IRS Schedule A Instructions

During tax time, individual taxpayers can choose to take a standard tax deduction, as determined by the Internal Revenue Service, or to itemize deductions, in order to lower their overall tax liability. If you choose to itemize deductions, you will need to use IRS Schedule A to calculate your total deductions.

In this article, we’ll walk through IRS Schedule A, including:

- How to complete Schedule A when filing your tax return

- How to determine whether to use the standard deduction or use Schedule A to report itemized deductions

- Video walkthroughs of each category of tax deductions

- Frequently asked questions about Schedule A

Let’s start with a step by step walkthrough of this tax form.

Table of contents

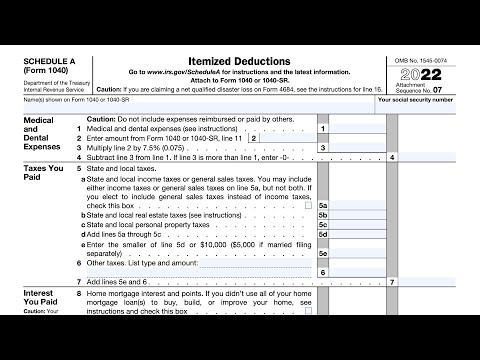

How do I complete IRS Schedule A?

Completing Schedule A is fairly straightforward, as long as you have your supporting documentation in order.

Before completing the schedule, you should have your records in order for quick reference. In each itemized deduction category, we’ll outline examples of records you may want to have available when completing this tax form.

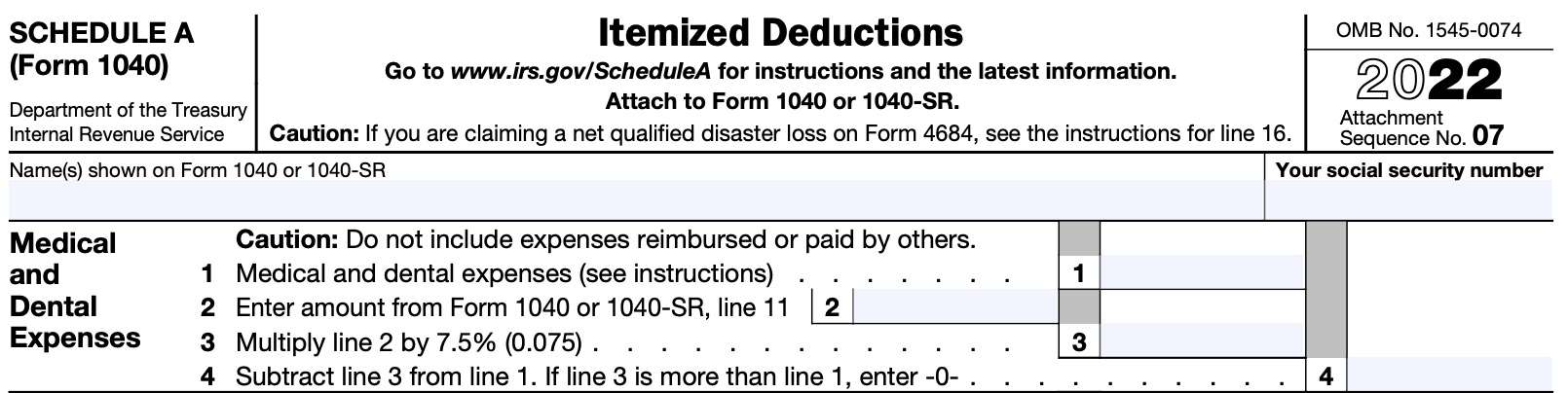

Medical and dental expenses

At the very top of the form, you should enter your taxpayer name (or names) as shown on your income tax return, followed by your Social Security number.

After completing the taxpayer information fields, we’ll enter medical and dental expenses.

Line 1: Medical and dental expenses

In Line 1, enter all eligible medical expenses or dental expenses you incurred during the tax year. A list containing examples of tax-deductible expenses is outlined below.

Eligible medical and dental expenses

Below is a list of eligible expenses, according to the form instructions:

- Insurance premiums for medical and dental care

- Must reduce this amount by any deductions you might have taken on IRS Schedule 1 for self-employed health care premiums

- Cannot include any premiums paid using pre-tax contributions

- Premiums for qualified long-term care insurance contracts as defined in IRS Publication 502, Medical and Dental Expenses

- Limitations apply; see note below

- Qualified long term care costs

- Prescription medications or insulin

- Medical provider appointments

- Medical exams, X-rays, and diagnostic testing

- Nursing care

- Hospitalizations

- Medicare Part B and Part D premiums

- Smoking cessation programs or prescriptions

- Weight-loss programs as treatment for a specific disease as diagnosed by a doctor

- Drug or alcohol addiction treatment

- Medical aids

- Eye surgery to improve vision

- Lodging expenses while away from home to receive medical care provided by a physician in a hospital or medical care facility related to a hospital

- Up to $50 per night for each qualifying individual

- Ambulance services

- Travel costs to receive medical care

- Breast pumps and lactation supplies

- Personal protective equipment to prevent the spread of coronavirus

Ineligible medical and dental expenses

The following is a list of expenses that you cannot deduct on IRS Schedule A:

- Cost of diet food

- Cosmetic surgery

- Unless it was necessary to improve a deformity related to:

- A congenital abnormality

- An injury from an accident or trauma, or

- A disfiguring disease

- Unless it was necessary to improve a deformity related to:

- Life insurance or income protection policies

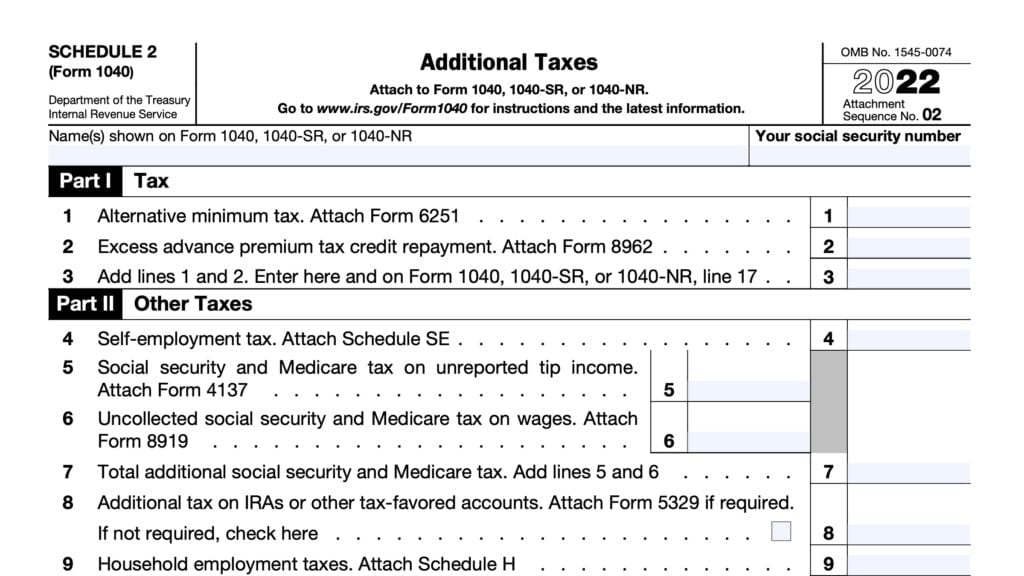

- The Medicare tax on your wages and tips or the Medicare tax paid as part of the self-employment tax or household employment taxes

- Nursing care for a healthy baby.

- You may be able to take a tax credit for the amount you paid for child care on IRS Form 2441.

- Illegal operations or drugs

- Imported drugs not approved by the U.S. Food and Drug Administration (FDA).

- This includes foreign-made versions of U.S.-approved drugs manufactured without FDA approval.

- Nonprescription medicines, other than insulin

- Includes over the counter nicotine gum and certain nicotine patches

- Travel your doctor told you to take for rest or a change.

- Funeral, burial, or cremation costs

For more detailed information about whether a medical or dental expense is tax deductible, see IRS Publication 502, Medical and Dental Expenses.

Line 2

In Line 2, enter the amount from Line 11 of your IRS Form 1040 or Form 1040-SR. This is your adjusted gross income, or AGI.

Line 3

Multiply the Line 2 amount by 7.5% (0.075). This represents the AGI floor for deductible medical and dental expenses. If your total expenses are less than this amount, you cannot deduct medical or dental expenses in the current tax year.

Line 4: Deductible medical and dental expenses

Subtract Line 3 from Line 1. The result is your deductible medical and dental expenses for the current year.

If the result is zero or negative, enter ‘0.’ You have no deductible medical or dental expenses for the tax year.

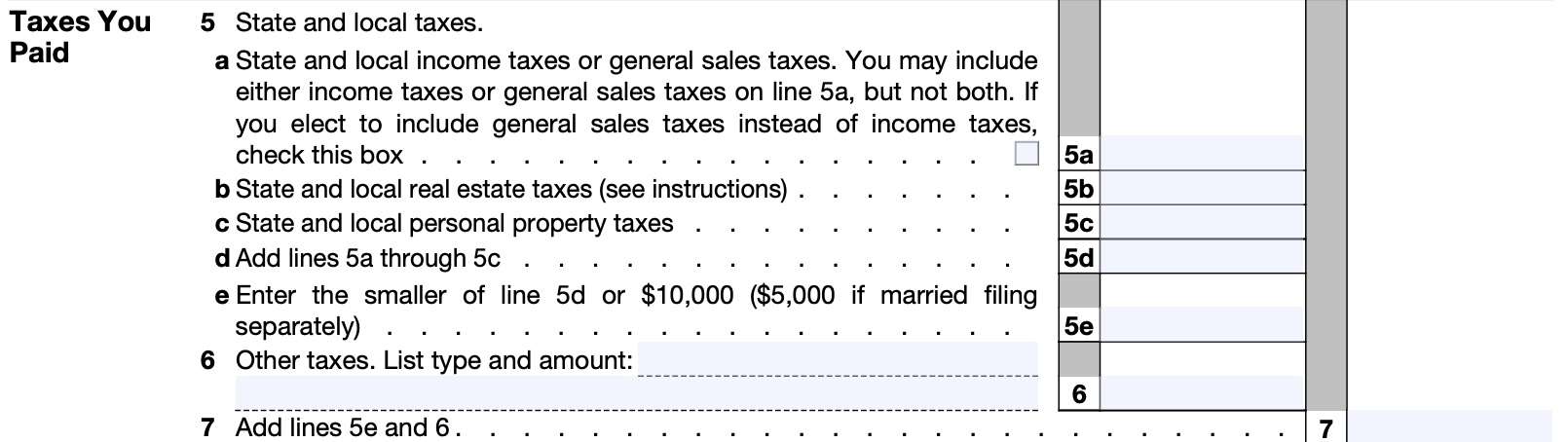

Taxes you paid

In this section, we’ll calculate the amount of taxes you have paid, which you can itemize as a deduction. Before we discuss taxes that you can include as an itemized deduction, we should first mention the taxes that are not deductible.

Taxes you cannot deduct

The following taxes are not deductible on IRS Schedule A:

- Federal income and most excise taxes

- Social security, Medicare, federal unemployment (FUTA), and railroad retirement (RRTA) taxes

- Customs duties

- Federal estate and gift taxes.

- See Line 16, other itemized deductions, if you had income in respect of a decedent

- Certain state and local taxes, including:

- Gasoline tax

- Car inspection fees

- Assessments for sidewalks or other improvements to your property

- Tax you paid for someone else

- License fees

- Foreign personal or real property taxes

Line 5: State and local taxes

State and local taxes constitute the largest deduction in this category. However, there are some limitations.

You may include income tax or sales tax, but not both

The Internal Revenue Code allows the state and local tax deduction of either state and local income tax, or state and local sales tax.

On IRS Schedule A, the default option is to use income taxes to calculate your state and local tax deduction. If you wish to use sales tax instead, you can choose to do so by checking the box in Line 5a.

For residents of states with no state income tax, this is a fairly easy decision. If you reside in a state with income and sales tax, you might have to decide on one or the other based upon:

- Which deduction is the bigger deduction in the tax year

- Which deduction requires additional work

- If both options exceed the annual deduction limits, you may choose the easier option

For residents who choose to deduct sales tax, then you may need to do a little extra work.

If you deduct sales tax, you must determine how to calculate the deduction

The Internal Revenue Service offers 3 options to calculate the state sales tax deduction:

- Actual expenses method

- State and Local General Sales Tax Deduction Worksheet, in conjunction with state and local sales tax tables in the form instructions

- IRS Sales Tax Calculator: Available on the IRS website

Check out our video on how to use the sales tax calculator on the IRS website to estimate your state and local general sales tax deduction.

Depending on your tax situation, there are pros and cons to each method.

Accuracy: The actual expenses method might be the most accurate option.

Convenience: The IRS Sales Tax Calculator offers taxpayers a more convenient solution for state sales taxes paid during the year. This is especially convenient for taxpayers who only kept receipts for large purchases.

You only need to have the following when you use the IRS website:

- Copy of your income statements, such as Form W-2

- Large receipts for specified purchases

- Record of your zip code (or zip codes) during the tax year

Bigger deduction: You may calculate a larger tax deduction using the tax tables and tax deduction worksheet. You can find further instructions in the IRS Schedule A instructions.

You can only deduct taxes in the year paid if it was also incurred in that year or earlier.

In other words, you cannot take a tax deduction for pre-paid taxes. For example, if you received an assessment for 2023 personal property tax, and you paid this tax in 2022, you cannot receive a tax deduction for the 2022 tax year. You can take the deduction for the 2023 tax year.

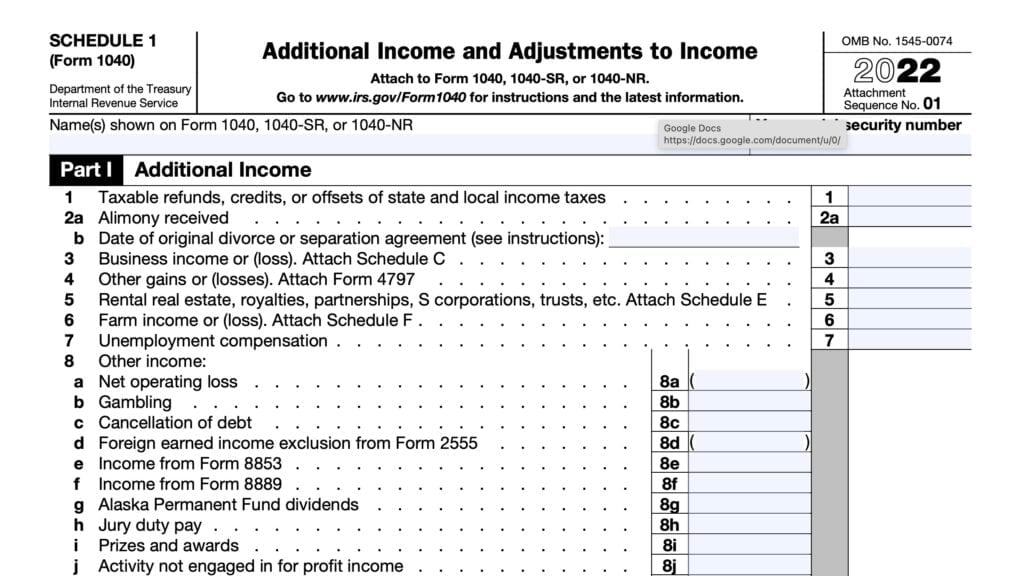

You may have to repay any tax refunds

If you received a refund for tax payments in the current tax year, you can simply reduce the amount of taxes claimed on IRS Schedule A by the amount of the refund.

But if you received a refund for tax payments that you previously deducted, you will probably have to report those tax refunds as additional income on IRS Schedule 1.

Finally, there is one last consideration.

There is a limit to the state and local tax deduction

The Tax Cuts and Jobs Act of 2017 (TCJA) created a specific limitation on the deductibility of state and local taxes on your federal income tax return.

Regardless of whether you choose income tax or sales tax, this limitation is $10,000 per household, per year ($5,000 for married taxpayers filing separately).

Line 5a: State and local income taxes or general sales taxes

Regardless of method used, enter the total amount of state and local income tax or state and local general sales tax that you paid in the year. If you choose to include sales taxes, you must check the box in Line 5a.

Line 5b: State and local real estate taxes

On this line, enter the state and local taxes you paid on real estate you own that wasn’t used for business. However, only include taxes if they are:

- Assessed uniformly at a like rate on all real property in the community, and

- Proceeds are used for general community or governmental purposes

Do not enter any of the following:

- Foreign taxes you paid on real estate

- Itemized charges for services to specific property or persons

- Monthly charge per house for tax collection

- Charges for water usage

- Charges for improvements that tend to increase property value

- Charges for maintenance, such as sidewalk repair, are deductible

Because of these reasons, community development district fees (CDD fees) are not deductible on IRS Schedule A.

Line 5c: State and local personal property taxes

In Line 5c, enter the state and local personal property taxes you paid, but only if the taxes were:

- Based solely upon property value

- Imposed on an annual basis

For example, let’s imagine you paid the annual vehicle registration fee for your car. In your state, part of the fee is based on the car’s value and part is based on its weight.

You can deduct only the part of the fee that was based on the car’s value.

Line 5d

Add Lines 5a through 5c. Enter the result here.

Line 5e: Total state and local tax deduction

In Line 5e, enter the smaller of the following:

- Line 5d

- $10,000

- $5,000 for a married couple filing a separate return

This represents your total state and local tax deduction.

Line 6: Other taxes

In Line 6, enter other taxes that are eligible for deduction. These taxes include:

- Income taxes you paid to a foreign country, and

- Generation skipping tax (GST) imposed on certain income distributions

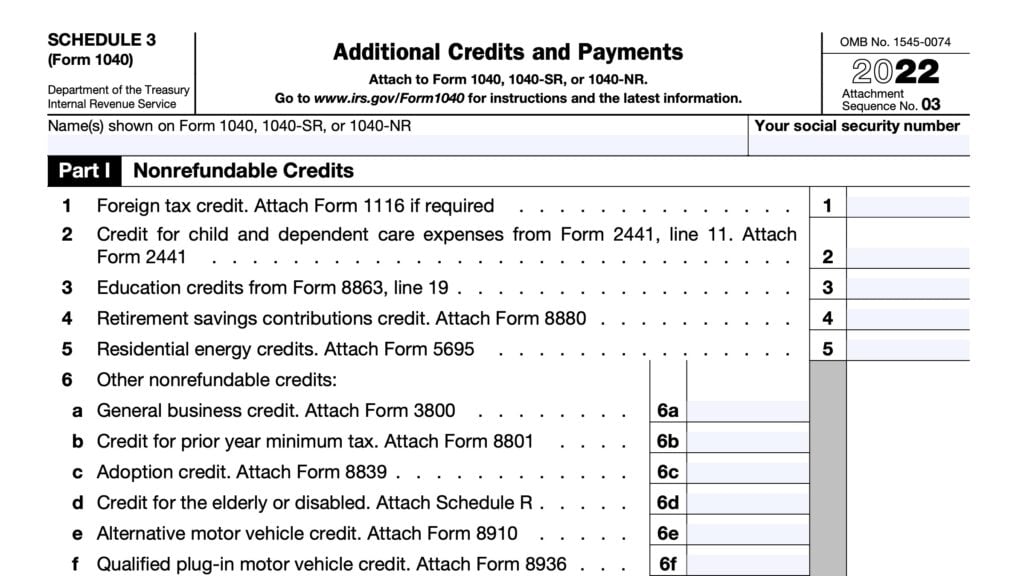

When considering income tax paid to another country, you may choose to take an income tax credit on IRS Schedule 3 instead of an itemized tax deduction.

Do not include the following taxes:

- Taxes paid to a U.S. possession

- Include these taxes on the appropriate state and local tax line

- Estate tax on income in respect of a decedent (IRD)

- Include this on Line 16, below

Line 7

Add Line 5e and Line 6. This represents the total taxes paid in the tax year.

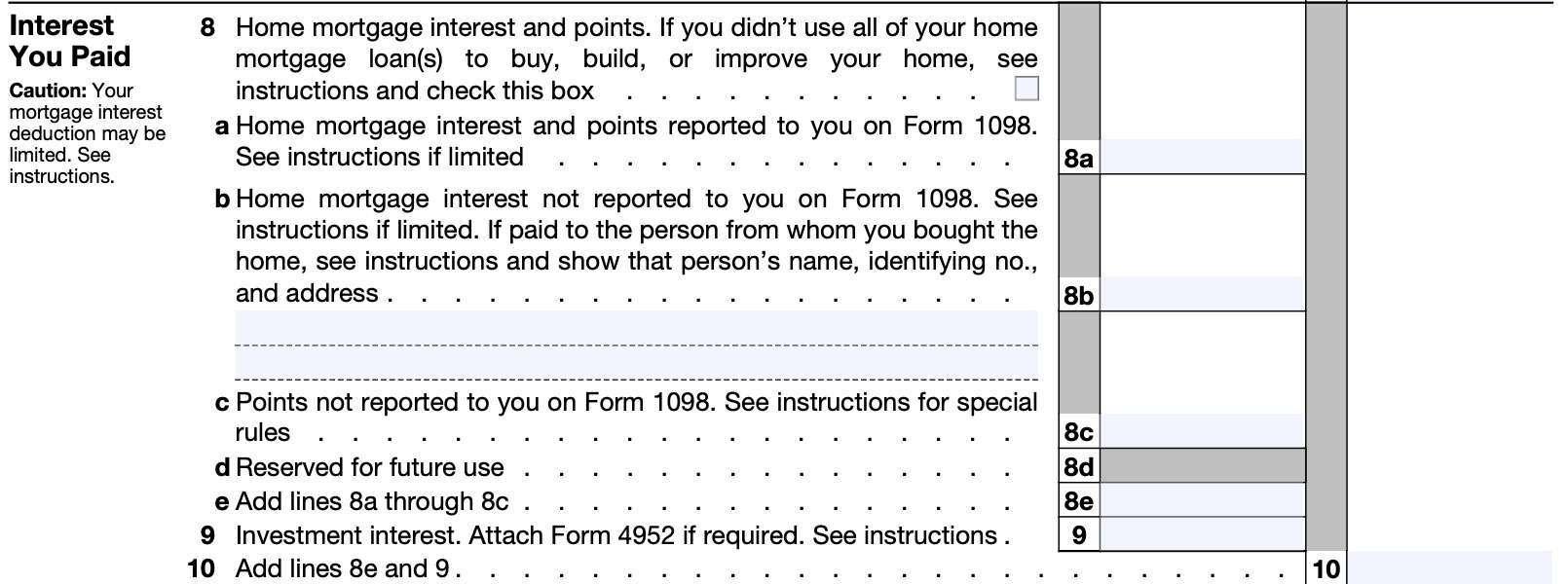

Interest you paid

In this section, we’ll calculate tax-deductible interest paid during the tax year. Let’s start with home mortgage interest on Line 8.

Line 8: Home mortgage interest and points

Before calculating home mortgage interest, there are a couple of important points.

First, you can only deduct mortgage interest to the extent that it was used to buy, build, or substantially improve your home. For example, if you took out a home equity line of credit to pay off an outstanding car loan, that mortgage interest is not deductible.

Second, you can deduct mortgage interest for a primary or second home. A home can be any of the following:

- House

- Condominium or townhome

- Cooperative

- Mobile home or manufactured home

- Boat or similar property

A home qualifies as long as it provides basic living accommodations to include sleeping space, toilet, and cooking facilities.

Next, a qualifying home mortgage can be any of the following:

- First mortgage or second mortgage

- Refinanced mortgages

- Home equity loans or home equity lines of credit

Finally, there are mortgage limits that apply, depending on when the mortgage closed.

For loans taken out on or before December 15, 2017, taxpayers may deduct mortgage interest on up to $1 million of mortgage debt ($500,000 for married individuals filing separate returns).

For loans taken out after December 15, 2017, taxpayers may deduct mortgage interest on up to $750,000 of mortgage debt ($375,000 for married individuals filing separate tax returns).

Line 8a: Home mortgage interest and points reported on Form 1098

In Line 8a, enter the home mortgage interest and mortgage points that the lender reported to you on IRS Form 1098. If there was more than one borrower (except for your spouse, when filing a joint income tax return), then you an only deduct your share of the annual mortgage interest.

If your actual mortgage interest paid was more than what was reported to you, enter the larger amount, then provide an explanation.

Line 8b: Home mortgage interest not reported to you on Form 1098

If you paid home mortgage interest to a recipient who didn’t provide you a Form 1098, report your deductible mortgage interest on Line 8b.

If you paid home mortgage interest to the person from whom you bought the home (known as a seller-financed mortgage), and that person didn’t provide you a Form 1098, write the following information on the dotted lines next to Line 8b:

- Person’s name

- Identifying number

- Can be Social Security number (SSN) or employer identification number (EIN)

- Address

Line 8c: Points not reported to you on Form 1098

Enter any points not otherwise reported to you on Form 1098 into Line 8c.

Points you paid only to borrow money are generally deductible over the life of the loan. As a general rule, points you paid for other services are not deductible.

If you refinanced your mortgage, points you paid to refinance are still deductible over the life of the loan. However, if you made substantial improvements to your home, you may be able to deduct part of the points attributable to the improvements in the year you made the improvements.

Line 8d: Reserved for future use

Do not use.

Line 8e: Total home mortgage interest

Add Lines 8a through 8c. Enter the total in Line 8e.

Line 9: Investment interest

Investment interest is interest paid on money you borrowed that is allocable to property held for investment. Investment interest doesn’t include any interest allocable to either:

- Passive activities, or

- Securities that generate tax-exempt income

If applicable, attach a copy of your completed IRS Form 4952 to your tax return. You may not need to use Form 4952 if:

- Your investment interest expense is less than your investment income from interest and ordinary dividends, minus qualified dividends

- You have no other deductible investment expenses

- You have no disallowed investment interest expense from the prior year

The IRS does not consider Alaska Permanent Fund dividends to be investment income. This includes dividends reported on IRS Form 8814.

Line 10: Total interest expense

Add Line 8e and Line 9. Enter the total here.

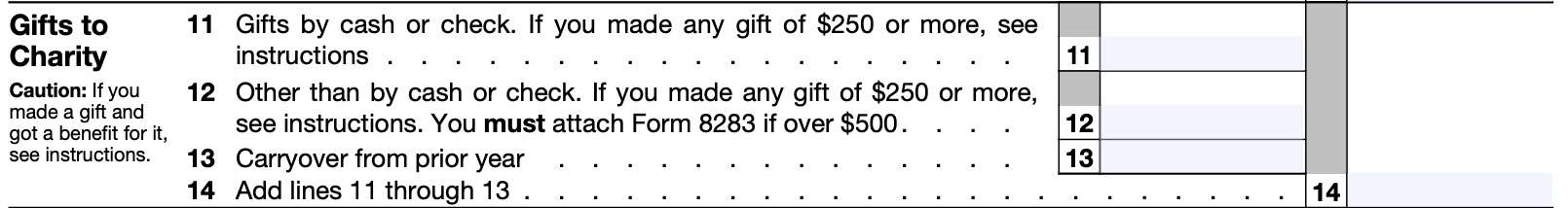

Gifts to charity

The federal government allows taxpayers to deduct certain charitable contributions from their overall tax liability. Taxpayers can deduct contributions or gifts to organizations that have the following purposes:

- Religious

- Charitable

- Educational

- Scientific

- Literary

You can verify an organization’s charitable status with the organization itself, or by using the IRS’ online search tool to determine if the organization is eligible to receive tax-deductible contributions.

However, your charitable donations are subject to certain limitations, based upon your tax situation.

Limits on tax deductions for charitable contributions

You may need to use IRS Publication 526, Charitable Contributions, to calculate your tax deduction if any of the following conditions apply:

- Your cash contributions or contributions of ordinary income property are more than 30% of your adjusted gross income, as reflected on Line 11 of your Form 1040 or Form 1040-SR

- Your gifts of capital gain property are more than 20% of your adjusted gross income

- You gave gifts of property that increased in value or gave gifts of the use of property

Non-deductible contributions

Also, there are certain charitable contributions that you cannot deduct. These include:

- Certain contributions to charitable organizations, to the extent that you receive a state or local tax credit in return for your contribution

- An amount paid to or for the benefit of a college or university in exchange for the right to purchase tickets to an athletic event in the college or university’s stadium.

- Travel expenses for charitable work (unless you can verify that there was no personal pleasure or recreation involved)

- Political contributions

- Dues, fees, or bills paid to country clubs, lodges, fraternal orders, or similar groups

- Cost of raffle, bingo, or lottery tickets.

- May be deductible under gambling losses on Line 16

- Value of your time or services

- Value of blood given to a blood bank

- The transfer of a future interest in tangible personal property.

- Generally, no deduction is allowed until the entire interest has been transferred

- Gifts to individuals and groups that are operated for personal profit.

- Gifts to foreign organizations

- Gifts to organizations engaged in certain political activities that are of direct financial interest to your trade or business

- Gifts to groups whose purpose is to lobby for changes in the laws

- Gifts to civic leagues, social and sports clubs, labor unions, and chambers of commerce.

- Value of benefits received in connection with a contribution to a charitable organization.

- IRS Publication 526, Charitable Contributions contains certain for exceptions

- Cost of tuition

- May be able to take an education tax credit on IRS Form 8863

Line 11: Gifts by cash or check

Enter the total amount of charitable contributions that you made by check or cash.

If you made a gift of $250 or more to any single organization, that organization must provide you with a contemporaneous written acknowledgement, or a receipt. This written acknowledgement must:

- Contain the amount of any money contributed and a description of any donated property,

- Indicate whether the organization did or didn’t give you any goods or services in return for your contribution

- Be provided before you file your individual income tax return, or by the tax return’s due date (including extensions)

This requirement does not apply to multiple contributions to the same organization that total more than $250. For example, a taxpayer who tithes $50 per week to his religious organization does not need to obtain a contemporaneous written acknowledgement for his donations.

Line 12: Donations other than by cash or check

If you made non-cash donations, enter the total amount of those donations in Line 12.

If you made a gift of $250 or more to an organization, you must obtain a contemporaneous written receipt.

For donations of $500 or more, you must also complete Form 8283, Noncash Charitable Contributions, and attach your completed form to your tax return.

If you donated a motor vehicle, aircraft, or boat and deducted more than $500, you must attach a statement from the charitable organization to your tax return. The charitable organization may choose to issue IRS Form 1098-C to provide the required information about your vehicle contribution.

For donations of $5,000 or more, you may also need to obtain a qualified appraisal to accompany your Form 8283.

Line 13: Carryover from prior year

If you have charitable contributions that you could not deduct in an earlier tax year due to deductibility limits, enter the amount in Line 13, after applying any limitations.

Generally, you have 5 years to use contributions that were subject to limitations in a prior tax year. Carryover amounts from 2020 or 2021 contributions are subject to a 60% limitation if you deduct them in a future tax year.

Line 14: Total charitable donations

Add Lines 11 through 13, then enter the total here. This represents your tax deductions for charitable contributions.

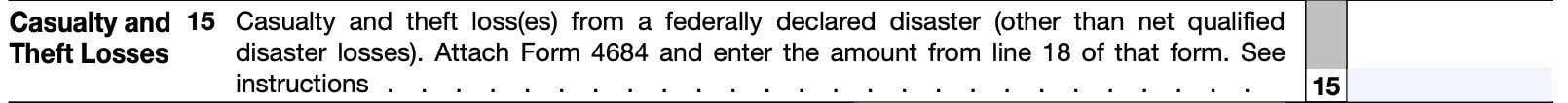

Casualty and theft losses

Generally speaking, you can only itemize casualty and theft losses to the extent that:

- Each casualty or theft loss is more than $100, and

- The total amount of all losses (after the $100 limit) exceeds 10% of your adjusted gross income, as reported on Line 11 of your Form 1040

Line 15

Enter any casualty and theft losses from a federally declared disaster in Line 15. You must complete IRS Form 4684 to calculate your casualty and theft loss(es).

Enter the amount from Line 18 of your completed Form 4684.

Do not enter net qualified disaster losses, as determined on Line 15 of that form. Instead, see the instructions for Line 16, below.

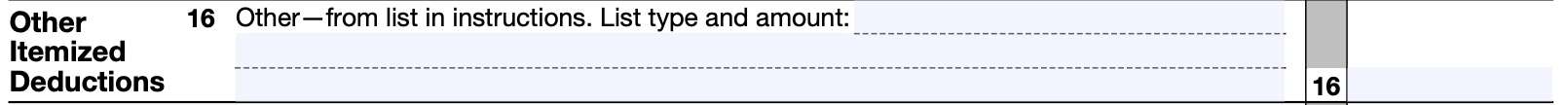

Other itemized deductions

Other itemized deductions that do not belong in another category will go on Line 16, below. This includes the following:

- Gambling losses, only to the extent of gambling winnings reported on IRS Schedule 1, Line 8b

- May include cost of non-winning bingo, lottery, and raffle tickets

- Casualty and theft losses of income-producing property from either of the following:

- IRS Form 4684, Lines 32 and 38b, or

- IRS Form 4797, Sales of Business Property, Line 18a

- Federal estate tax on income in respect of a decedent.

- A deduction for amortizable bond premium

- An ordinary loss attributable to a contingent payment debt instrument or an inflation-indexed debt instrument

- For example, a Treasury Inflation-Protected Security, or TIPS bond

- Deduction for repayment of amounts under a claim of right if over $3,000

- Certain unrecovered investment in a pension

- Impairment-related work expenses of a disabled person

IRS Publication 529, Miscellaneous Deductions, contains additional information.

Line 16

Enter other itemized deductions as outlined above.

Net Qualified Disaster Loss

If you are claiming the standard deduction, but choose to report a qualified casualty and theft loss from Line 15 of your Form 4684, you may do so by following these steps:

- List the amount from Line 15 of your completed Form 4684 on the dotted line next to Line 16

as “Net Qualified Disaster Loss.” Attach Form 4684. - List your standard deduction amount on the dotted line next to Line 16 as “Standard Deduction Claimed With Qualified Disaster Loss.”

- Combine the two amounts on Line 16, then enter the amount on Form 1040 or 1040-SR, Line 12

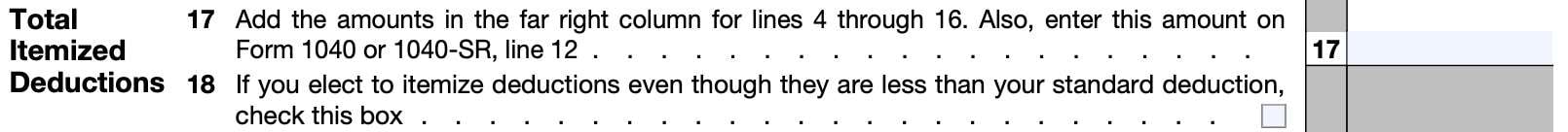

Total itemized deductions

Line 17

Add the following lines:

- Line 4: Medical and dental expenses

- Line 7: Taxes you paid

- Line 10: Interest you paid

- Line 14: Charitable contributions

- Line 16: Other itemized deductions

Line 18

Check this box only if you choose to itemize deductions, even if they are less than the standard deduction you are entitled to. Depending on where you live, you may choose to do this to obtain additional tax credits or other benefits available to you under state law.

Video walkthrough

Watch this instructional video for step by step guidance on completing IRS Schedule A.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

Taxpayers may choose between itemizing tax deductions or taking the standard deduction. The larger amount usually provides a greater federal tax benefit. When including state and local incentives, certain taxpayers may receive a larger overall benefit by itemizing deductions, even if the standard deduction is larger.

Individual taxpayers may itemize eligible medical and dental expenses, certain state and local taxes paid, qualified home mortgage and investment expenses, charitable contributions, qualified casualty and theft losses, and other itemized deductions specified by federal law.

For tax year 2022, the standard deduction was $12,950 for single filers and married taxpayers filing separately, $19,400 for heads of household, and $25,900 for married taxpayers filing a joint return.

For tax year 2023, the standard deduction is $13,850 for single filers and married taxpayers filing separately, $20,800 for heads of household, and $27,700 for married taxpayers filing a joint return.

Where can I find IRS Schedule A?

You can find IRS Schedule A on the IRS website. For your convenience, we’ve enclosed the most recent version in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!