IRS Form W-4V Instructions

If you’ve recently started receiving government benefits, such as Social Security benefits or unemployment compensation, you may be asked to complete IRS Form W-4V, Voluntary Withholding Request.

In this article, we’ll walk you through everything you need to know about IRS Form W-4V, including:

- How to complete IRS Form W-4V

- Other withholding forms you may file instead of Form W-4V

- Frequently asked questions

Let’s start with a step by step walkthrough of this tax form.

Table of contents

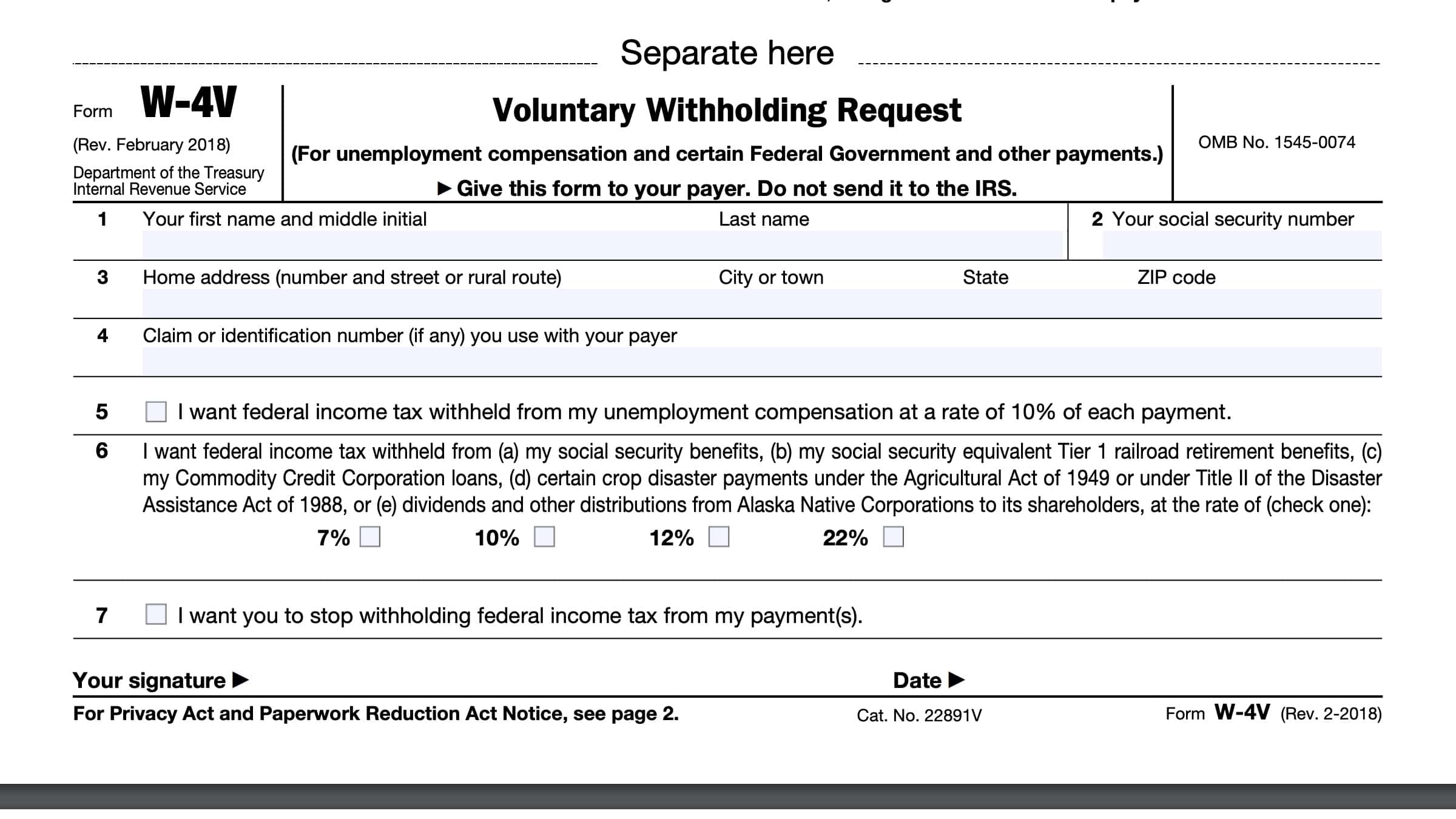

How do I complete IRS Form W-4V?

This one-page tax form is relatively straightforward. Let’s go through it one step at a time.

Line 1: Taxpayer name

Enter your complete name in Line 1, including:

- First name

- Middle initial

- Last name

Go to the next field.

Line 2: Social Security number

Enter your Social Security number (SSN) in this field.

Line 3: Home address

Enter your home address in Line 3, including city, state, and zip code. This should be the same address that is already in your tax records.

Helpful tip: If you changed your address since your most recent federal tax return, you may need to file IRS Form 8822, Change of Address to update your tax records with the Internal Revenue Service.

However, you do not need to do that before you submit Form W-4V, since this form will go to a different payer, such as the Social Security Administration or a state unemployment office. Just be sure to update your tax records in a timely manner to avoid any mishandled paperwork.

For taxpayers living outside the United States

If your address is outside the United States or the U.S. possessions, enter the following information on Line 3:

- City

- Province or state

- Country name

- Use the country’s practice for entering the postal code

- Spell out the country name. Do not abbreviate

Line 4: Claim number or identification number

Enter the claim or identification number you use with your payer.

For tax withholding Social Security benefits, the claim number is the Social Security number under which your claim was filed, or benefits were paid. In addition to the nine-digit SSN, the claim number contains a one or two-digit letter & number combination suffix.

Important information about Social Security claim numbers

If you do not know your claim number, you can contact the Social Security Administration by calling their toll-free number ((800) 772-1213) or by making an appointment at your local Social Security office.

The letter or letter/number suffix helps the SSA identify the type of Social Security benefit at hand. Below is a partial list of some of the more common suffix codes you can expect to see as part of a claim number.

| Code | Identification |

| A | Primary claimant (i.e. wage earner) |

| B | Wife, age 62 or older |

| B1 | Husband, age 62 or older |

| B2 | Wife under 62, with child in her care |

| B3 | Wife, age 62 or older, second claimant |

| B5 | Wife under 62, with child in her care, second claimant |

| B6 | Divorced wife, age 62 or older |

| BY | Husband under 62, with child in his care |

| C1-C9 | Child (includes minor, student, or disabled child) |

| D | Widow, age 60 or older |

| D1 | Widower, age 60 or older |

| D2 | Widow, age 60 or older (2nd claimant) |

| D3 | Widower, age 60 or older (2nd claimant) |

| D6 | Surviving divorced wife |

| E | Widowed mother |

| E1 | Surviving divorced mother |

| E4 | Widowed father |

| E5 | Surviving divorced father |

| F1 | Father |

| F2 | Mother |

| F3 | Stepfather |

| F4 | Stepmother |

| F5 | Adoptive father |

| F6 | Adoptive mother |

| HA | Disabled claimant (wage earner) |

| HB | Wife of disabled claimant, age 62 or older |

| W | Disabled widow |

| W1 | Disabled widower |

| W6 | Disabled surviving divorced wife |

For other government payments, you may need to consult your payer for the correct claim or identification number format.

Line 5

If you want federal tax withholdings to apply to your unemployment compensation, check the box in Line 5. This will instruct the payer to withhold 10% of your unemployment benefits for tax payments.

Line 6

Check one of the boxes in Line 6 if you want federal income tax withholding to apply to your monthly benefit from any of the following:

- Social Security benefits

- Social Security Tier 1 Railroad Retirement benefits

- Commodity Credit Corporation loans

- Certain crop disaster payments under either:

- The Agricultural Act of 1949, or

- Title II of the Disaster Assistance Act of 1988

- Dividends and other distributions from Alaska Native Corporations to shareholders

You will also need to determine the withholding amount from the options presented below:

- 7%

- 10%

- 12%

- 22%

According to the IRS instructions, you are not allowed to choose a withholding amount other than what is presented above. You also are not allowed to specify flat dollar amounts.

Line 7

Check the box in Line 7 if you do not want any withholding of federal income tax.

Signature

Be sure you sign the bottom of the form. Once finished, give your completed Form W-4V to your payer, whether it’s the Social Security Administration, federal government program, or state unemployment office.

Do not give your completed Form W-4V to the IRS.

What is IRS Form W-4V used for?

IRS Form W-4V, Voluntary Withholding Request, is the tax form that taxpayers may use to determine the amount of tax withheld from various government payments, such as:

- Social Security payments

- Tier 1 Railroad retirement benefits

- Unemployment benefits

- Payments from certain federal government benefit programs

Not sure if you have the correct tax withholding form? Here are other forms in the Form W-4 series that you may consider.

IRS Form W-4, Employee’s Withholding Certificate

Taxpayers complete Form W-4, Employee’s Withholding Certificate, to give their employer instructions on the withholding of federal income tax from their earned income based on their available tax credits, deductions, and filing status.

Watch this instructional video to learn more about how IRS Form W-4 works.

IRS Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments

Taxpayers complete IRS Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments to give their payer instructions on tax withholding for regular pension or annuity payments.

Watch this brief educational video to learn more IRS Form W-4P.

IRS Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollovers

Taxpayers who wish to give instruction on nonrecurring payments, such as one-time IRA withdrawals, or eligible rollovers, can complete Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollovers.

Watch this instructional video to learn more about how IRS Form W-4R works.

IRS Form W-4S, Request for Federal Income Tax Withholding from Sick Pay

Taxpayers who wish to have taxes withheld from sick pay issued by a third-party payer may complete IRS Form W-4S, Request for Federal Income Tax Withholding From Sick Pay.

For more detail on how IRS Form W-4S works, check out this video.

Video walkthrough

For more information on IRS Form W-4V, watch this instructional video.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

According to the SSA website, you may turn in your completed Form W-4V in person, by fax, or by mail, to the nearest Social Security office to where you live.

Taxpayers file IRS Form W-4V to withhold specified percentages from government benefits programs, such as Social Security or unemployment compensation. These withholdings are voluntary and can be revoked in writing at any time.

If you are receiving a payment other than unemployment compensation and want to change your withholding rate, complete a new Form W-4V. Give the new form to the payer.

If you want to stop withholding, complete a new Form W-4V. After you complete Lines 1 through 4, check the box on line 7, and sign and date the form. Give the new form to the payer.

Where can I find IRS Form W-4V?

As with most tax forms, you can download Form W-4V from the IRS website. For your convenience, we’ve attached the latest version of this IRS form here in this article.