Tax Topic 203-A Guide to Tax Refund Offsets

If you’re checking the status of your tax refund from a recently tax return and find the refund is less than you were expecting, you might be in for a surprise. This article will walk you through what you need to know about IRS Tax Topic 203, which discusses your reduced tax refund.

Specifically, we’ll talk about:

- How the IRS can garnish your tax refund to pay delinquent debt

- What types of past due debt the IRS can garnish your refund to pay off

- What steps you, the taxpayer, can take to avoid having your tax refund garnished

But first, if you were directed to Tax Topic 203, you might be wondering what tax topics are in the first place.

Table of contents

What is Tax Topic 203?

Tax Topic 203 is also known as Reduced Refund. IRS will refer you to this page if they garnished your federal income tax refund to pay down certain financial debts under the Treasury Department’s tax refund offset program.

What is the Treasury Offset Program?

Under the Department of Treasury’s Bureau of the Fiscal Service, the Treasury Offset Program exists to empower the federal government to garnish tax refunds to satisfy unpaid debts. The Department of Treasury does this through the Internal Revenue Service.

IRS tax refunds garnished to pay down delinquent debt are known as refund offsets. It is important to note the Treasury Department does not use this program to satisfy all delinquent debts. For example, the IRS uses a different program to satisfy delinquent federal taxes.

What types of debts may be satisfied under the Treasury Offset Program?

The Treasury Department may authorize the Internal Revenue Service to withhold part or all of a tax refund to satisfy the following types of financial debts:

- Past-due child support payments;

- Federal agency non-tax debts (including delinquent student loan debt)

- State income tax obligations, such as unpaid state income taxes; or

- Certain unemployment compensation debts owed to a state. Generally, these these are debts for

- Compensation paid due to fraud, or

- Contributions owing to a state fund that the taxpayer did not pay

How does the Treasury Offset Program work?

The Treasury Department’s Bureau of the Fiscal Service (previously known as the Financial Management Service) manages the Treasury Offset Program (TOP).

The Bureau also makes payments on behalf of most federal agencies. This includes things like:

- Social Security benefits

- Veterans’ benefits

- Military pensions

- Tax refunds

The TOP program consists of a database of delinquent qualifying debts. Every time the Bureau makes a payment to an individual, TOP screens that person’s name and Social Security number against its records. There are two possible results.

No match found: If there is no match to an outstanding overdue debt, then the payment goes out as planned. In the case of a tax refund, then TOP disburses the original refund amount as reported in the tax return.

Match found: If a match to an overdue debt exists, then there is a payment offset. This means that TOP will divert part, or all, of the planned payment to pay down the outstanding debt. For a tax refund, TOP will send the total refund, or a portion of the refund, to pay the debt.

How does the Treasury Offset Program get information about delinquent debt?

Any federal, state, or local agency that receives information about delinquent debt can report that debt to TOP. For federal agencies reporting federal debts, this is mandatory after 120 days.

For example, the Department of Education reports delinquent student loan payments to TOP. Once in the TOP database, those student loans are subject to tax offsets

For state agencies, the reporting largely depends on the type of state debts.

Unpaid child support

States send information about delinquent child-support debt to the U.S. Department of Health and Human Services, Office of Child Support Enforcement (OCSE). OCSE sends that information to TOP.

State income tax program

State tax-collecting departments (often called the Department of Revenue) send information about delinquent state taxes to TOP. By law, TOP may offset an IRS refund to collect that money owed to the states.

Supplemental Nutritional Assistance Program

States send information about delinquent SNAP debt to the U.S. Department of Agriculture, Food and Nutrition Service (FNS). FNS sends that information to TOP for collection.

Unemployment Insurance

Working with the U.S. Department of Labor, TOP may offset federal tax refund payments to collect delinquent state unemployment insurance debt in 2 situations:

- For fraud or failure to report earnings

- When unpaid UI employer tax debt has not been collected for at least one year after the debt was determined to be due

Does the Treasury Offset Program take my entire tax refund?

No. Certain exceptions exist, particularly for extenuating circumstances, or as allowed by federal law.

For example, during the COVID pandemic, the Department of Education suspended federal student loan payments. During this suspension, the Education Department also stopped enforcing the collection of delinquent student loan debt.

Additionally, advance child tax credit payments authorized under the American Rescue Plan Act were specifically excluded from the TOP program. Same with the Recovery Rebate credit.

How can avoid having my tax refund garnished by the IRS?

There are several things you may be able to do before the IRS starts taking your refunds. However, once you stumble upon IRS Tax Topic 203, know that you’ve got some work to do.

While TOP is responsible for collecting outstanding debts, you cannot resolve those debts through the Treasury Department. You must attempt to resolve those debts through the federal or state agency that reported them to TOP.

But you still might have some options in one of the following ways.

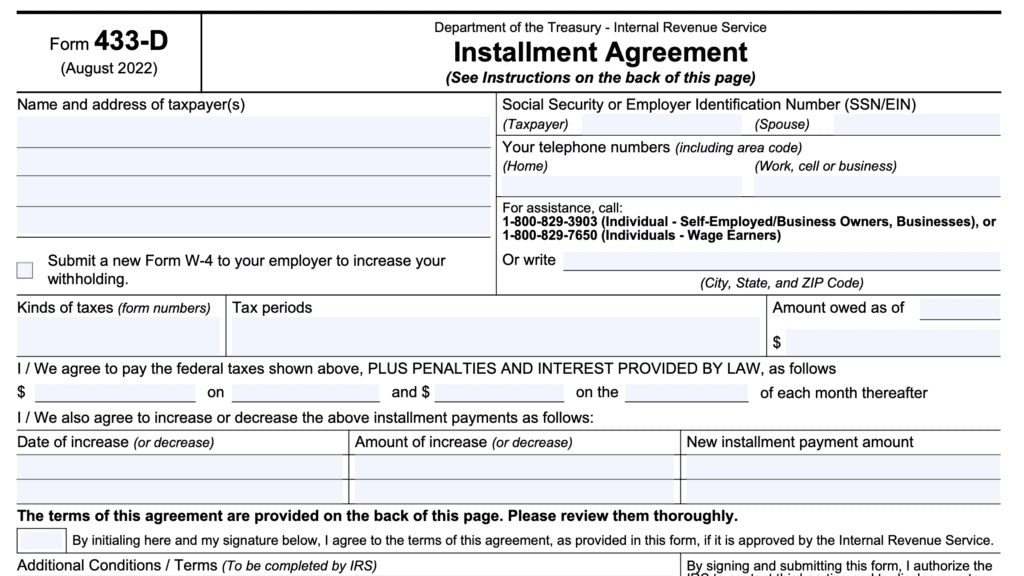

Try to set up a payment plan

The best way to avoid tax offsets is to avoid having your debt become delinquent in the first place. Many people avoid any conversations with agencies in the hopes that these problems go away. They don’t.

But there are resources available to help people afford their payments, particularly those who are experiencing financial hardship. Contact your respective agency to see what options are available to you.

Do not ignore your pre-offset notice

The IRS cannot simply take your tax refund without any notification. While the IRS might not have given you notice, the reporting agency must do so before sending your delinquent debt to TOP. According to the TOP website:

The agency must send a letter to the debtor at the name and address on file for the debt at least 60 days before sending the debt to TOP. The letter must tell the debtor about the debt (type and amount), that the agency intends to refer the debt for offset, and what rights the debtor has to resolve the debt situation. The letter must give the debtor opportunities to pay the debt, enter into a payment agreement, or dispute that they owe the money to the agency.

Bureau of the Fiscal Service website

File for Injured Spouse Allocation

If you are the debtor, this will not work. But if you are a spouse of a debtor, the TOP program cannot claim your share of the tax refund to satisfy the outstanding debt.

If the tax offset impacted your previously filed joint tax return, you may file IRS Form 8379 to claim part of your refund that the IRS diverted towards your spouse’s delinquent debt.

Tax planning

If you were expecting a huge refund at the end of tax season, that means you may have been short-changing yourself throughout the tax year. And that additional cash flow may have helped you keep on top of those payments that you’re delinquent on.

Proper tax planning, either with your financial planner or tax accountant, may help you uncover that additional cash flow to help you keep on top of your payments throughout the year.

Video walkthrough

Watch this informative video to learn more about Tax Topic 203, the Treasury Offset Program, and more!

Frequently asked questions

The IRS website contains a variety of posts with general information about taxes for individuals and for businesses. These posts generally include information about IRS procedures, general filing information, and the collections process. Tax Topic 203 falls under the IRS collections process.

For outstanding debts through the Treasury Offset Program, your best chance to avoid garnishment is to work directly with the entity you owe money to set up a payment plan. If your tax refund was garnished to pay your spouse’s debt, you may find relief by filing Form 8379, Injured Spouse Allocation.