIN, Form 945-X, and calendar year on the top of each sheet.

You must describe the events that caused the underreported or overreported withheld income tax or backup withholding. A generic explanation such as “withheld income tax was overstated” is insufficient and may delay processing your Form 945-X because the IRS may need to ask for a more complete explanation.

Provide the following information in your explanation for each error you are correcting:

- Form 945-X line number(s) affected

- Date you discovered the error

- Difference (amount of the error)

- Cause of the error

You may report the information in paragraph form. As an example:

“The $1,000 difference shown in Column 3 of Line 3 was discovered on May 13, 2013, during an internal audit. Due to a typographical error, we reported $11,000 as withheld income tax on Form 945 instead of the $10,000 actually withheld from payees. This correction removes the $1,000 that was overreported.”

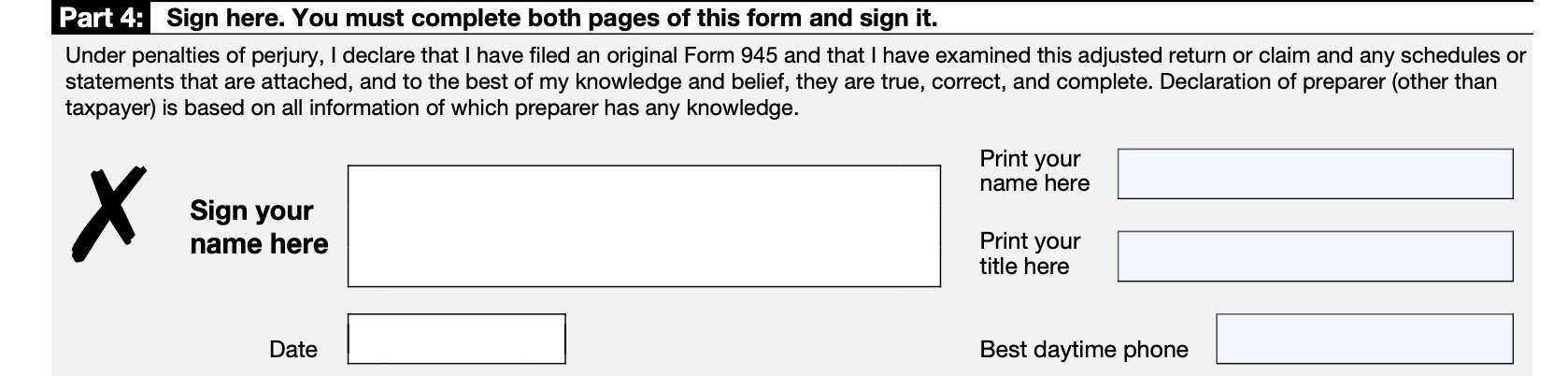

Part 4: Signature

In Part 4, you’ll sign the bottom of the form. Also include the following information:

- Printed name

- Title

- Date

- Daytime telephone number

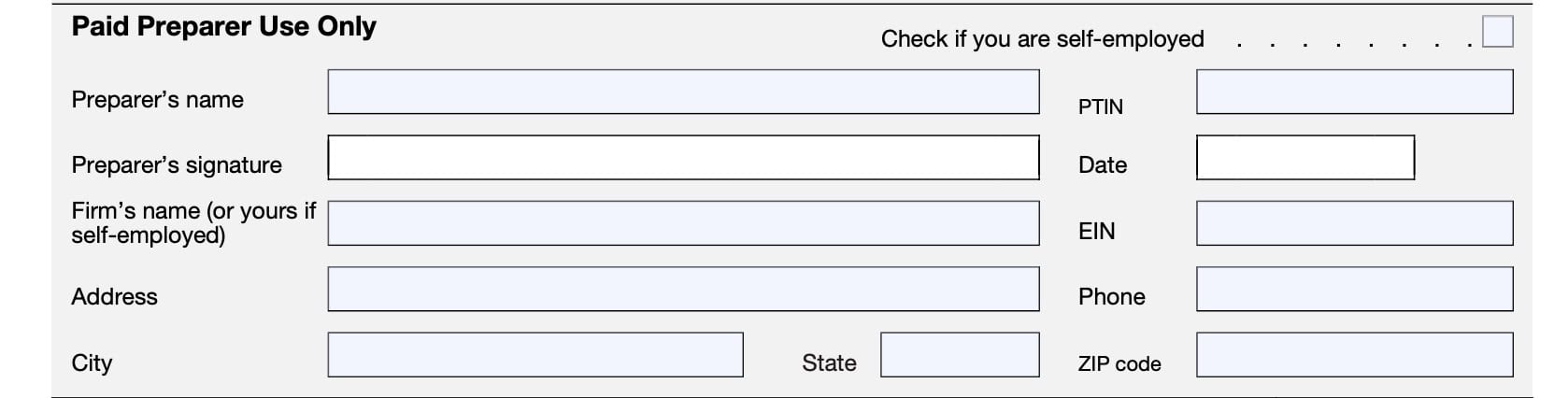

Paid preparer use only

If you are using a paid tax preparer to complete IRS Form 945-X, then this area will be completed with the tax preparer’s information. Otherwise, this area may be blank.

Video walkthrough

Frequently asked questions

According to the IRS, you should use IRS Form 945-X to correct administrative errors only on a previously filed Form 945. Use IRS Form 843, Claim for Refund and Request for Abatement, to request a refund or abatement of assessed interest or penalties.

No. According to the IRS, you must use a separate Form 945-X for each calendar year for which you are reporting a correction to federal tax withholding. If you are reporting for two tax years, you must use a second form for the additional tax year.

Where can I find IRS Form 945-X?

You may find all tax forms in the IRS website. For your convenience, we’ve enclosed the latest version of IRS Form 945-X in this article.