IRS Form 9779 Instructions

Businesses who wish to pay federal taxes electronically may enroll in the Treasury Department’s Electronic Federal Tax Payment System (EFTPS). To enroll en EFTPS, businesses can complete and submit IRS Form 9779, Electronic Federal Tax Payment System Business Enrollment.

In this article, we’ll walk you through everything you need to know about IRS Form 9779, including:

- How to complete IRS Form 9779

- Filing considerations

- Frequently asked questions

Let’s start with a step by step overview on how to complete this tax form.

Table of contents

How do I complete IRS Form 9779?

We will walk through this two-page tax form step by step, beginning with the business information fields at the top of Page 1.

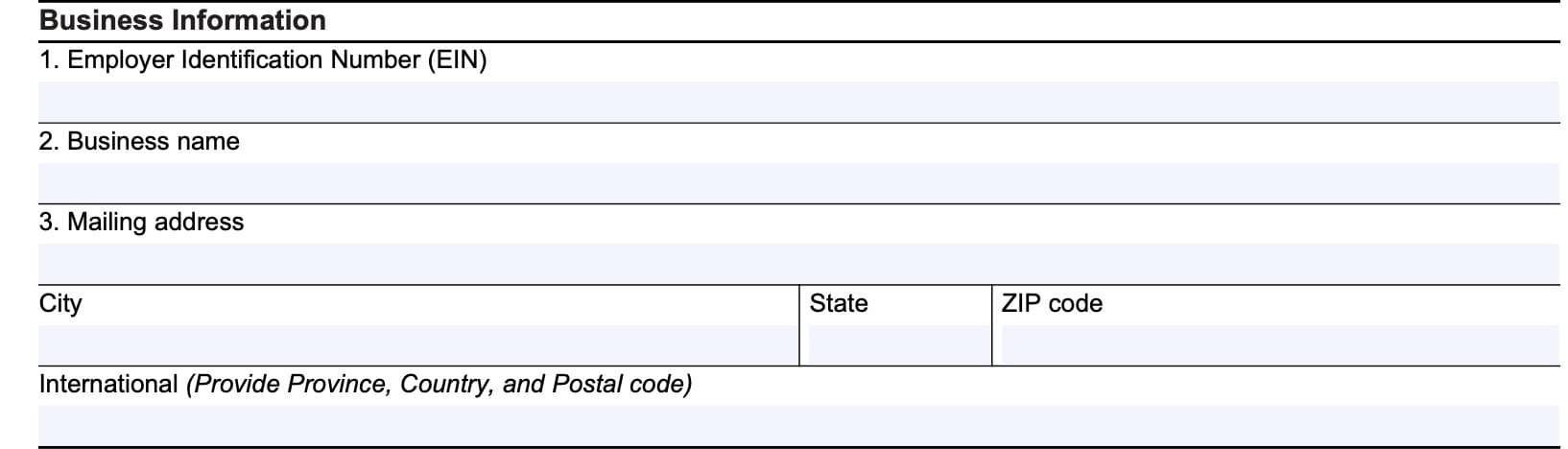

Business information

In this section, you’ll provide complete information on behalf of the business in question.

Item 1: Employer identification number

In this line, enter the nine-digit employer identification number (EIN) here.

Solo entrepreneurs

If you are a sole proprietor, without employees, then you should enroll in EFTPS as an individual taxpayer. To do this, you will need to file IRS Form 9783, EFTPS Individual Enrollment.

On IRS Form 9783, you’ll need to use the primary Social Security Number as your taxpayer identification number.

Item 2: Business name

Enter the name of the business entity in Item 2.

A sole proprietorship (with employees) should use the owner’s name rather than the DBA name in this field.

Item 3: Mailing address

In Item 3, enter the business’ mailing address exactly as it appears on the tax return. Be sure to include the following:

- Street name and number

- City

- State

- Zip code

International taxpayers should provide the province, country, and foreign postal code, instead. Be sure to only use the following characters:

- Letters: A through Z

- Numbers: 0 through 9

- Symbols: – and &

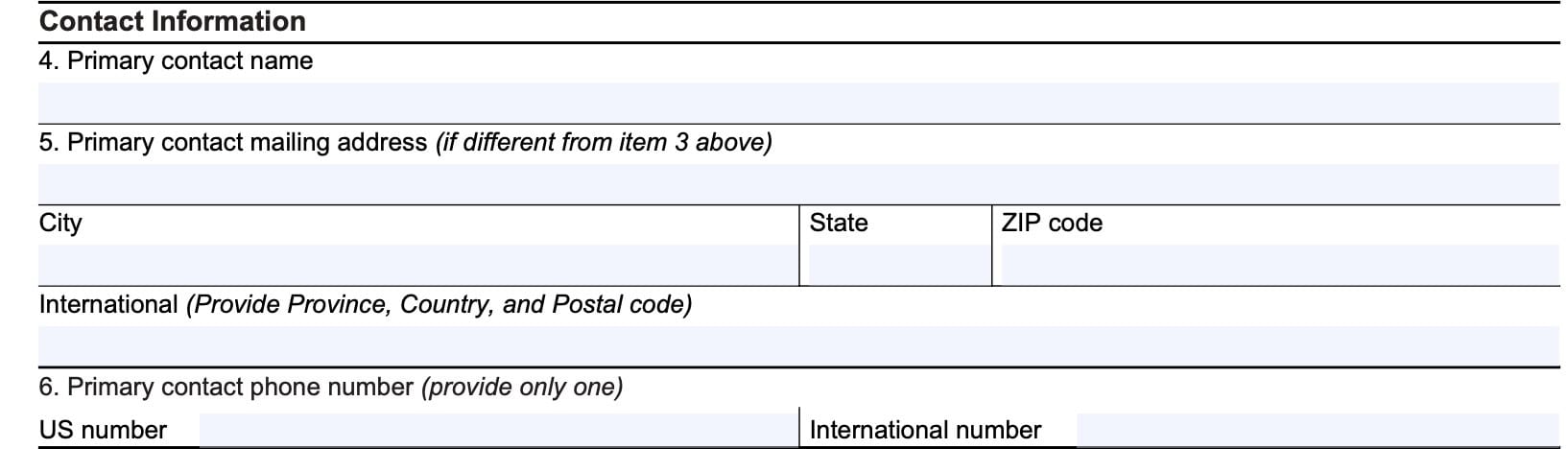

Contact information

In this section, we’ll enter information about the point of contact authorized that can be contacted if questions arise. All EFTPS mailings and written correspondence will be sent to the primary contact.

Item 4: Primary contact name

Enter the name of the person, company, or third party to contact if questions arise. All EFTPS mailings will

be sent to the primary contact.

Item 5: Primary contact mailing address

If different from the mailing address in Item 3, then enter the point of contact’s mailing address here. This is where the Internal Revenue Service will send EFTPS-related correspondence.

Item 6: Primary contact phone number

Enter the primary contact’s phone number here. You may enter a United States phone number or an international phone number, but not both.

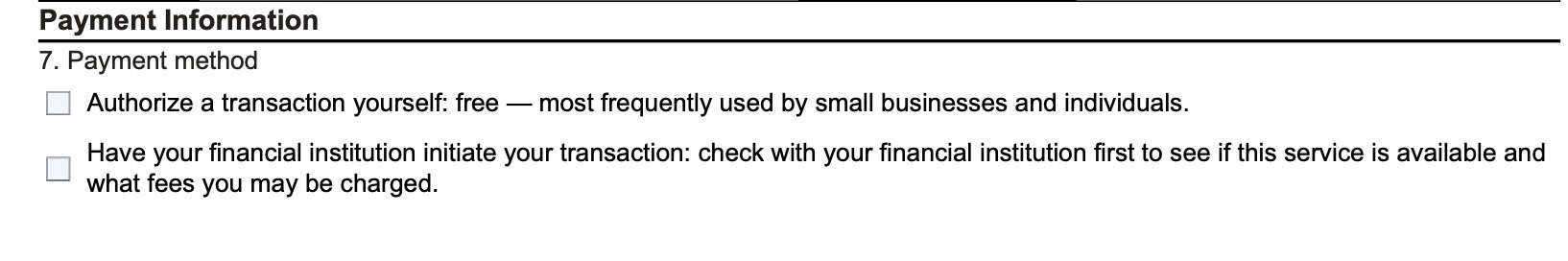

Payment information

This area contains two options regarding the payment method available for electronic funds transfer (EFT).

Item 7: Payment method

You may select one of the following:

- Authorize a transaction yourself

- Most small businesses and individual taxpayers use this option

- Free of charge

- Have your financial institution initiate your transaction

- You may incur charges for this method, so check with your financial institution beforehand

Note: If you wish to use multiple accounts in one financial institution or accounts in multiple financial institutions, you will need to complete a separate form for each enrollment.

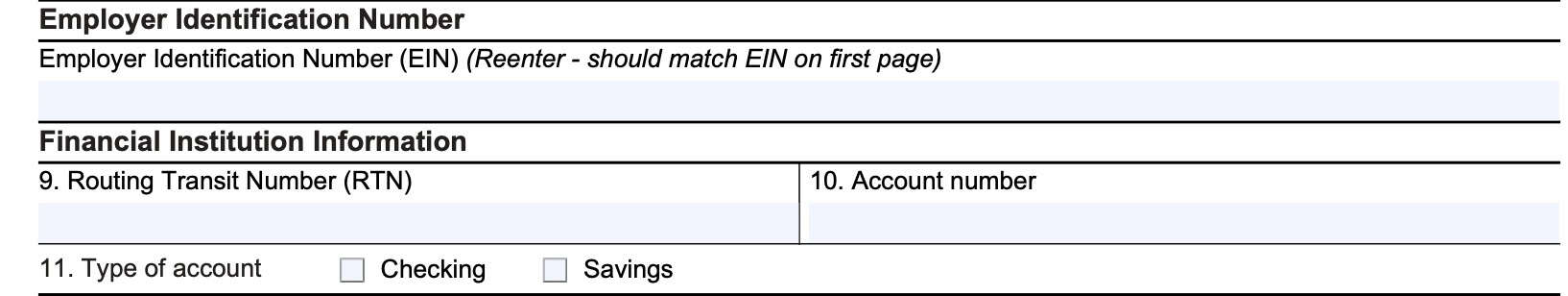

EIN and Financial institution information

At the top of Page 2, we’ll provide the employer identification number and financial institution information for EFTPS enrollment.

Employer identification number

Re-enter the employer ID number that you entered in Item 1.

Item 9: Routing transit number (RTN)

Enter the nine-digit routing transit number of your financial institution here.

This is the number that should appear on the lower left-side of your checks. You may also find your RTN by logging into your financial institution’s online account or mobile service app.

Item 10: Account number

Enter your account number in Item 10. Unlike your RTN, your account number may contain more than or fewer than, 9 digits. This should be the account that you plan to use to make federal income tax payments.

Item 11: Type of account

Check the appropriate box, depending on whether this is a checking account or savings account.

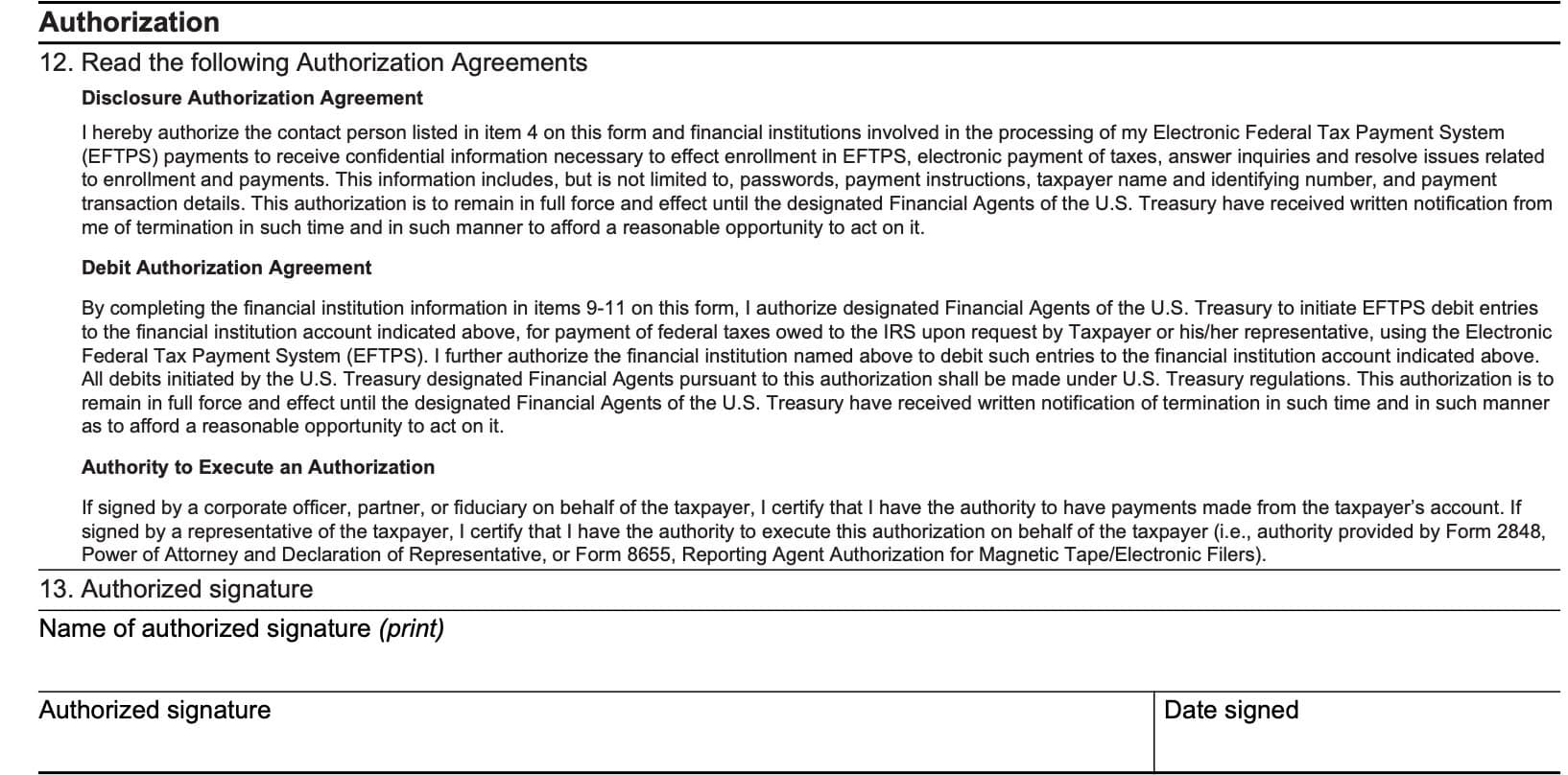

Authorization

It’s easy to skip the fine print, but you should take the time to understand what you’re signing. In this section, we’ll break down each of the following agreements so you understand what your signature authorizes:

- Disclosure Authorization Agreement

- Debit Authorization Agreement

- Authority to Execute an Authorization

Disclosure Authorization Agreement

This is a third-party authorization to allow your contact person (designated in Item 5) and your financial institution to:

- Receive confidential information that is required for EFTPS enrollment

- Process electronic tax payments

- Answer questions and resolve issues related to enrollment and online payments

This confidential information may include:

- Passwords

- Payment instructions

- Taxpayer name and identifying number

- Payment transaction details

This authorization remains in effect until the taxpayer provides written notification to the U.S. Department of the Treasury that this authorization is terminated.

Debit Authorization Agreement

The following agreement authorizes the federal government to debit your bank account, listed in Items 9-11, for federal tax deposits. Any electronic debits will comply with federal law and Treasury Department regulations (final regulations).

This authorization also remains in effect until the taxpayer provides written notification to the U.S. Department of the Treasury that this authorization is terminated.

Authority to Execute an Authorization

The final authorization certifies that the person signing this form on behalf of the taxpayer has the authority to do so.

The signer is stating that if he or she is not the taxpayer, then the taxpayer has delegated authority in writing, which can be done on one of the following:

- IRS Form 2848, Power of Attorney and Declaration of Representative, or

- IRS Form 8655, Reporting Agent Authorization

Assuming that you’ll fine with these authorization agreements, let’s proceed to the signature portion.

Item 13: Taxpayer signature

The taxpayer must sign Item 13 to authorize EFTPS participation. Without a signature, EFTPS Customer Service will return this form.

This section also provides authorization to share the information provided with your financial institution(s) required for EFTPS processing. If signed on behalf of the taxpayer, the signer certifies authority to execute this authorization.

How to file IRS Form 9779

Mail the completed form to:

EFTPS Enrollment Processing Center

P.O. Box 173788, Denver, CO 80217-3788

Video walkthrough

Frequently asked questions

IRS Form 9779, Electronic Federal Tax Payment System Business Enrollment, allows businesses to enroll in EFTPS, the federal government’s electronic tax payment system. Although EFTPS enrollment is voluntary, businesses must pay federal taxes electronically.

Use of the Electronic Federal Tax Payment System, or EFTPS is optional. Although individual taxpayers may pay by check or money order, businesses must make federal tax payments electronically.

Where can I find IRS Form 9779?

You can find the latest versions of IRS forms on the Internal Revenue Service website. For your convenience, we’ve included the latest version of IRS Form 9779 in this article, as a PDF file.