IRS Form W-4P Instructions

If you’ve just started receiving a pension or annuity payments, your payer might ask you to complete IRS Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments.

In this article, we’ll walk through everything you need to know about this tax form, including:

- How to understand and complete IRS Form W-4P

- Adjustments you can make based upon your income, deductions, or tax credits

- Frequently asked questions

Let’s start with a step by step review of IRS Form W-4P.

Table of contents

How do I complete IRS Form W-4P?

There are five steps to completing this W-4P form:

- Step 1: Enter Personal Information

- Step 2: Income From a Job and/or Multiple Pensions/Annuities (Including a Spouse’s Job/Pension/Annuity)

- Step 3: Claim Dependent and Other Credits

- Step 4: Other Adjustments

- Step 5: Sign Here

Let’s walk through each step, one at a time.

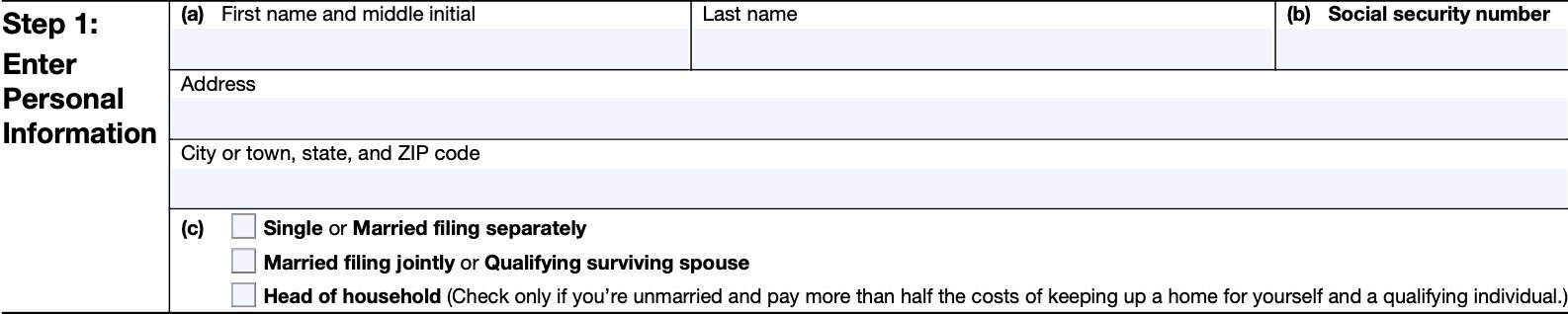

Step 1: Enter Personal Information

In this first step, you’ll enter your personal information.

Step 1(a)

Enter the following information

- First name & initial

- Last name

- Mailing address, including city, state, and zip code

Step 1(b)

Enter your Social Security number (SSN) as it appears on your Social Security card. If, for some reason, the name on your Social Security card doesn’t match your name, then you should check your earnings history with the Social Security Administration to make sure you’re receiving the appropriate credit for your Social Security withholding.

If you’re missing your Social Security card, you can request a new copy by filing Form SS-5, Application for Social Security Card.

Step 1(c)

Check the correct marital status. You can choose between:

- Single or married filing separately

- Married filing jointly or qualifying surviving spouse

- Head of household

- Only available if you are unmarried and you pay more than 50% of the costs to maintain a home for yourself and a qualifying individual

According to the form instructions, your selected marital status will be used to determine:

- Your standard deduction, and

- Tax rates used to calculate your tax withholding

Standard deductions for tax year 2025 are listed below.

2025 Standard Deductions

According to the IRS, below are the 2025 standard deductions by tax filing status:

| Filing status | Standard deduction amount |

| Single | $15,000 |

| Married filing separately | $15,000 |

| Married filing jointly | $30,000 |

| Head of household | $22,500 |

Step 2: Income From a Job and/or Multiple Pensions/Annuities (Including a Spouse’s Job/Pension/Annuity)

The form instructions state that for Steps 2-4, you should only complete the ones that apply to your tax situation.

Specifically, this means that you should only complete Step 2 if:

- You have income from a job

- If you have more than one pension or annuity

- You are married filing a joint tax return, and both spouses receive income, either from a job, pension, or annuity payments

In this situation, you have the choice between one of 2 federal income tax withholding methods:

- Use the IRS tax withholding estimator to calculate your federal income tax withholding, or

- Complete the steps outlined in Step 2

Let’s evaluate each option a little more closely, starting with the tax estimator tool.

Use The Tax Estimator On The IRS Website

You can use the online tax estimator, located on the IRS website, to help calculate your tax withholding, which will also help you with Steps 3 & 4, below.

The form instructions state that this is the most accurate withholding method of the options available to you, particularly if you have self-employment income.

Below is an instructional YouTube video on how to use the online tax withholding tool.

Complete the steps outlined in Step 2

If the online withholding tool isn’t for you, then you might be able to simply complete the items in Step 2, then move on. Here’s how.

Step 2(b)(i)

If you and/or your spouse have one or more jobs, then you should enter the following information in Step 2(b)(i):

- Total taxable annual pay from all jobs, plus

- Income reported on IRS Form W-4, Step 4(a), minus

- Deductions entered on Form W-4, Step 4(b) for the jobs

Otherwise, enter ‘0.’

Step 2(b)(ii)

If you and/or your spouse have other pensions or annuities that pay less than this one, then enter the total annual taxable payments from all lower-paying pensions & annuities.

Otherwise, enter ‘0.’

Step 2(b)(iii)

Add Steps 2(b)(i) and 2(b)(ii) and enter the total here.

Tax tip

Because of the Tax Cuts and Jobs Act, the IRS has dramatically redesigned IRS Forms W-4 and Forms W-4P. The IRS has also created new withholding rules which have refined federal income tax withholding methods.

You may need to resubmit Form W-4 and/or Form W-4P for more accurate withholdings.

Submit a new IRS Form W-4P if either of the following apply:

- You have not updated your tax withholding since 2021, or

- This is a new pension or annuity that pays less than the others

Submit a new Form W-4 for your job if you have not updated your tax withholding certificate since 2019.

Move on to Step 3 if:

- Step 2(b)(i) is blank, and

- This pension or annuity pays more than the others

Otherwise, skip down to Step 4c to determine any extra tax withholding you’d like to apply.

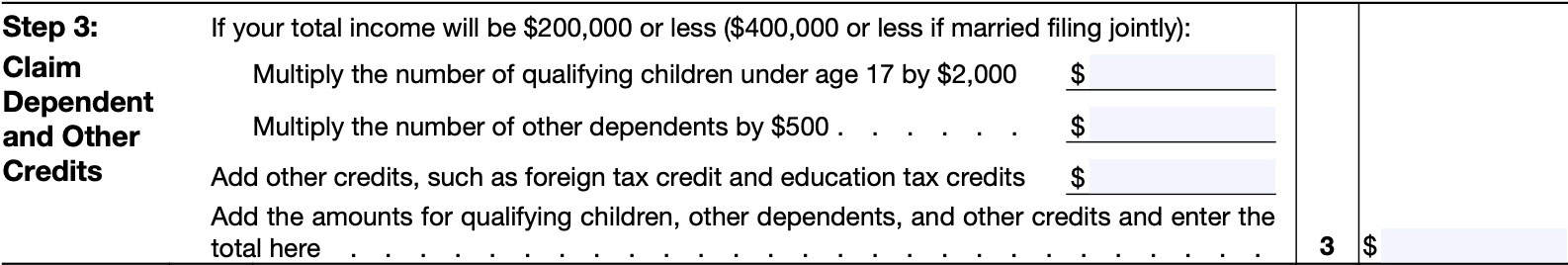

Step 3: Claim Dependent and Other Credits

The Internal Revenue Service suggests that you complete Steps 3-4(b) only if Step 2(b)(i) is blank and this is the highest periodic pension or annuity that you have.

You only need to complete Step 3 if you are eligible for the child tax credit or credit for other dependents on Schedule 8812.

Child Tax Credit Or Credit For Other Dependents

To qualify for the child tax credit, your child must:

- Be under age 17 as of December 31 of the current year

- Be your dependent who generally lives with you for more than half the tax year

- Have a Social Security number

You may be able to claim a tax credit for other dependents if you cannot claim the child tax credit. This could include an older child or a qualifying relative.

In Step 3, you’ll multiply the number of qualifying children by $2,000. Enter this amount in the top row.

Next, multiply the number of dependents that you can claim by $500. Enter the total in the next line.

Other tax credits

You can also enter other tax credits that you may be eligible for at the bottom of Step 3. Below is a partial list of tax credits that you may enter here, as well as the associated tax form:

- Foreign tax credit: IRS Form 1116

- Education credits: IRS Form 8863

- Residential energy credits: IRS Form 5695

You can find a more comprehensive list of available tax credits on Schedule 3, Additional Credits & Payments.

Finally, add the total amount of tax credits (including any other tax credits you may be eligible for) in Step 3.

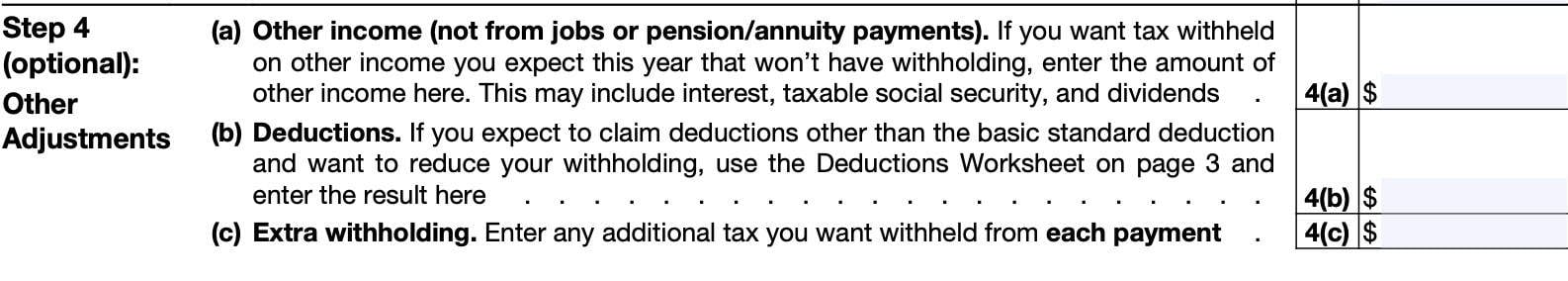

Step 4: Other Adjustments

Step 4 is optional, depending on whether your have other sources of income or tax deductions to consider, or if you simply want to elect extra withholdings. Let’s start with other income.

Step 4(a): Other income

If you have other sources of income that are not subject to tax withholding, you can include them here. Accounting for these other income sources can help you ensure the correct amount of federal income tax is being withheld for all income.

Examples of these other income sources can include:

- Nonperiodic distributions from an IRA or 401k, reported on IRS Form 1099-R

- Interest income reported on IRS Form 1099-INT

- Dividend income reported on IRS Form 1099-DIV

- Taxable Social Security payments

Step 4(a) is not required, but can help you with more accurate tax withholding.

Step 4(b): Deductions

If you expect to itemize tax deductions on IRS Schedule A, and you would like to reduce your tax withholding, then you should complete the Deductions Worksheet, located in the form instructions.

Let’s walk through this worksheet, step by step.

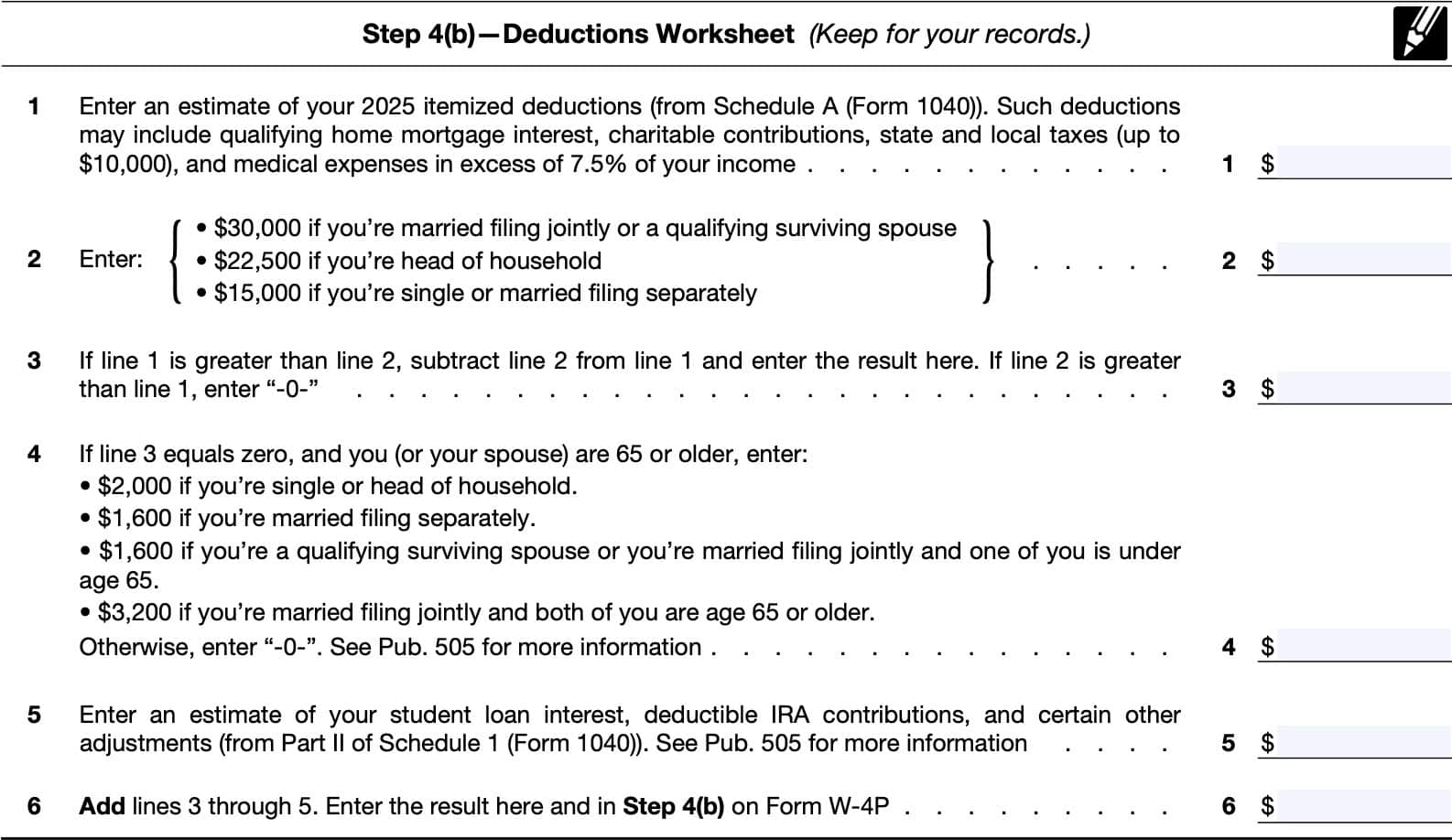

Step 4(b) Deductions Worksheet

Line 1

Enter your estimated itemized deductions. You may consider using estimates based on your Schedule A from last year. Deductions can include:

- Qualifying home mortgage interest

- Charitable contributions

- State and local taxes (up to a limit of $10,000 per year)

- Medical expenses (in excess of 7.5% of adjusted gross income)

Certain taxpayers may also be able to include casualty and theft losses from IRS Form 4684.

Line 2

In Line 2, enter one of the following, based on your filing status:

- Married filing jointly or qualifying surviving spouse: $30,000

- Head of household: $22,500

- Single or married filing separately: $15,000

Line 3

If Line 1 is greater than Line 2, then subtract Line 2 from Line 1 and enter the difference.

Otherwise, enter ‘0.’

Line 4

If Line 3 equals zero (your standard deduction is greater than your itemized deductions), and you or your spouse are 65 or order, then enter:

- $2,000 if you are single or head of household

- $1,600 if you are married filing separately

- $1,600 if you are:

- A qualifying surviving spouse, or

- If you are married filing a joint return and one of you is under age 65

- $3,200 if you are married filing a joint return and both spouses are age 65 or older

Line 5

Enter an estimate of any income adjustments from Schedule 1 on your tax return. Below is a partial list of example tax deductions on Part II of Schedule 1:

- Deductible contributions to your individual retirement arrangement (IRA)

- Student loan interest, reported on IRS Form 1098-E

- Business expenses claimed on IRS Form 2106

- Health savings account deduction, from IRS Form 8889

- Moving expenses for members of the Armed Forces, from IRS Form 3903

- Deductible part of self-employment tax, as reported on Schedule SE

You may find additional information in IRS Publication 505, Tax Withholding and Estimated Tax.

Line 6

Add Lines 3 through 5. Enter the result in Step 4(b).

Step 4(c): Extra withholding

Enter the amount of federal income tax withholding that you calculated in Step 2 here. If you want to withhold additional federal taxes to avoid a big tax bill, you can increase this amount as you feel necessary.

Step 5: Sign Here

Sign in Step 5.

If you don’t sign this part of the form, then your employer cannot withhold the correct amount of federal income taxes.

Video walkthrough

Watch this instructional video to walk through IRS Form W-4P, step by step.

Do you have the correct withholding form?

If you’re reading this section, perhaps you’re not sure if you have the correct withholding form. Before you leave, here is a brief overview of the other tax withholding forms and their purpose.

IRS Form W-4, Employee’s Withholding Certificate

Taxpayers complete Form W-4, Employee’s Withholding Certificate, to give their employer instructions on the withholding of federal income tax from their earned income based on their available tax credits, deductions, and filing status.

Watch this instructional video to learn more about how IRS Form W-4 works.

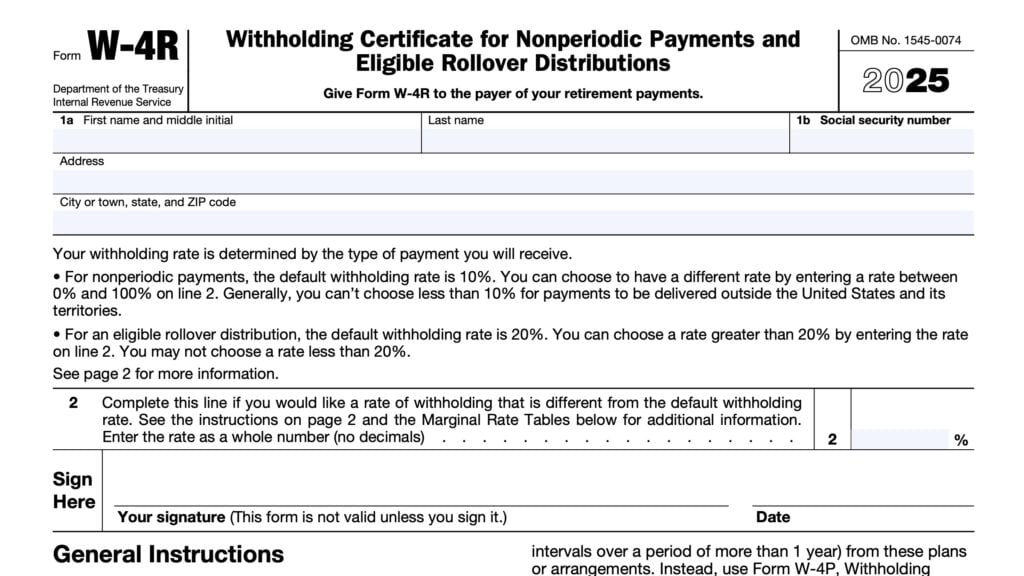

IRS Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions

Taxpayers who wish to give instruction on nonrecurring payments, such as one-time IRA withdrawals, or eligible rollovers, can complete Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollovers.

Watch this instructional video to learn more about how IRS Form W-4R works.

IRS Form W-4S, Request for Federal Income Tax Withholding from Sick Pay

Taxpayers who wish to have taxes withheld from sick pay issued by a third-party payer may complete IRS Form W-4S, Request for Federal Income Tax Withholding From Sick Pay.

For more detail on how IRS Form W-4S works, check out this video.

IRS Form W-4V, Voluntary Withholding Request

IRS Form W-4V, Voluntary Withholding Request, is the tax form that taxpayers may use to determine the amount of tax withheld from various government payments, such as:

- Social Security payments

- Tier 1 Railroad retirement benefits

- Unemployment benefits

- Payments from certain federal government benefit programs

Watch this video to learn more about how IRS Form W-4V works.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

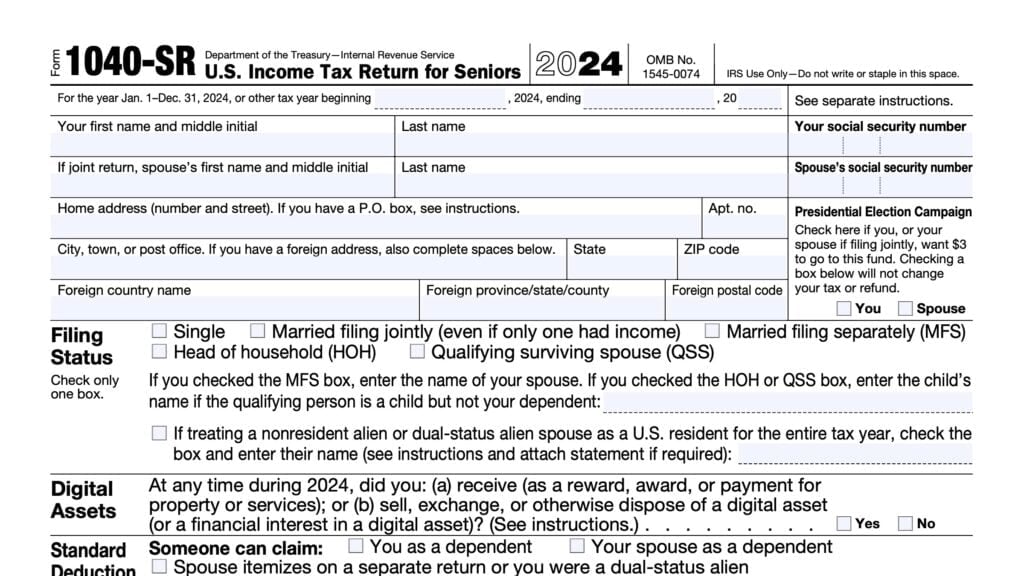

IRS Form W-4P is the tax form that taxpayers can complete to elect tax withholdings from periodic pension payments, annuity payments, or regular IRA distributions. For nonperiodic distributions, taxpayers may select IRS Form W-4R, instead.

If you don’t give Form W-4P to your payer, you don’t provide an SSN, or the IRS notifies the payer that you gave an incorrect SSN, then the payer will withhold tax from your monthly pension payment or annuity payments as if your filing status is single.