Schedule 8812 Instructions

The federal government provides numerous tax breaks to parents raising children, in the form of tax credits. Some of the most important tax credits are child and dependent tax credits, which eligible taxpayers calculate on Schedule 8812 of their Form 1040, 1040-SR, or 1040-NR.

In this article, we’ll walk through Schedule 8812, including:

- How to complete this tax form and its accompanying worksheets, step by step

- Eligibility criteria

- Information about the child tax credit, additional child tax credit, and credit for other dependents

Let’s start with a step by step walkthrough of this IRS tax form.

Table of contents

How do I complete Schedule 8812?

There are 4 parts to this two-page schedule, which is a part of IRS Form 1040:

- Part I: Child Tax Credit & Credit for Other Dependents

- Part II-A: Additional Child Tax Credit for All Filers

- Part II-B: Certain Filers Who Have Three or More Qualifying Children and Bona Fide Residents of Puerto Rico

- Part II-C: Additional Child Tax Credit

Let’s go through each part in depth, starting with Part I.

Part I: Child Tax Credit and Credit for Other Dependents

In Part I, we’ll calculate the child tax credit and the credit for other dependents.

These are nonrefundable tax credits, which means that they can lower your tax liability to zero, but cannot create a tax refund.

Line 1: Adjusted gross income

In Line 1, enter the amount from Line 11 of your IRS Form 1040, 1040-SR, or 1040-NR. This is your adjusted gross income, or AGI.

Line 2

There are three separate parts to Line 2.

Line 2a: Excluded income from Puerto Rico

If you excluded income from Puerto Rico, enter this amount in Line 2a.

Line 2b: Excluded foreign income

If applicable, enter any amounts from Line 45 and Line 50 from IRS Form 2555, Foreign Earned Income.

If you filed IRS Form 2555, you cannot claim the additional child tax credit in Part II-A, below.

Line 2c: Excluded Income From American Samoa

If you excluded income from American Samoa on IRS Form 4563, include the excluded amount in Line 2c. You’ll find this number on Line 15 of Form 4563.

Line 2d: Total excluded income

In Line 2d, enter the sum of Lines 2a, 2b, and 2c.

Line 3

Add Line 1 and Line 2d. Enter the result in Line 3.

Line 4

Enter the number of qualifying children under age 17 with a Social Security number, as required.

This number should equal the number of boxes checked under ‘child tax credit’ in column (4) of the Dependents section on IRS Form 1040 or Form 1040-SR.

Line 5

Multiply the number in Line 4 by $2,000. Enter the result in Line 5.

Line 6: Other dependents

In Line 6, enter the number of other dependents you may have. This includes any qualifying children

- Who are not under age 17 or

- Who do not have a Social Security number

- Includes dependent children with an individual taxpayer identification number (ITIN)

This number should equal the number of boxes checked under ‘credit for other dependents’ in column (4) of the Dependents section on IRS Form 1040 or 1040-SR.

Do not include yourself, your spouse, or anyone who is not a U.S. citizen, U.S. national, or U.S. resident alien. Also, do not include anyone you included on Line 4, above.

Line 7

Multiply the Line 6 figure by $500. Enter the result in Line 7.

This represents the tax credit you might receive for other dependents.

Line 8

Add Line 5 and Line 7. Enter the result in Line 8.

Line 9

Enter one of the following amounts based on your tax filing status:

- Married taxpayers filing jointly: $400,000

- All other filing statuses: $200,000

Line 10

If the result is zero or a negative number, enter ‘0.’

If the result is a positive number, and not a multiple of $1,000, enter the next highest multiple of $1,000.

For example, if the result is $425, enter $1,000.

Line 11

Multiply the Line 10 amount by 5%. Enter the result in Line 11.

Line 12

Is the total credit amount in Line 8 greater than Line 11?

If no, then stop. You cannot take any of the following tax credits:

- Child tax credit

- Other dependent credit

- Additional child credit

Skip the rest of the tax form, and enter ‘0’ on the following lines:

If Line 8 is greater than Line 11, then subtract Line 11 from Line 8. Enter the result in Line 12.

Line 13

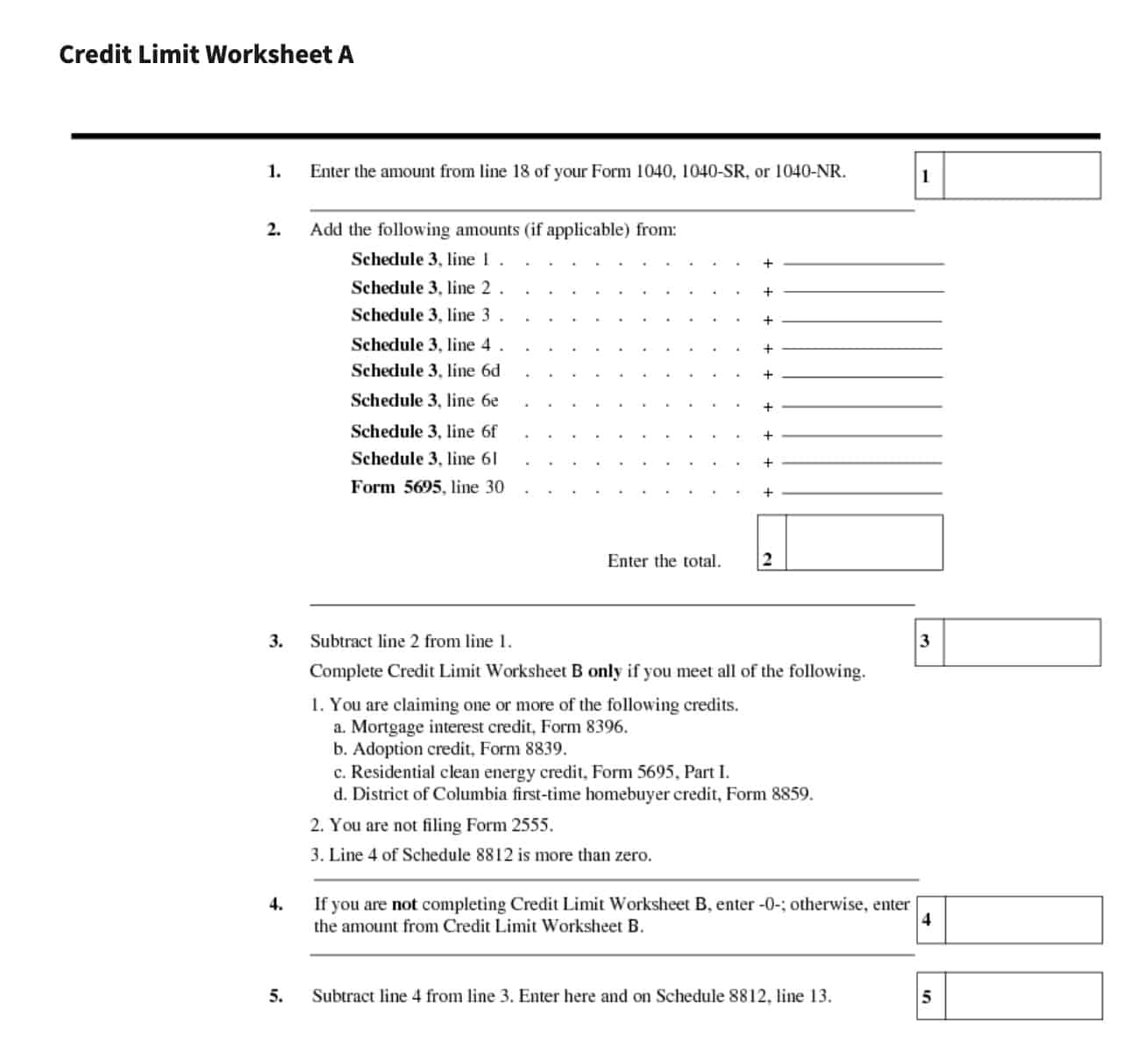

For Line 13, you will have to complete Credit Limit Worksheet A, from the Schedule 8812 instructions.

Additionally, you may have to complete Credit Limit Worksheet B, if you meet all of the following conditions:

- You are claiming one or more of the following credits:

- Mortgage interest credit on IRS Form 8396, Mortgage Interest Credit

- Adoption credit on IRS Form 8839, Qualified Adoption Expenses

- Residential clean energy credit on IRS Form 5695, Part I, Residential Energy Credits

- District of Columbia first-time homebuyer credit on IRS Form 8859

- You are not filing IRS Form 2555.

- Line 4 of Schedule 8812 is more than zero

- You have one or more qualifying children under age 17 with a valid SSN

Instructions for both credit limit worksheets are outlined in the worksheets section, below.

Line 14

Enter the smaller of:

This represents the child tax credit as well as the additional tax credit for other dependents. Both of these tax credits will directly reduce the amount of tax you pay when you file your federal income tax return.

Enter this amount on Line 19 of your Form 1040, Form 1040-NR, or Form 1040-SR.

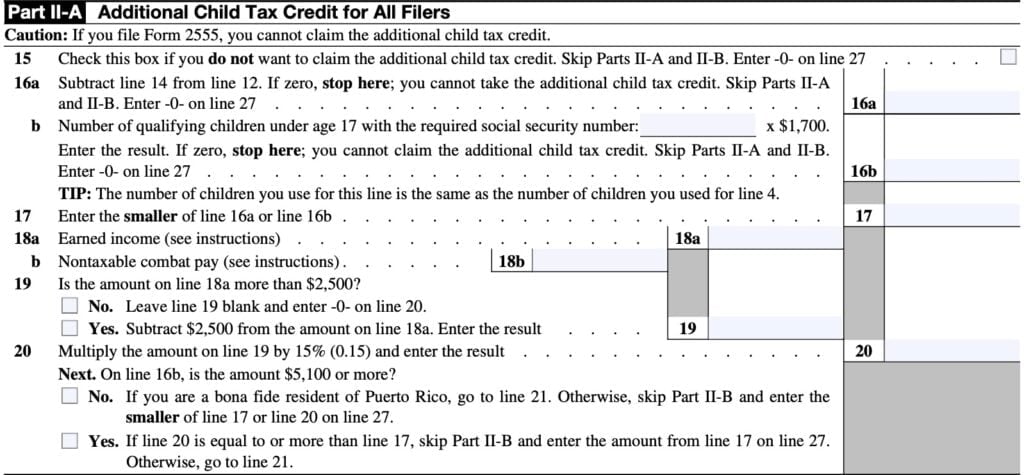

Part II-A: Additional Child Tax Credit for All Filers

In Part II-A, we’ll calculate the additional child tax credit. If you file IRS Form 2555, you cannot claim the additional child tax credit.

In this case, you’ll skip Part II-A and Part II-B, and enter ‘0’ on Line 27.

Bona fide residents of Puerto Rico

If you were a bona fide resident of Puerto Rico, you may be eligible to claim the ACTC if you had at least one qualifying child.

Generally, you were a bona fide resident of Puerto Rico if, during the tax year, you:

- Met the presence test,

- Did not have a main home outside of Puerto Rico, and

- Did not have a closer connection to the United States or to a foreign country than you have to Puerto Rico.

For the latest information on bona fide resident status, see IRS Publication 570, Tax Guide for Individuals With Income From U.S. Possessions.

Line 15

Check the box in Line 15 if you do not want to claim the additional child tax credit. In this case, you’ll skip Parts II-A and II-B, then enter ‘0’ in Line 27.

Line 16

There are two parts to Line 16.

Line 16a

For Line 16a, subtract Line 14 from Line 12.

If the result is zero, stop. You cannot claim the additional child tax credit. Skip the rest of Parts II-A and II-B, then enter ‘0’ in Line 27.

Line 16b

In Line 16b, enter the number of qualifying children under the age of 17 with the required Social Security number. Multiply this number by $1,700.

If the answer is zero, stop. You cannot claim the additional child tax credit. Skip the rest of Parts II-A and II-B, then enter ‘0’ in Line 27.

The number of children you use for Line 16b should be the same as the number you used for Line 4.

Line 17

Enter the smaller of:

- Line 16a

- Line 16b

Line 18

For Line 18a, enter the amount of earned income, based on the form instructions.

If you have net earnings from self-employment and you use either optional method to figure those net earnings, use the Earned Income Worksheet, below, to figure the amount to enter on Line 18a.

Otherwise, you may use the following Earned Income Chart to determine what to enter in Line 18a.

| If you | And you | Enter the following on Line 18a |

| have net earnings from self-employment | use either optional method to figure those net earnings, | the amount figured using the Earned Income Worksheet next (even if you are also claiming earned income credits). |

| are taking the EIC on Form 1040 or 1040-SR, Line 27, | completed Worksheet B, relating to the EIC, in your Instructions for Form 1040 | your earned income from Worksheet B (from the Form 1040 Instructions), Line 4b, plus all of your nontaxable combat pay if you did not elect to include it in earned income for the EIC. |

| are taking the EIC on Form 1040 or 1040-SR, Line 27, | did not complete Worksheet B, relating to the EIC, in your Instructions for Form 1040 | your earned income from Step 5 of the EIC instructions in your tax return instructions, plus all nontaxable combat pay if you did not elect to include it in earned income for the EIC. |

| are not taking the EIC | the amount figured using the Earned Income Worksheet next. |

In Line 18b, enter all nontaxable combat pay earned during the tax year. This amount will be reported either on

- Line 1i of Form 1040, or 1040-SR, or

- IRS Form W-2, box 12, with code Q

If filing a joint return, include the nontaxable combat pay for both spouses, if both spouses are on active duty.

Line 19

Is the amount on Line 18a greater than $2,500?

If No, leave Line 19 blank and enter ‘0’ on Line 20.

If Yes, subtract $2,500 from the Line 18a amount and enter the result in Line 19.

Line 20

Multiply the Line 19 amount by 15% (0.15), then enter the result in Line 20.

Is the Line 16b amount $5,100 or greater?

No. If you are a bona fide resident of Puerto Rico, go to Line 21, below.

Otherwise, skip Part II-B, and enter the smaller of the following on Line 27.

Yes. If Line 20 is equal to or greater than Line 17, then skip Part II-B and enter the Line 17 amount on Line 27. Otherwise, go to Line 21.

Part II-B: Certain Filers Who Have Three or More Qualifying Children and Bona Fide Residents of Puerto Rico

Line 21

Enter withheld Social Security, Medicare, and advance Medicare taxes from Form(s) W-2, boxes 4 and 6. If married filing a joint return, include both spouses amounts.

Use the Additional Medicare Tax and RRTA Tax Worksheet to figure the amount to enter on Line 21 if:

- You are completing Part II-B and your employer withheld or you paid Additional Medicare Tax or tier 1 RRTA tax, or

- You are a bona fide resident of Puerto Rico

Line 22

In Line 22, enter the total of the following amounts:

- Schedule 1, Line 15: Deductible part of self-employment tax, from Schedule SE

- Schedule 2, Line 5: Social Security and Medicare Tax on Unreported Tip Income

- Schedule 2, Line 6: Uncollected Social Security and Medicare tax on Wages

- Schedule 2, Line 13: Uncollected Social Security and Medicare or RRTA tax on Tips or Group-Term Life Insurance from Form W-2, Box 12

Line 23

Add Line 21 and Line 22. Enter the total in Line 23.

Line 24

Form 1040 and 1040-SR filers: Enter the total of the following:

- Form 1040 or 1040-SR, Line 27: Earned Income Tax Credit

- Schedule 3, Line 11: Excess Social Security and Tier 1 RRTA tax withheld

Form 1040-NR filers: Enter the amount from Schedule 3, Line 11.

Line 25

Subtract Line 24 from Line 23. If the result is zero or a negative number, enter ‘0.’

Line 26

Enter the larger of:

Part II-C: Additional Child Tax Credit

Line 27

Enter the smaller of:

Enter this amount on Line 28 of your income tax return.

You may have a reduced additional child tax credit based upon tax adjustments made in Schedule 8812. File your completed Schedule 8812 with your rest of your tax return.

Schedule 8812 Worksheets

There are several worksheets you might need to complete as you go through IRS Schedule 8812:

- Credit Limit Worksheet A

- Credit Limit Worksheet B

- Earned Income Worksheet

- Additional Medicare Tax & RRTA Tax Worksheet

Let’s go through each one, step by step.

Credit Limit Worksheet A

Line 1

In Credit Limit Worksheet A, start by entering the amount from Line 18 of your Form 1040, 1040-SR, or 1040-NR. This represents your total tax bill, plus any alternative minimum tax as well as any excess advance premium tax credit repayment.

Line 2

In Line 2 of Worksheet A, enter the following amounts as applicable:

- Schedule 3, Line 1, Foreign Tax Credit from IRS Form 1116

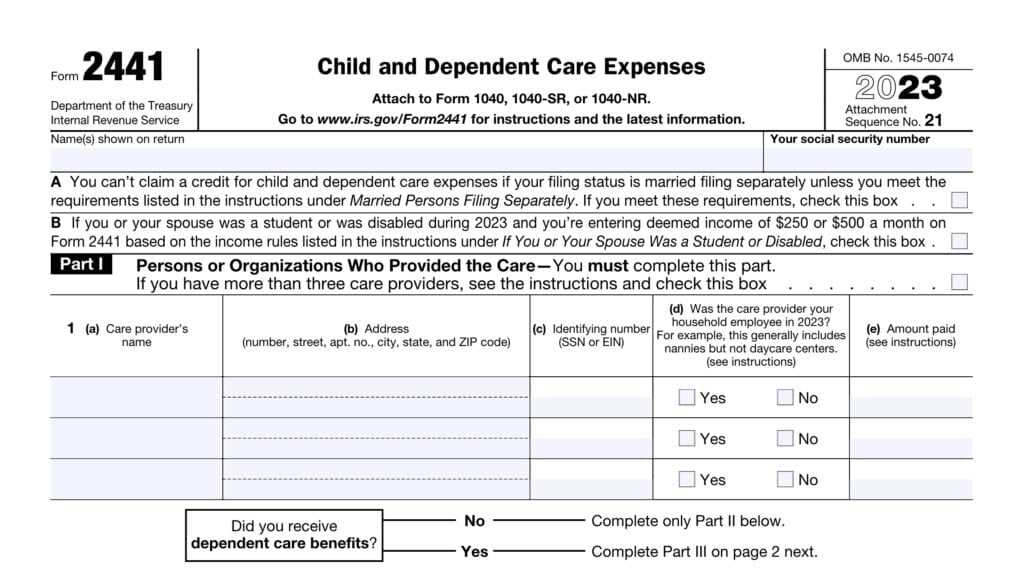

- Schedule 3, Line 2, Credit for Child and Dependent Care Expenses from IRS Form 2441

- Schedule 3, Line 3, Education Credits from IRS Form 8863

- Schedule 3, Line 4, Retirement Savings Contributions Credit from IRS Form 8880

- Schedule 3, Line 6d, Credit for the Elderly or Disabled from Schedule R

- Schedule 3, Line 6e, Alternative Motor Vehicle Credit from IRS Form 8910

- Schedule 3, Line 6f, Qualified Plug-in Motor Vehicle Credit from IRS Form 8936

- Schedule 3, Line 6l, from IRS Form 8978

- IRS Form 5695, Line 30: Residential Clean Energy Credit

Line 3

Subtract Line 1 from Line 2. Enter the result in Line 3 of the worksheet.

Line 4

If you are not completing Credit Limit Worksheet B, enter ‘0,’ then enter the Line 3 amount on Line 13 of Schedule 8812.

Otherwise, enter the amount from Credit Limit Worksheet B.

Line 5

Subtract Line 4 from Line 3. Enter the result in Line 13 of Schedule 8812.

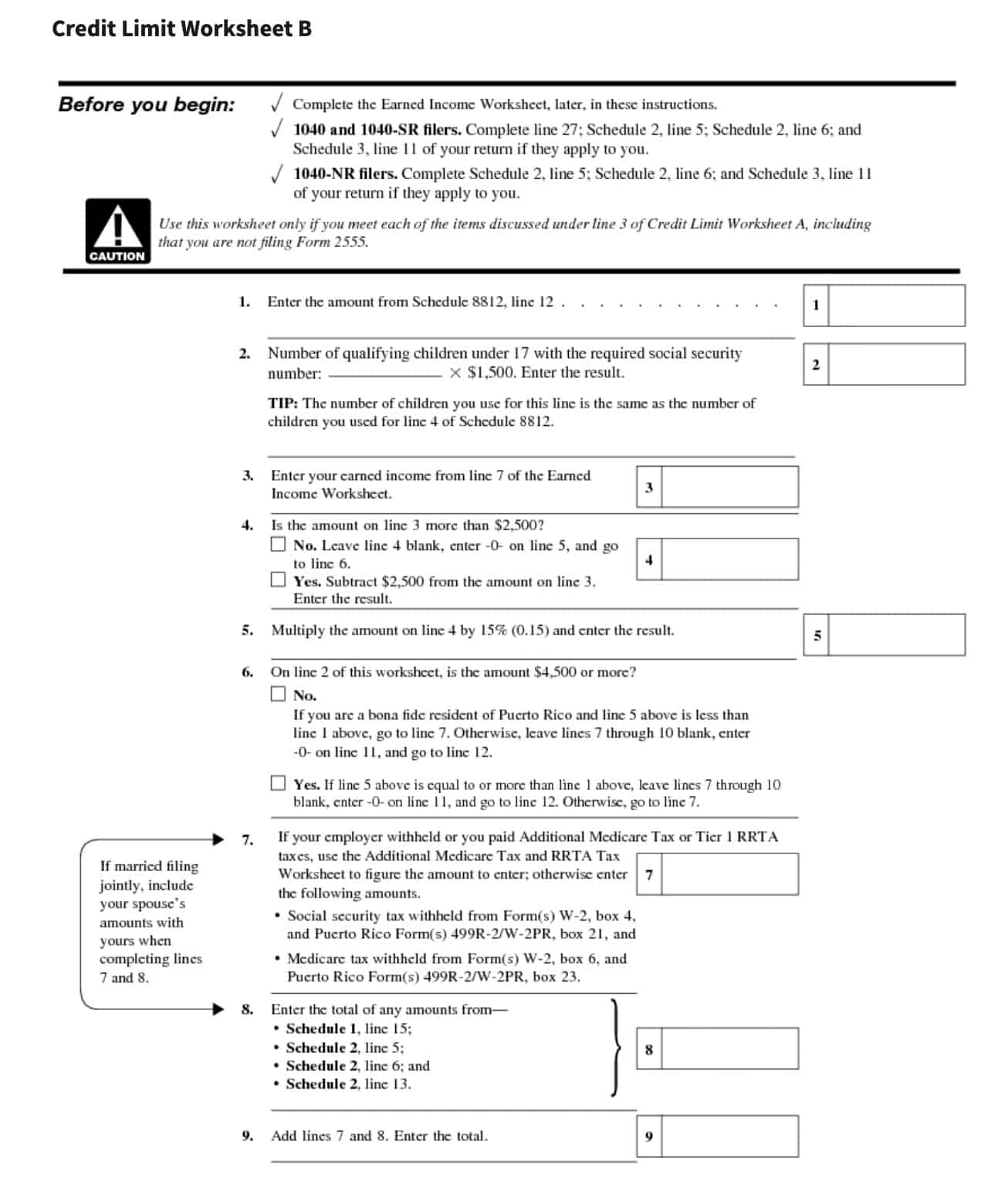

Credit Limit Worksheet B

If you meet one of the outlined criteria, you will need to complete the following steps before you begin Credit Limit Worksheet B:

- Complete the Earned Income Worksheet, outlined below

- For Form 1040 and 1040-SR filers: Complete the following as applicable to your situation:

- Line 27: Earned Income Credit

- Schedule 2, Line 5: Social Security and Medicare tax on Unreported Tip Income from IRS Form 4137

- Schedule 2, Line 6: Uncollected Social Security and Medicare Tax on Wages from IRS Form 8919

- Schedule 3, Line 11: Excess Social Security and Tier 1 RRTA Tax Withheld

- For Form 1040-NR filers: Complete the following as applicable:

- Schedule 2, Line 5

- Schedule 2, Line 6

- Schedule 3, Line 11

Once you’ve completed the above steps, you’re ready to begin Credit Limit Worksheet B.

Line 1

Enter the amount from Schedule 8812, Line 12.

Line 2

In Line 2, multiply the number of children under age 17 with a Social Security number by $1,500. Enter the result.

This represents the refundable portion of the child tax credit.

Line 3

Enter the earned income from Line 7 of the Earned Income Worksheet.

Line 4

Is the amount on Line 3 more than $2,500?

If No, leave Line 4 blank. Enter ‘0’ on Line 5, then go to Line 6 of Credit Limit Worksheet B.

If Yes, subtract $2,500 from the Line 3 amount. Enter the result.

Line 5

Multiply the Line 4 amount by 15% (0.15), then enter the result.

Line 6

On Line 2 of the Credit Limit Worksheet B, is the amount $4,500 or more?

No, the amount is less than $4,500.

If you are a bona fide resident of Puerto Rico, and Line 5 of the Credit Limit Worksheet B is less than Line 1 of the worksheet, then go to Line 7, below. Otherwise, skip Lines 7 through 10, enter ‘0’ on Line 11, then go to Line 12 below.

Yes, the amount is $4,500 or more.

If Line 5 from the Credit Limit Worksheet B is equal to or greater than Line 1, skip Lines 7 through 10, enter ‘0’ on Line 11, then go to Line 12 below. Otherwise, go to Line 7.

Line 7

If your employer withheld, or you paid Additional Medicare tax or Tier 1 RRTA taxes, you’ll need to complete the Additional Medicare Tax & RRTA Tax Worksheet to calculate the amount to enter in Line 7. Otherwise, enter the following:

- Social Security taxes withheld from:

- Form(s) W-2, Box 4, and

- Puerto Rico Form(s) 499R-2/W-2PR, Box 21

- Medicare tax withheld from:

- Form(s) W-2, Box 6, and

- Puerto Rico Form(s) 499R-2/W-2PR, Box 23

If you are filing a joint tax return as a married couple, include both spouses’ information in Line 7.

Line 8

In Line 8, enter the total of any amounts from the following:

- Schedule 1, Line 15: Deductible part of self-employment tax, from Schedule SE

- Schedule 2, Line 5: Social Security and Medicare Tax on Unreported Tip Income

- Schedule 2, Line 6: Uncollected Social Security and Medicare tax on Wages

- Schedule 2, Line 13: Uncollected Social Security and Medicare or RRTA tax on Tips or Group-Term Life Insurance from Form W-2, Box 12

For married couples filing a joint return, include both spouses’ information in Line 8.

Line 9

Add Lines 7 & 8. Enter the total.

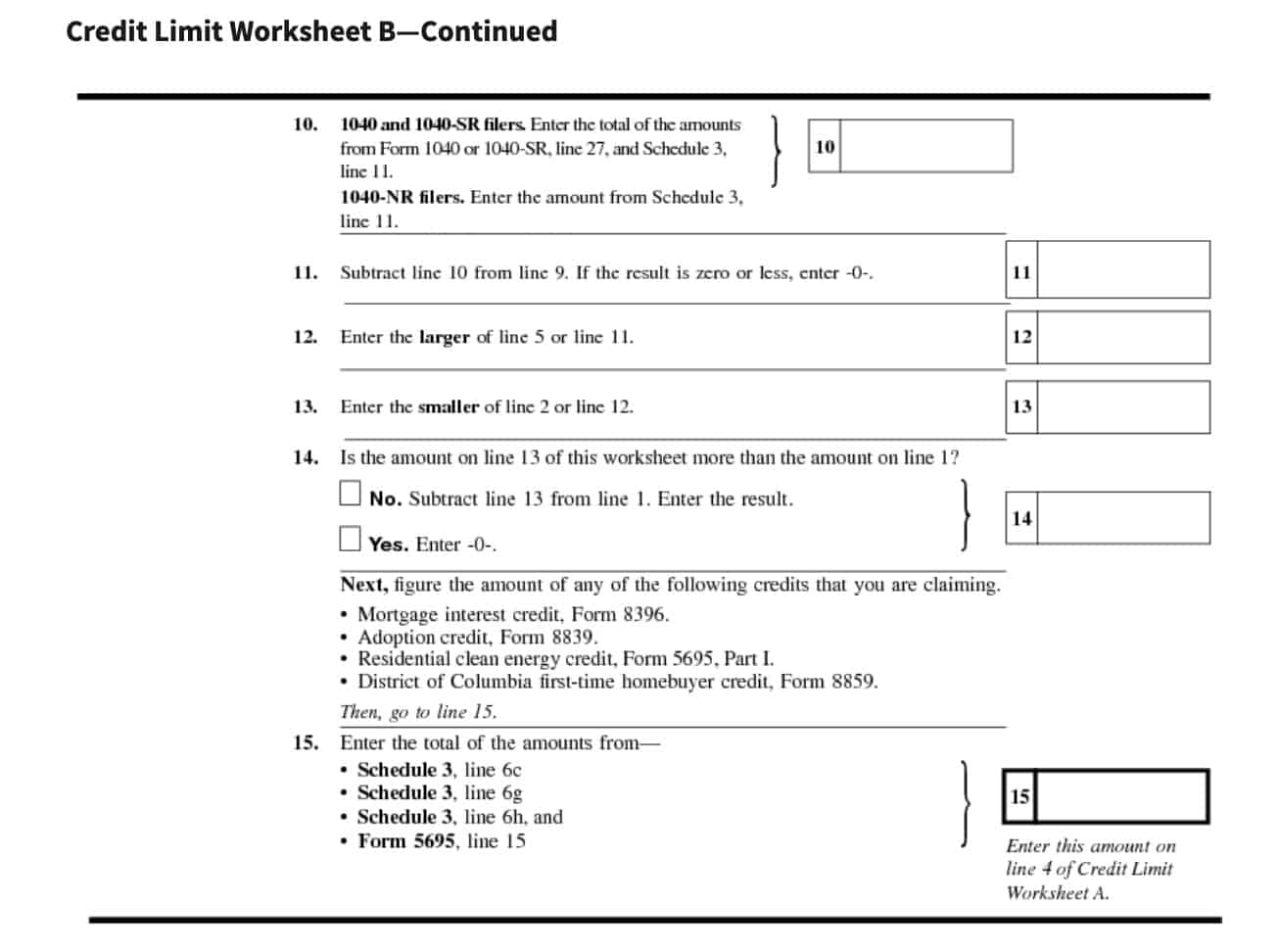

Line 10

Form 1040 & 1040-SR filers: Enter the total of the following:

- Form 1040 or 1040-SR, Line 27: Earned Income Tax Credit

- Schedule 3, Line 11: Excess Social Security and Tier 1 RRTA Tax Withheld

Form 1040-NR filers: enter the excess Social Security & Tier 1 RRTA Tax Withheld on Schedule 3, Line 11.

Line 11

Subtract Line 10 from Line 9. If the result is zero or a negative number, enter ‘0.’

Line 12

Enter the larger of either of the following from Credit Limit Worksheet B:

Line 13

Enter the smaller of either of the following from Credit Limit Worksheet B:

Line 14

If the amount on Line 13 from Credit Limit Worksheet B is more than the amount on Line 1, then enter ‘0.’

Otherwise, subtract Line 13 from Line 1 and enter the result in Line 14.

Next, determine how much, if any, of the following tax credits you are claiming:

Line 15

In Line 15, enter the total of:

- Line 14

- Mortgage interest credit from IRS Form 8396

- Adoption credit from IRS Form 8839

- Residential clean energy credit from IRS Form 5695, Part I

- District of Columbia first-time homebuyer credit from IRS Form 8859

Enter this total in Line 4 of Credit Limit Worksheet A.

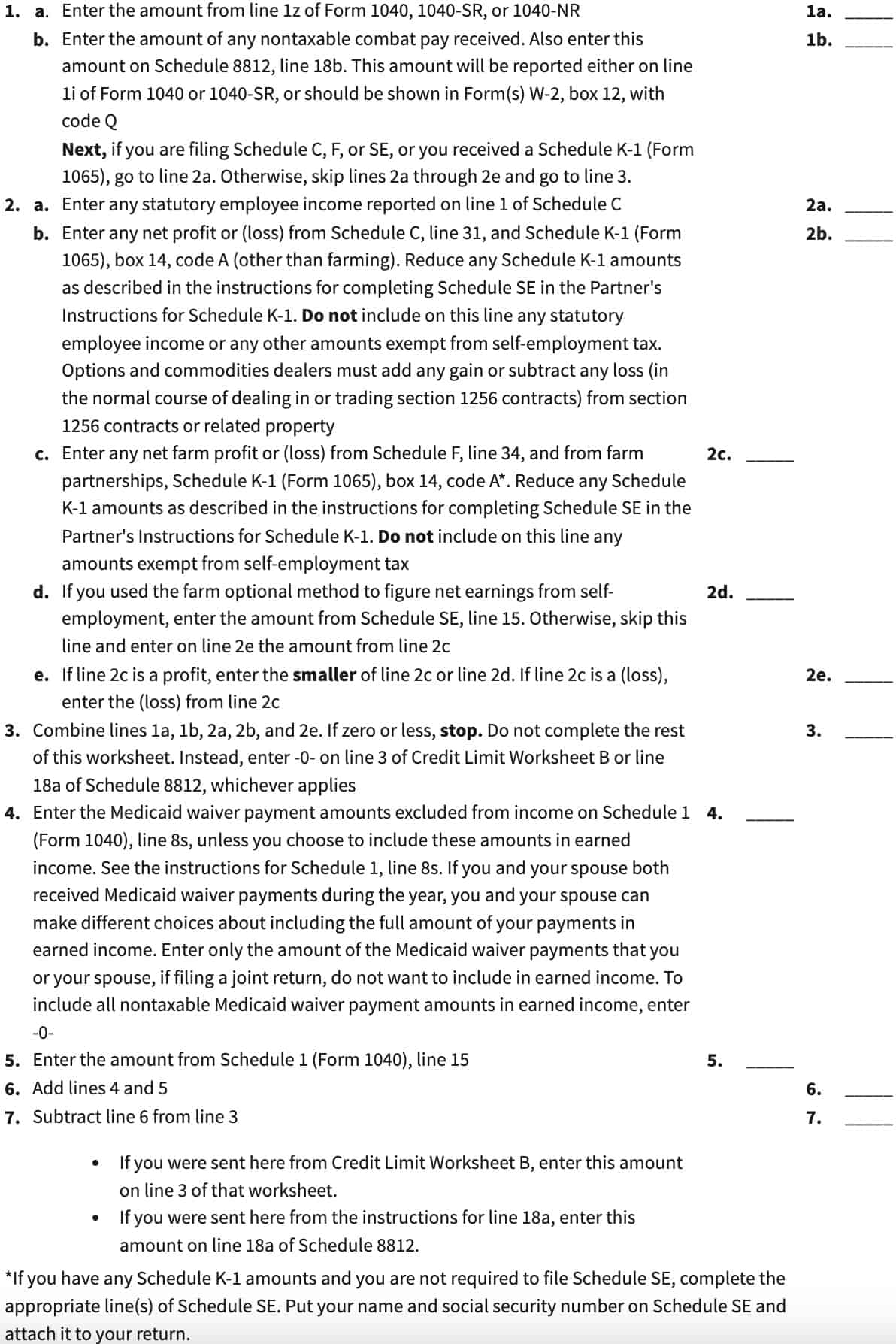

Earned income worksheet

If required on Worksheet B or Line 18a, you may need to complete the Earned Income Worksheet.

However, when using the earned income worksheet:

- Disregard community property laws when calculating amounts to enter

- If married filing a joint tax return, include your spouse’s amounts with yours as you complete the worksheet

With that, let’s start with Line 1.

Line 1

In Line 1a, enter the amount from Line 1z from your IRS Form 1040, 1040-SR, or 1040-NR.

In Line 1b, enter the amount of any nontaxable combat pay that you received during the tax year. Also enter this amount on Line 18b of Schedule 8812.

You will find this amount either on:

- IRS Form 1040 or 1040-SR, Line 1i, or

- Form W-2, Box 12, with Code Q

If you have received Schedule K-1 from a partnership, or are filing any of the following forms, go to Line 2a:

- Schedule C

- Schedule F

- Schedule SE

Otherwise, skip Line 2 and go to Line 3.

Line 2

In Line 2a, enter any statutory employee income reported on Line 1 of Schedule C.

For Line 2b, enter the net profit (or loss) from the following:

- Schedule C, Line 31

- Schedule K-1 (Form 1065), Box 14, Code A (other than farming)

Reduce any Schedule K-1 amounts as described in the instructions for completing Schedule SE in the Partner’s instructions for Schedule K-1.

Do not include any statutory employee income or other amounts exempt from self-employment tax. If you are an options or commodities dealer, you must add gains or subtract losses from Section 1256 contracts or related property.

In Line 2c, enter any amounts from the following:

- Net farm profit (or loss) from Schedule F, Line 34

- Farm partnerships, Schedule K-1, Box 14, Code A

Do not include any statutory employee income or other amounts exempt from self-employment tax.

For Line 2d, if you used the farm optional method to calculate net earnings from self-employment, enter the amount from Line 15, Schedule SE. Otherwise, skip Line 2d, and enter the amount from Line 2c into Line 2e.

For Line 2e: if Line 2c is a profit, enter the smaller of

- Line 2c

- Line 2d

If Line 2c is a loss, then enter the loss from Line 2c into Line 2e.

Line 3

Combine the following:

- Line 1a

- Line 1b

- Line 2a

- Line 2b

- Line 2e

If the result is zero or a negative number, stop. Do not complete this form. Enter ‘0’ on Line 3 of Credit Limit Worksheet B or Line 18a of Schedule 8812, as applicable.

Otherwise, enter the total and move to Line 4.

Line 4

In Line 4, enter the Medicaid waiver payment amounts excluded from income on Schedule 1, Line 8s, unless you choose to include these amounts in earned income.

If you and your spouse both received Medicaid waiver payments during the year, you can make different choices about including the full amount of payments in your earned income.

Only include the amount of Medicaid waiver payments that you do not want to include in earned income.

Line 5

Enter the deductible part of the self-employment tax from Line 15, Schedule 1.

Line 6

Add Line 4 and Line 5. Enter the result in Line 6.

Line 7

Subtract Line 6 from Line 3. Enter the result in Line 7.

Enter this result on either of the following, as applicable:

- Line 3 of Credit Limit Worksheet B

- Line 18a of Schedule 8812

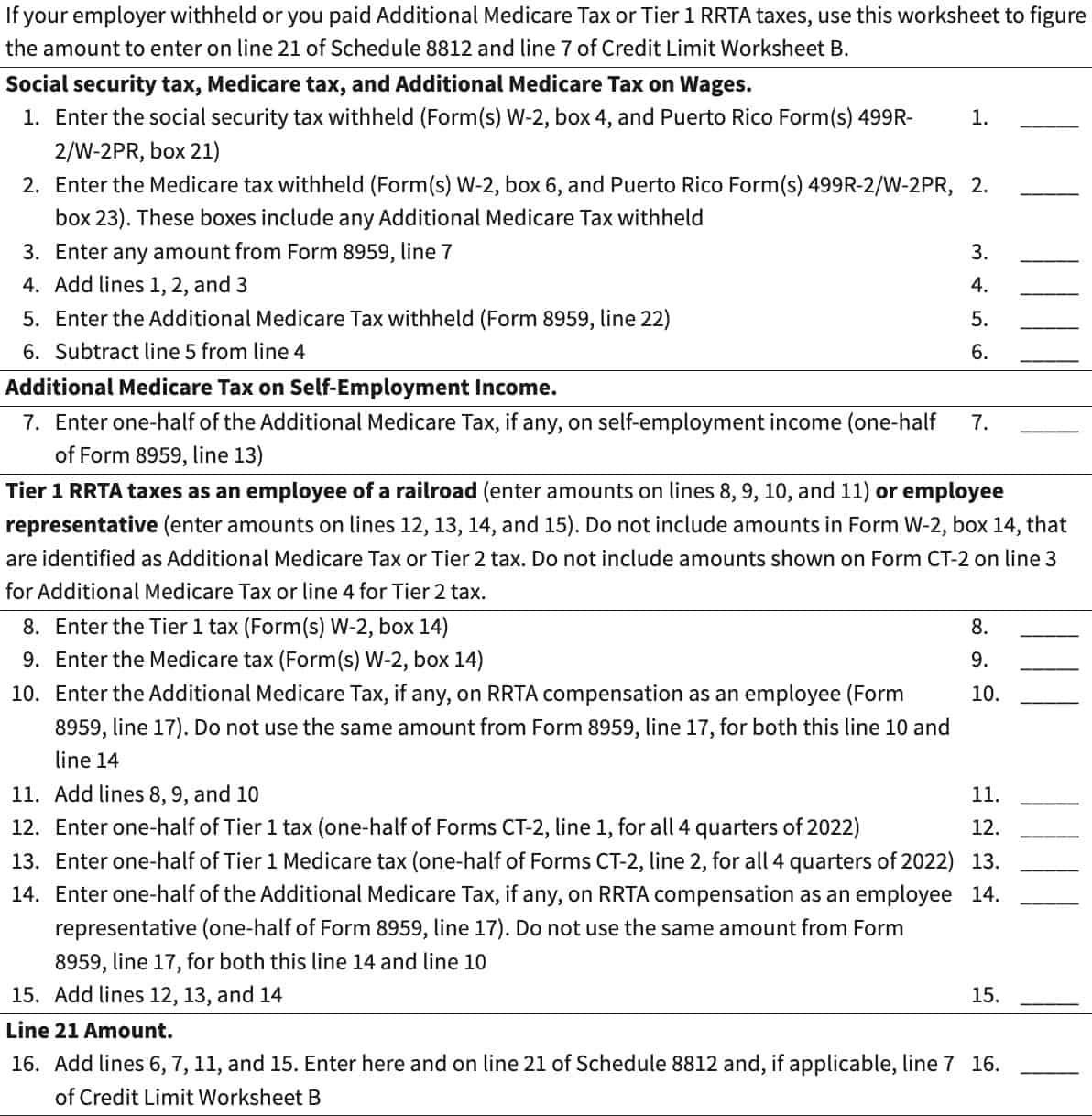

Additional Medicare Tax and RRTA Tax Worksheet

If you paid additional medicare tax or Tier 1 RRTA tax, or your employer withheld either, you’ll use this worksheet to determine the amount to enter on:

Line 1

In Line 1, enter the Social Security tax withheld from either of the following:

- IRS Form(s) W-2, Box 4

- Puerto Rico Form(s) 499R-2, Box 21

Line 2

Enter the Medicare tax withheld on either of the following:

- IRS Form(s) W-2, Box 6

- Puerto Rico Form(s) 499R-2, Box 23

These amounts include any Additional Medicare Tax withheld.

Line 3

Enter any amount from IRS Form 8959, Line 7.

Line 4

Add the following:

Enter the total here.

Line 5

Enter the Additional Medicare Tax withheld on IRS Form 8959, Line 22.

Line 6

Subtract Line 5 from Line 4. Enter the result in Line 6.

Line 7

Enter 1/2 of the Additional Medicare tax, as applicable, on self-employment income. To do this, multiply the Line 13 amount from IRS Form 8959 by 50% (0.50).

Line 8

Enter any Tier 1 tax tax from Form W-2, Box 14.

Line 9

Enter the Medicare tax from Form W-2, Box 14.

Line 10

In Line 10, enter any additional Medicare tax on RRTA compensation as an employee, from IRS Form 8959, Line 17. Do not use the same amount for this line and Line 14, below.

Line 11

Add the following:

Enter the total in Line 11.

Line 12

Enter 1/2 of all Tier 1 tax. This is one-half of the total from Forms CT-2, Line 1, for all 4 quarters of the tax year.

Line 13

In Line 13, enter 1/2 of all Tier 1 Medicare tax. This is one-half of the total from Forms CT-2, Line 2, for all 4 quarters of the tax year.

Line 14

Enter 1/2 of the Additional Medicare Tax on RRTA compensation as an employee representative. Do not use the same amount for both this line and Line 10, above.

Line 15

Add the following:

Enter the total in Line 15.

Line 16

Add the following:

Enter the total here and on Line 21 of Schedule 8812. If applicable, also enter the total on Line 7 of Credit Limit Worksheet B.

Video walkthrough

Watch this instructional video to learn more about reducing your tax liability by claiming tax credits for qualifying children and other dependents with Schedule 8812.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

The purpose of Schedule 8812 to help taxpayers calculate the child tax credit, additional child tax credit, and tax credit for other dependents. The child tax credit amounts include a refundable tax credit and a nonrefundable credit.

For tax years 2018 through 2025, the full child tax credit is $2,000 per qualifying child. The refundable part of the child tax credit is $1,500 per child, also known as the additional child tax credit.

Taxpayers may use Schedule 8812 to claim a nonrefundable credit of up to $500 per qualifying dependent. To claim this credit, the taxpayer must not claim themselves, a spouse, or someone who is not a U.S. citizen, U.S. resident, or U.S. national.

For purposes of the child tax credit, the child must be your dependent, under age 17 at the end of the tax year, and meet all the conditions in Steps 1 through 3 under Who Qualifies as Your Dependent in the Instructions for Form 1040.

How do I find Schedule 8812?

Like other federal income tax forms, you may find Schedule 8812 available as a PDF file on the IRS website. For your convenience, we’ve enclosed the latest version in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!