Schedule EIC Instructions

The earned income tax credit is one of the most important tax benefits for many taxpayers. This refundable tax credit helps qualifying taxpayers to reduce their tax liability, often to zero in many cases. To claim the earned income tax credit, taxpayers must file Schedule EIC with their tax return.

In this article, we’ll walk through everything you need to know about this important tax form, including:

- How to complete Schedule EIC

- Specific criteria for the earned income credit

- Frequently asked questions about Schedule EIC

Let’s start with an overview of the tax form itself.

Table of contents

How do I complete Schedule EIC?

This IRS form is fairly straightforward to complete. But before we begin with Line 1, there are some things we should note at the top of the form.

Taxpayer information

At the top of the form, you’ll see the name and SSN fields for the taxpayer. Complete these fields as they appear on your tax return.

Just below, check the box if you are:

- Your filing status is: Married filing a separate return from your spouse

- You are eligible for the earned income credit

To be eligible for the EIC in this situation, you must:

- Have a qualifying child, and either

- You lived apart from your spouse for the last 6 months of the tax year, or

- You are legally separated under state law under a written separation agreement, and you did not live in the same house at the end of the tax year

Qualifying child

To be a qualifying child for purposes of the earned income credit, your child must be one of the following:

- Son or daughter

- An adopted child is always considered a son or daughter for EITC purposes

- Stepchild

- Eligible foster child

- Brother or sister

- Stepbrother or stepsister

- Half brother or half sister

- Descendent of any of the above

Additionally, the qualifying child must meet the following EITC eligibility requirements:

- Meet certain age eligibility criteria

- Must be under age 19 at the end of the tax year and younger than you or your spouse, or

- Must be under age 24 at the end of the tax year, a student, and younger than you or your spouse, or

- Be permanently and totally disabled, regardless of age

- Not file a joint return

- May file a joint tax return if the sole purpose is to claim a tax refund of withheld federal income tax or estimated taxes paid

- Have lived with the taxpayer for more than half of the year

- 183 days or more

- Exceptions exist for circumstances involving temporary absence, birth, death, or kidnapping

Penalties for false claims

Because the earned income credit is subject to tax fraud, the IRS audits federal EITC claims more often than other income tax credits.

Ineligible taxpayers who take the EIC may find their EIC claim is disallowed. Furthermore, the IRS may disallow certain taxpayers from taking the EIC in the future, even if they are eligible in subsequent years.

If the IRS determines that the taxpayer error was due to reckless or intentional disregard of the EIC rules, IRS will not allow that taxpayer to claim the EIC for the next two tax years. In cases of fraudulent EIC claims, the IRS will disallow the taxpayer from claiming the credit for the following 10 years.

In the case of a disallowed EITC claim, taxpayers may resubmit an EIC claim using IRS Form 8862, Information to Claim Certain Credits after Disallowance.

Let’s begin with Line 1.

Line 1: Child’s name

Enter the first name and last name of your qualifying child.

It’s important to note that there is only room on Schedule EIC for three qualifying children. If you have more than three qualifying children, just know that you only need to list three to receive the maximum earned income tax credit.

Line 2: Child’s Social Security Number

In Line 2, enter each child’s SSN. All qualifying children must have valid Social Security numbers.

According to IRS Publication 596, Earned Income Credit, a qualifying child’s EIC can be disallowed if:

- The qualifying child’s SSN is missing from your tax return or is incorrect

- The qualifying child’s Social Security card says, “Not valid for employment” and was issued for use in receiving federally funded benefits, or

- Instead of a valid SSN, the child has either:

- Individual taxpayer identification number (ITIN): Issued to a noncitizen who cannot get an SSN

- Adoption taxpayer identification number (ATIN): Issued to adopting parents who cannot obtain an SSN on the adopted child’s behalf until the adoption has been finalized

Line 3: Child’s year of birth

Enter the four-digit year of each child’s birth in Line 3.

If the child was born after 2005, and the child is younger than you (or your spouse, for married couples), go directly to Line 5, below. If not, go to Line 4a.

Line 4a: Was the child under age 24 at the end of the tax year?

In Line 4a, check ‘Yes’ if your qualifying child:

- Was under age 24 at the end of the tax year

- A student, and

- Younger than you (or your spouse, if filing a joint tax return)

Afterwards, go to Line 5. Otherwise, check ‘No,’ then proceed to Line 4b.

Line 4b: Was the child permanently and totally disabled?

If your qualifying child was permanently and totally disabled at any point during the tax year, check ‘Yes’ and go to Line 5.

If not, then stop completing Schedule EIC for this child. This child does not qualify for the EIC.

Permanent and total disability

The Internal Revenue Service considers your child to be permanently and totally disabled if both of the following apply.

- Your child can’t engage in any substantial gainful activity because of a physical or mental condition.

- A doctor determines the condition has lasted or can be expected to last continuously for at least a year or can lead to death.

Substantial gainful activity

Substantial gainful activity means performing significant duties over a reasonable period of time while working for pay or profit, or in work generally done for pay or profit.

Full-time work (or part-time work done at an employer’s convenience) in a competitive work situation for at least the minimum wage shows that the child can engage in substantial gainful activity.

Line 5: Child’s relationship

In Line 5, describe the child’s relationship to you. As previously mentioned, a qualifying child must be one of the following:

- Son or daughter

- An adopted child is always considered a son or daughter for EITC purposes

- Stepchild

- Eligible foster child

- Brother or sister

- Stepbrother or stepsister

- Half brother or half sister

- Descendent of any of the above

Line 6: Number of months child lived with you in the United States

Enter the number of months the qualifying child lived with you in the United States.

To meet the EIC criteria, the child must have lived with you more than six months of the tax year in the United States.

If your child lived with you more than six months, but less than seven months, enter ‘7.’ If your child was born or died during the tax year, and lived with you more than half the time he or she was alive, enter ’12.’

Video walkthrough

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Earned Income Tax Credit (EITC) criteria

IRS Publication 596 outlines the following requirements that taxpayers must meet to claim the EIC.

Rules for everyone

Below are the EITC rules that apply for everyone, regardless of whether you have a qualifying child.

Adjusted Gross Income Limitations

The EITC is only available to taxpayers whose adjusted gross income (AGI) is below the following thresholds:

- Three or more qualifying children: $53,057

- $59,187 for married taxpayers filing jointly

- Two qualifying children: $49,399

- $55,529 for married taxpayers filing jointly

- One qualifying child: $43,492

- $49,622 for married taxpayers filing jointly

- No qualifying children: $16,480

- $22,610 for married taxpayers filing jointly

Valid Social Security number

Both the taxpayer and any qualifying child must have a valid SSN for EITC purposes. Neither the taxpayer nor the qualifying child may qualify for the earned income tax credit with either an individual taxpayer identification number (ITIN) or an adoption tax identification number (ATIN).

Requirements for married couples filing separate returns

A taxpayer who is married, but filing a separate tax return from his or her spouse may claim the EIC if either of the following apply:

- You lived apart from your spouse for the last 6 months of the tax year, or

- You are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and you didn’t live in the same household as your spouse at the end of the tax year.

U.S. citizenship status

If you were a nonresident alien for any part of the year, you can’t claim the EIC unless your filing status is married filing jointly.

You can use that filing status only if your spouse is a U.S. citizen or resident alien and you choose to be treated as a U.S. resident.

Income requirements

In addition to the EIC thresholds, there are certain income-related criteria that taxpayers must fulfill to claim the earned income credit.

Foreign earned income

You can’t claim the EIC if you file IRS Form 2555, Foreign Earned Income with your federal tax returns.

Taxpayers file these forms to exclude income earned in foreign countries from adjusted gross income, or to deduct or exclude a foreign housing amount.

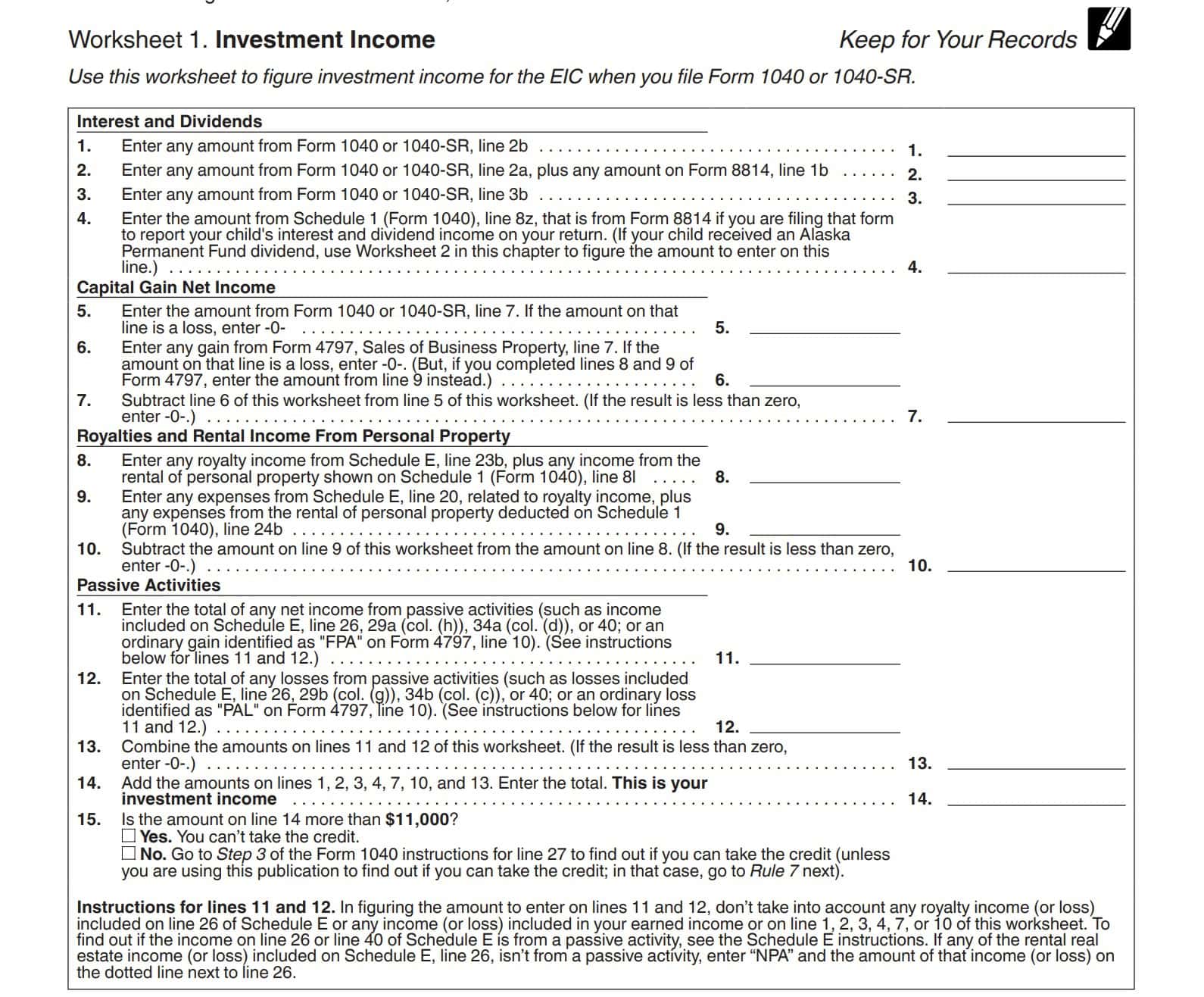

Investment income limitations

Your investment income cannot exceed $10,300 for the tax year. IRS Publication 596 contains the following worksheet to help taxpayers determine if their investment income exceeds the threshold.

Earned income

You must have earned income to qualify for the earned income tax credit.

The IRS considers earned income to be any of the following:

- Wages, salaries, tips, and other taxable employee pay.

- Employee pay is earned income only if it is taxable.

- Nontaxable combat pay can qualify as earned income, if included in accordance with IRS guidelines

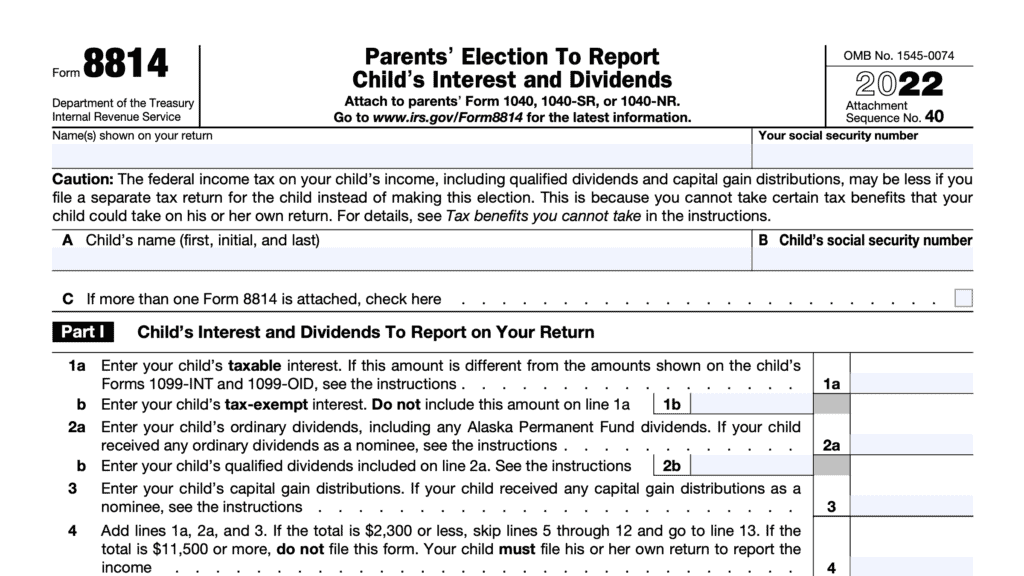

- Nontaxable employee pay, such as certain dependent care benefits and adoption benefits, isn’t earned income. But there is an exception for nontaxable combat pay, which you can choose to include in earned income, as explained later in this chapter.

- Employee pay is earned income only if it is taxable.

- Net self-employment income

- Gross income received as a statutory employee

Let’s move on to rules for people trying to claim this refundable tax credit with a qualifying child.

Rules for taxpayers with a qualifying child

There are three specific criteria taxpayers must meet to claim the EITC:

- Relationship, age, residency, and joint return tests

- Cannot be claimed by more than one taxpayer

- Cannot be the qualifying child of another taxpayer

Qualifying child must meet relationship, age, residency, and joint return tests

A qualifying child must meet the relationship, age, residency, and joint tax return criteria as previously outlined.

Qualifying child cannot be used by more than one taxpayer to claim the EITC

Only one taxpayer can claim the EITC for a qualifying child.

If two parents meet the tests to claim qualifying child, only one can actually claim the child. Usually, that will be the custodial parent. The noncustodial parent usually cannot take the EIC, or any of the following tax benefits based upon the qualifying child:

- Child tax credit, credit for other dependents, or additional child tax credit on Schedule 8812

- Head of household filing status

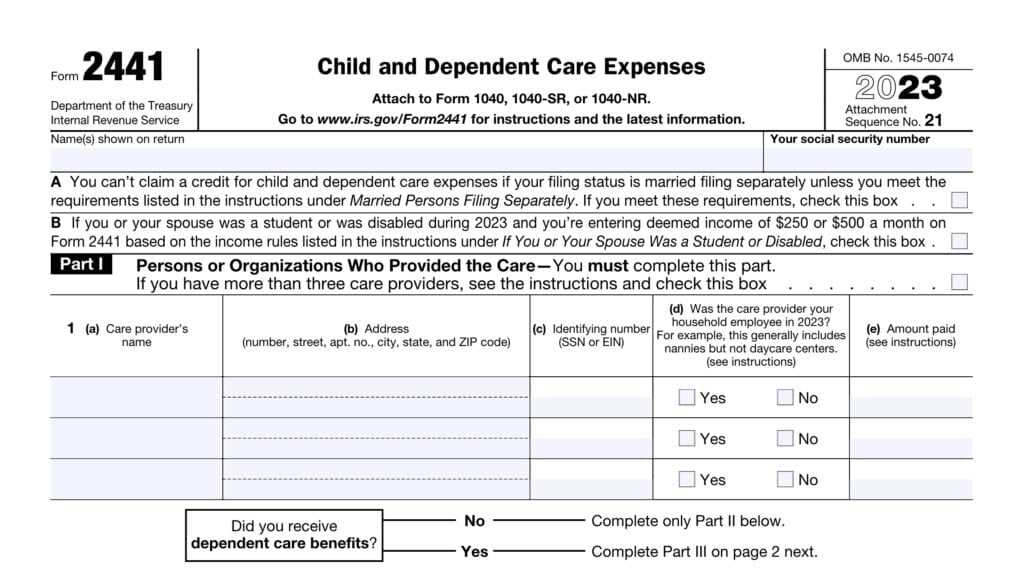

- Tax credit for child and dependent care expenses on IRS Form 2441

- Exclusion for dependent care benefits

Taxpayer cannot be the qualifying child of another person

Finally, a taxpayer cannot claim the EIC if another taxpayer can claim that person as a qualifying child for EIC purposes.

Rules for taxpayers without a qualifying child

There are several requirements for people who want to claim the EIC without a qualifying child.

Age requirements

You must be at least age 25 but under age 65 at the end of the tax year. If you are married filing a joint return, either you or your spouse must be at least age 25 but under age 65 at the end of the year.

It doesn’t matter which spouse meets the age test, as long as one of the spouses does.

You cannot be someone else’s dependent or qualifying person

As you go through Schedule EIC, you will have to ascertain both of these criteria.

You must have lived in the United States for more than half of the year

This means the 50 states and the District of Columbia. It doesn’t include Puerto Rico or U.S. possessions such as Guam.

Active duty service members serving overseas are considered to meet this criteria if they were on extended active duty. Extended active duty means being on active duty orders lasting 90 days or longer.

Frequently asked questions

Schedule EIC is the schedule that taxpayers complete to document their qualifying child or children to claim the earned income credit.

If you have at least one child who meets the conditions to be your qualifying child for purposes of claiming the EIC, complete and attach Schedule EIC to your Form 1040 or 1040-SR.

The maximum available earned income credit is available to taxpayers with three children. The amount of your EIC payment does not increase with a fourth child, so there is only room for up to three qualifying children.

Where do I find Schedule EIC?

You can find this tax form on the IRS website. For your convenience, we’ve attached the latest version to this article.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!