IRS Form W-2G Instructions

If you won a significant amount from gambling activities, you might receive IRS Form W-2G, Certain Gambling Winnings, at the end of the tax year.

In this article, we’ll walk you through everything you need to know about this tax form, including:

- How to understand your IRS Form W-2G

- How to report your gambling income on your tax return

- When you can and cannot deduct gambling losses

- Other frequently asked questions

Let’s start with a basic rundown of IRS Form W-2G.

Table of contents

IRS Form W-2G Instructions

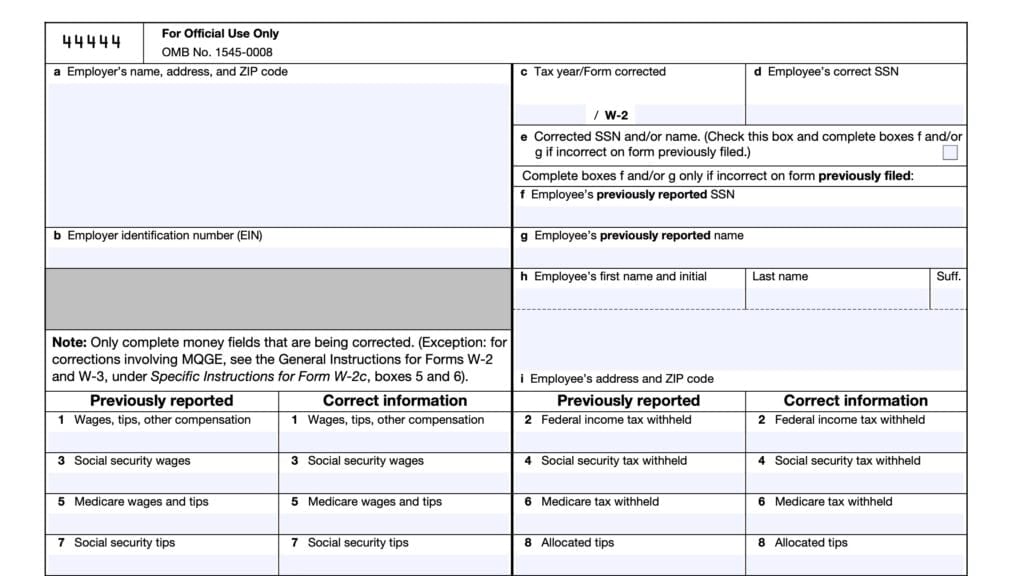

In most of our articles, we walk you through how to complete the tax form. However, since IRS Form W-2G is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their Forms W-2G, instead of how to complete them.

Before we start breaking down this tax form, it’s important to understand that there can be up to 6 copies of IRS Form W-2G. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy 1: For state, city, or local tax department

- Copy B: To be reported on the winner’s income tax return

- Copy C: To be retained by the winner

- Copy 2: To be filed with employee’s state, city, or local tax return

- Copy D: For the payer

For recipients who do not pay state, city, or local income tax, copies 1 and 2 are optional.

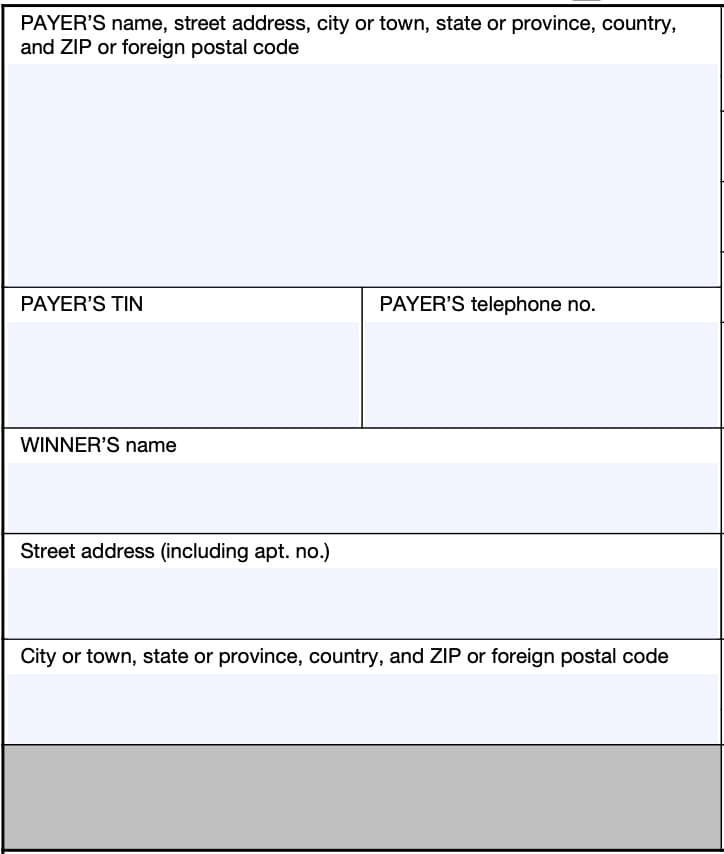

Let’s get into the form itself, starting with the information fields on the left side of the form.

Taxpayer identification fields

Payer’s Name, Address, And Telephone Number

You should see the payer’s complete business name and address in this field.

Payer’s TIN

You should see the complete employer identification number (EIN) in this field.

Payer’s telephone number

The payer’s phone number should be listed in this part of the tax form.

Keep this for reference in case the total amount of the gambling winnings reported differs from the amount of your winnings in your records.

Winner’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the payer and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Payee’s TIN

As the recipient or payee, you should see your taxpayer identification number in this field. For payees, the TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which the filer will send to the Internal Revenue Service, should not appear truncated.

Let’s go to the right side of the tax form, where we’ll get a better understanding of the winnings and how they’re reported.

Winnings information for federal tax purposes

There are four different types of gambling covered in the IRS instructions for Form W-2G:

- Horse Racing, Dog Racing, Jai Alai, and Other Wagering Transactions Not Discussed Later

- Sweepstakes, Wagering Pools, and Lotteries

- Bingo, Keno, and Slot Machines

- Poker Tournaments

For each box, most tax information is fairly similar. However, we will identify key differences in reporting requirements based on the type of gambling involved

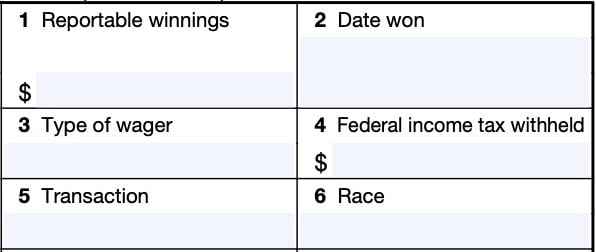

Box 1: Reportable winnings

The gambling establishment or payer will report the total amount of winnings in Box 1.

The IRS reporting requirement depends on the amount of the gambling winnings and the type of gambling activities being reported. Below is a breakdown of the IRS reporting requirements by gambling activity

Horse Racing, Dog Racing, Jai Alai, and Other Wagering Transactions Not Discussed Later

Your payer must report winnings of $600 or more if the payment was at least 300 times the amount of the wager.

Sweepstakes, Wagering Pools, and Lotteries

Your payer must report winnings of $600 or more if the payment was at least 300 times the amount of the wager. This includes charity events as well, as long as the winnings exceed 300 times the cost of the raffle tickets or charity drawings.

Bingo, Keno, and Slot Machines

For bingo and slot machines, gaming organizations must report winnings of $1,200 or greater. For keno, the threshold is $1,500.

Aggregate reporting method

Gambling establishments may use the optional aggregate reporting method to report these payments.

Under this method, the establishment can aggregate multiple payments of reportable gambling winnings from bingo, keno, or slot machines received by a payee in a 24-hour calendar day or

“gaming day” on a single Form W-2G.

A “gaming day” is a 24-hour period that ends at a particular time chosen by the gaming establishment. Generally, this ending time occurs when either:

- The establishment is closed, or

- Business is the slowest, such as early morning hours

On December 31, all open information reporting periods must close at 11:59 PM to end by the end of the calendar year. Then on January 1st, all information reporting periods begin at 12:00 AM.

Poker Tournaments

A gambling facility must report net gambling winnings of $5,000 or greater for poker tournaments.

Box 2: Date won

Box 2 will contain the date of the winning event. This may not be the date that you received gambling winnings.

Box 3: Type of wager

You should see the type of wager listed here.

For horse races, you might not see anything for a regular race be. But you might see special wagers listed, such as Daily Double or Big Triple.

For sweepstakes, betting pools and lotteries, you might see the following:

- Type of wager

- Name of lottery

- Price of wager

For bingo, slot machines, keno, or poker tournaments, you should simply see the type of betting activity (i.e. ‘poker tournament’).

Box 4: Federal income tax withheld

You’ll see federal income tax withholding reported in Box 4. Generally, the amount of federal income taxes withheld should be zero unless regular gambling withholding or backup withholding rules apply.

Below is a brief description of both types of withholding.

Regular gambling withholding

Under Internal Revenue Code Section 3402(q), the regular gambling withholding rate is 24% of net winnings (applies after the cost of the wager).

The regular withholding rate applies to:

- Horse racing

- Dog racing

- Jai alai

- Sweepstakes

- Wagering pools

- Lotteries

- Other wagering transactions not otherwise discussed.

Regular gambling withholding does not apply to the following events:

- Bingo

- Keno

- Slot machines

- Poker tournaments

Backup withholding

Backup withholding rules apply in a situation where the winner does not give a proper taxpayer identification number (TIN) to the payer. A TIN can be either:

- Social Security number

- Individual taxpayer identification number (ITIN)

You may be asked to complete IRS Form W-9, Request for Taxpayer Identification Number and Certification. This will allow the payer to report the correct TIN to the Internal Revenue Service and avoid backup withholding for federal taxes.

Box 5: Transaction

If applicable, this box will contain either:

- Ticket number, card number, serial number, or other information to help identify the winning transaction, or

- Name of the tournament and the tournament’s sponsor.

Box 6: Race

Box 6 only applies to races or jai alai games. In this case, you should see the race or game applicable to the winning ticket.

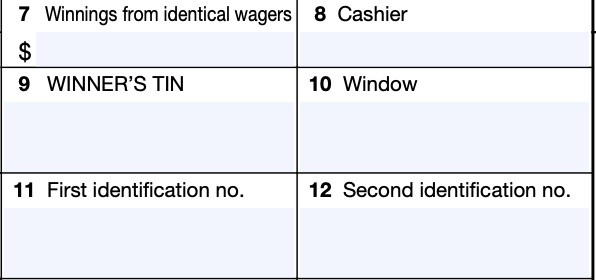

Box 7: Winnings from identical wagers

Box 7 contains winnings from identical wagers. This does not apply to:

- Bingo

- Keno

- Slot machines

- Poker tournaments

Identical wagers

Two or more wagers are considered to be identical wagers if:

- They are placed with the same payer, and

- Winning depends on the same occurrence or non-occurrence of the same event or events

- For horse races, dog races, or jai alai, wagers must also be placed in the same parimutuel pool to be considered identical wagers

An example of identical wagers would be multiple bets placed in a parimutuel pool with a single payer on the same horse to win a specific race.

Box 8: Cashier

Box 8 does not apply to:

- Sweepstakes

- Wagering pools

- Lotteries

- Poker tournaments

Otherwise, Box 8 will contain information about the cashier and/or the window number where the winning payment was made.

Box 9: Winner’s TIN

This should contain your taxpayer identification number or TIN. If you did not provide your TIN, then your winnings are subject to backup withholding rules.

Box 10: Window

Box 10 may contain information about the window where winnings are paid from. Does not apply to:

- Sweepstakes

- Wagering pools

- Lotteries

- Poker tournaments

Box 11: First identification number

As verification of the name, address, and TIN of the person receiving the winnings, your payer must enter the identification numbers from two forms of identification.

Acceptable forms of identification include:

- Driver’s license

- Passport

- Social Security card

- Military identification card

- Voter registration card

- Tribal member ID card issued by a federally recognized Indian tribe

- Completed and unmodified Form W-9

This information field should contain the ID number and the state or jurisdiction. This might be the same number found in Box 9.

One form of ID must include your photograph. However, gaming establishments owned or licensed by a tribal government may waive the photo ID requirement for payees who:

- Are members of that federally recognized Indian tribe, and

- Present a tribal member identification card issued by the same tribal government

Box 12: Second identification number

Box 12, if applicable, will contain the identification number from the second form of ID that you presented to receive your winnings.

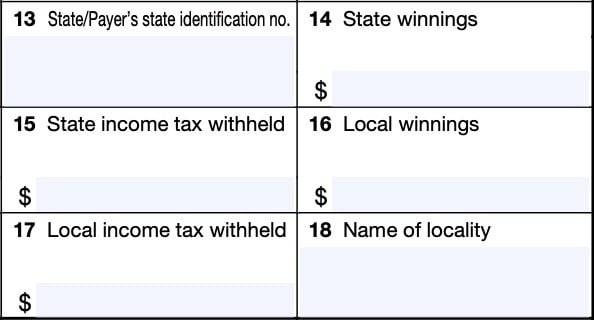

State and local tax information

Boxes 13 through 18 are optional fields for the payer’s convenience. Since the IRS does not require state and local tax information to be reported, some or all of these fields may be blank.

Box 13: State/Payer’s state identification number

The payer’s state-issued identification number will be listed in Box 13.

Box 14: State winnings

This box contains the amount of state winnings. However, the IRS instructions do not give any additional guidance on how this may differ from winnings reported at the federal level.

Box 15: State income tax withheld

If applicable, Box 15 contains state income taxes withheld, if applicable.

Box 16: Local winnings

Box 16 contains the amount of state winnings. However, the IRS instructions do not give any additional guidance on how this may differ from winnings reported at the federal level.

Box 17: Local income tax withheld

Contains the amount of local tax withholdings, if applicable.

Box 18: Name of locality

Contains the name of the locality where you received your winnings.

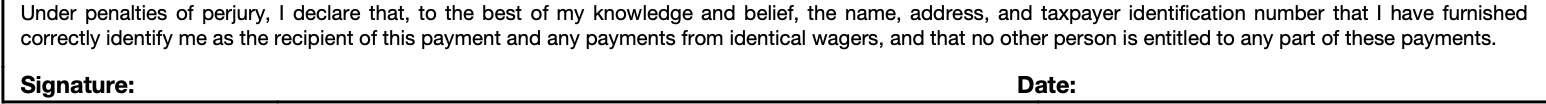

Signature

Unlike IRS Form W-2 that you receive from your employer, you must sign Form W-2G to affirm, under penalties of perjury, that you have provided sufficient information to identify yourself as the recipient of these winnings.

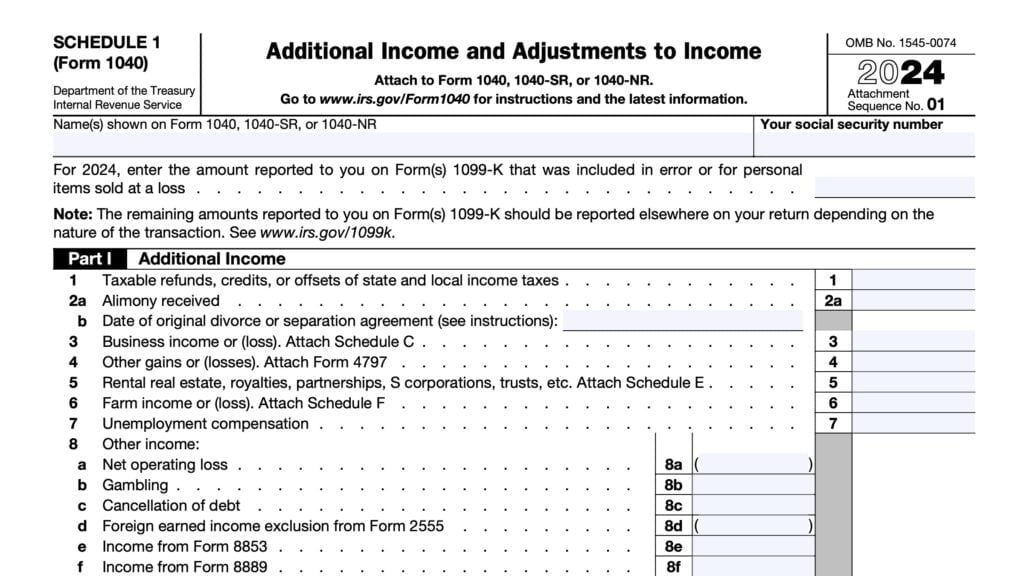

Reporting gambling income on your tax return

In general, taxpayers with gambling winnings should report all gambling winnings (including those not reported on Form W-2G) on Schedule 1 of their individual tax return.

Professional gamblers may be able to report income on Schedule C when filing their tax return, which may allow a greater amount of gambling-related tax deductions.

Deducting gambling losses

Taxpayers may deduct gambling losses on their tax return. However, there are several caveats.

Deductions from gambling losses cannot exceed reported gambling income

In other words, taxpayers cannot create an operating loss from gambling in order to generate a larger refund when filing their individual returns.

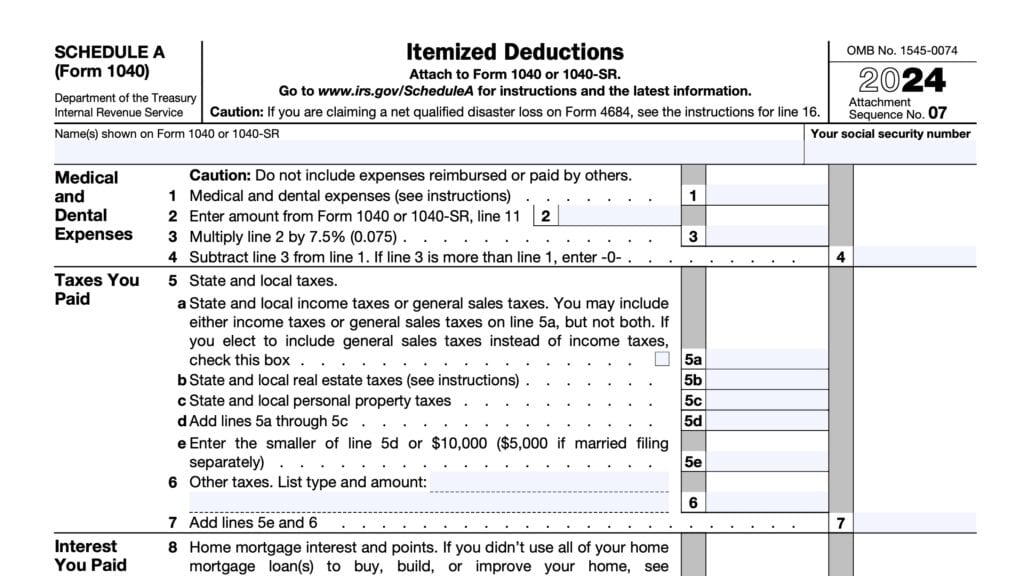

Most taxpayers must deduct gambling losses on Schedule A

To claim gambling losses as a tax deduction, most nonprofessional gamblers must file IRS Schedule A to itemize tax deductions on their tax return. Taxpayers who choose the standard deduction instead of the itemized deduction method generally will not see a tax benefit from their gambling losses.

Professsional gamblers may be able to deduct gambling losses on Schedule C. However, the Tax Cuts and Jobs Act has placed restrictions on the ability for professional gamblers to deduct non gambling expenses on their tax returns.

State income taxes are a completely different game

In the above scenario, a taxpayer may report $50,000 in gambling income and report up to $50,000 in gambling losses, if that actually happened.

For federal tax purposes, this might end up as a wash. However, for state tax purposes, not every state allows gambling losses as a tax deduction. In this situation, you could end up paying state income tax on your gambling income, even if you didn’t report a net profit to the IRS.

Keeping records is crucial

If you claim gambling expenses that are equal to or greater than your reported gambling income, then you should expect an IRS auditor to want to see records of those expenses.

They don’t have to be fancy or official, but they do need to document the dates, amounts, and types of wagers that you placed. Most professional gamblers understand this crucial step and do this.

Video walkthrough

Watch this instructional video to learn about your IRS Form W-2G!

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

No. You must report gambling winnings on Schedule 1 of your Form 1040 as additional income. If you itemize deductions, you may deduct gambling losses, up to the amount of your winnings, on Schedule A. If you take the standard deduction, you cannot deduct gambling losses.

IRS Form W-2G is used to report gambling winnings and withheld federal taxes to the Internal Revenue Service. The requirements to file Form W-2G depend on the type of gambling, the amount of the gambling winnings, and the ratio of the winnings to the wager.

Gambling establishments and other payers must give each winner Copies B and C of their IRS Form W-2G no later than January 31 of the year after winnings were paid. The due date for Copy A to be sent to the IRS is February 28.